Please use a PC Browser to access Register-Tadawul

Corporación América Airports (NYSE:CAAP) Valuation Check After Strong Recent Share Price Rally

Corporacion America Airports S.A. CAAP | 25.04 25.04 | -0.91% 0.00% Pre |

Corporación América Airports (NYSE:CAAP) has quietly outpaced many transportation peers, with shares up roughly 17% this month and about 35% over the past 3 months, drawing attention to its underlying earnings momentum.

That recent surge in the share price, now around $25.56, caps a strong run where the 30 day share price return of 16.66% and three year total shareholder return of 205.01% suggest momentum is still firmly building rather than fading.

If CAAP’s climb has you rethinking what “airport style” growth can look like, it might be a good time to widen the lens and explore fast growing stocks with high insider ownership.

Yet with shares sitting just shy of analyst targets while long term intrinsic value still screens as heavily discounted, investors now face a pivotal question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 1.2% Undervalued

With Corporación América Airports last closing at $25.56 against a narrative fair value of $25.87, the story hinges on modest upside built on durable growth assumptions.

Ongoing major infrastructure investments, such as the Florence Airport Master Plan (recently environmentally approved), expansion projects in Armenia, and future growth opportunities in M&A and concessions, should increase capacity and competitiveness, underpinning future top-line and adjusted EBITDA expansion.

Curious how steady traffic, rising margins, and a trimmed growth outlook still add up to that fair value? The narrative leans on calibrated earnings expansion, richer profitability, and a lower future earnings multiple than today. Want to see exactly how those moving parts stack together to justify the current price gap?

Result: Fair Value of $25.87 (UNDERVALUED)

However, persistent macro volatility in Argentina and tightening regulatory or concession terms across key markets could quickly compress margins and challenge today’s measured growth assumptions.

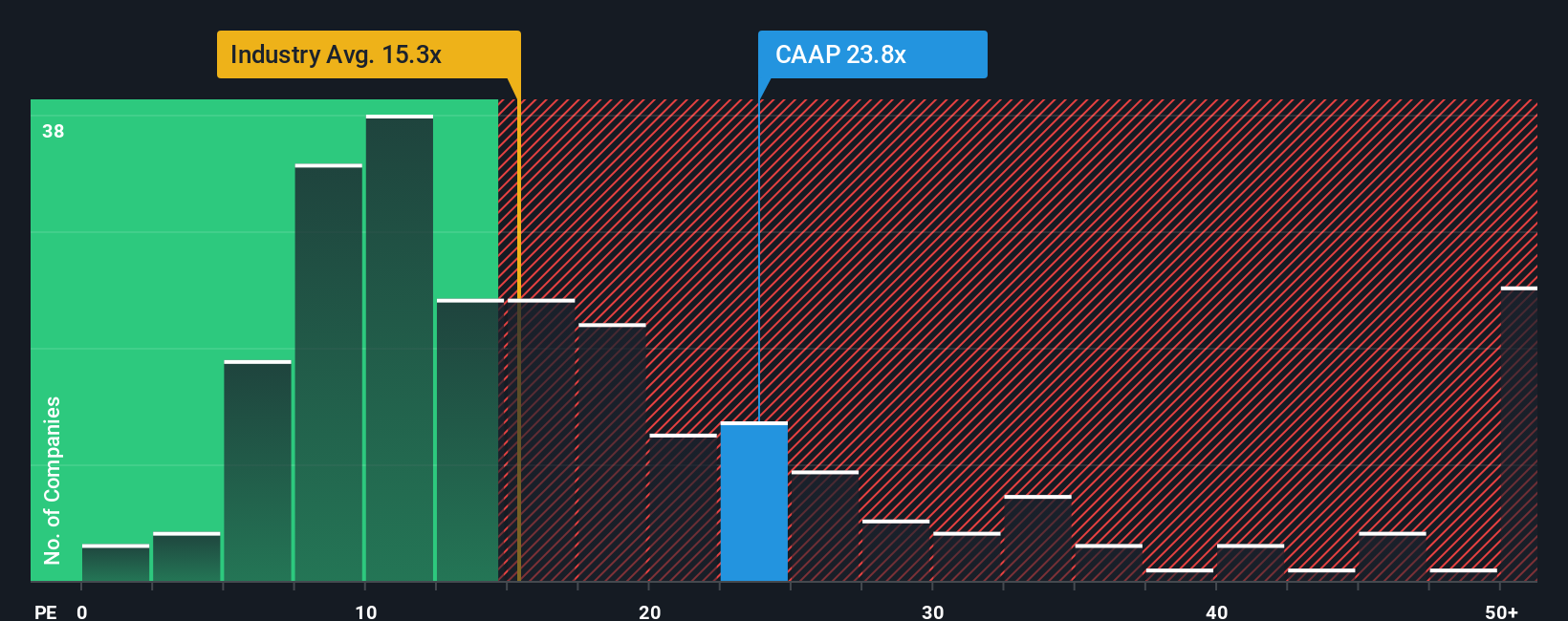

Another View: Earnings Multiple Sends a Different Signal

The narrative fair value suggests modest upside, but the earnings multiple paints a tougher picture. CAAP trades on a 23.5x price to earnings ratio versus a 21.9x fair ratio and a 14.7x sector average. This implies investors are already paying up and leaves less room for error.

Build Your Own Corporación América Airports Narrative

If the numbers or assumptions here do not quite match your view, dive into the fundamentals yourself and craft a fresh perspective, Do it your way.

A great starting point for your Corporación América Airports research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities on Simply Wall St’s Screener, so you are not late to the next big move.

- Lock in potential income streams by reviewing these 15 dividend stocks with yields > 3% that offer attractive yields backed by solid business models.

- Position yourself early in the next wave of innovation with these 27 AI penny stocks that could reshape entire industