Please use a PC Browser to access Register-Tadawul

CoreCivic (CXW) Earnings Surge 69% Challenges Cautious Narratives On Profit Potential

CoreCivic, Inc. CXW | 16.74 | -10.29% |

How CoreCivic’s FY 2025 Numbers Set the Stage for the Story Ahead

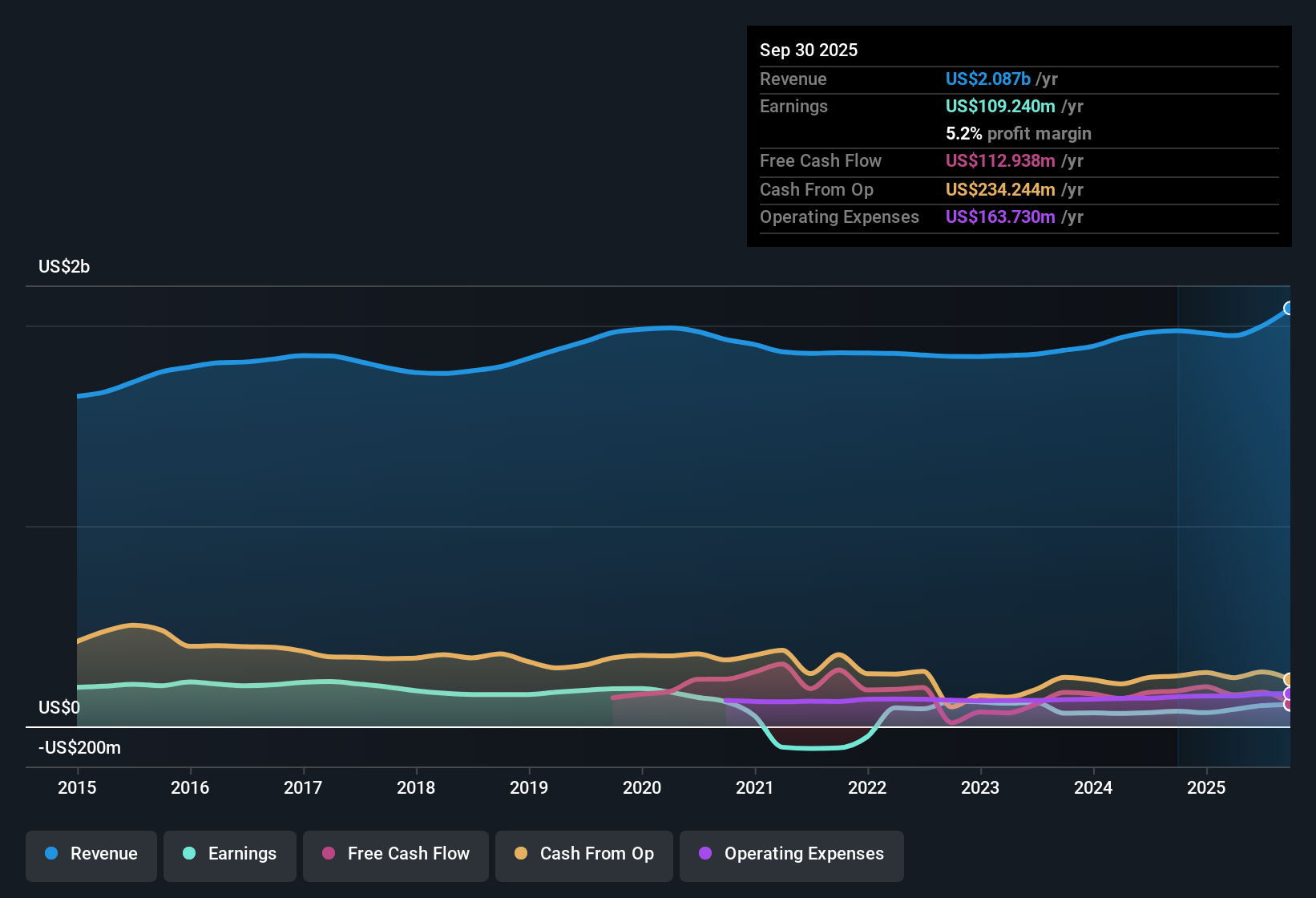

CoreCivic (CXW) closed FY 2025 with fourth quarter revenue of US$604.0 million and basic EPS of US$0.26, while trailing twelve month revenue came in at about US$2.2 billion and EPS at US$1.09, framing a year where reported earnings grew 69.2% and five year average earnings growth was 33.1% per year. The company has seen revenue move from US$479.3 million in Q4 2024 to US$604.0 million in Q4 2025. Basic EPS over those quarters shifted from US$0.17 to US$0.26 as net profit margins over the last year reached 5.3% versus 3.5% the prior year. This sets up a results season where investors will be weighing higher earnings and improved margins against the underlying drivers.

See our full analysis for CoreCivic.With the headline numbers on the table, the next step is to line these results up against the widely followed narratives around CoreCivic, to see which stories the earnings back up and which ones get questioned by the margin and growth profile.

69.2% Earnings Growth Meets 5.3% Margin Reality

- Over the last 12 months, CoreCivic generated US$2.2b of revenue and US$116.5 million of net income, with earnings up 69.2% year over year and a net profit margin of 5.3% compared with 3.5% the prior year.

- Analysts' consensus view links this earnings momentum to surging federal detention demand, yet the 5.3% margin still looks modest for a company benefiting from higher facility utilization. This means:

- Consensus expects stronger long term margins as more beds are activated, while the current 5.3% margin shows that a meaningful part of earnings is still being absorbed by costs.

- The year over year jump in earnings and margin improvement supports the idea of better profitability, but the margin level also leaves room for costs or contract terms to matter a lot to future profitability.

Quarterly Revenue Steps Up To US$604 Million

- Q4 2025 revenue came in at US$604.0 million, up from US$580.4 million in Q3 2025 and US$479.3 million in Q4 2024, while quarterly net income over this period ranged from US$25.1 million to US$38.5 million.

- Supporters of the bullish narrative point to rising occupancy and contract wins as key drivers, and the quarterly pattern gives that some backing but also some limits:

- Consensus highlights reactivation of idle facilities and higher utilization as tailwinds, which lines up with revenue moving from under US$500 million in late 2024 to over US$600 million by Q4 2025.

- At the same time, net income in Q4 2025 of US$26.5 million is below the Q2 2025 high of US$38.5 million, which shows that higher revenue alone has not translated into steadily higher profits every quarter.

P/E Of 15.3x And Debt Coverage Trade Off

- With a share price of US$17.86, CoreCivic trades on a P/E of 15.3x, compared with an analyst price target of US$29.88 and a DCF fair value of US$33.48, while a key flagged risk is that debt is not well covered by operating cash flow.

- Critics focus on that debt coverage issue, and the numbers show why it matters even alongside the apparent valuation gap:

- The P/E of 15.3x, together with the share price sitting below both the analyst target of US$29.88 and the DCF fair value of US$33.48, suggests the market may be weighing the debt coverage risk heavily.

- The combination of stronger trailing earnings and a lower P/E multiple still has to be viewed next to the warning that operating cash flow does not comfortably cover debt, which can limit how much flexibility the company has if conditions change.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CoreCivic on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this data is pointing you in another direction, shape your own view in a few minutes and Do it your way

A great starting point for your CoreCivic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

For all the earnings growth, CoreCivic still carries modest 5.3% margins and a flagged issue around debt not being well covered by operating cash flow.

If that mix of thin margins and debt coverage risk has you wanting more financial resilience, take a few minutes to scan solid balance sheet and fundamentals stocks screener (45 results) and zero in on companies where cash flow strength is front and center.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.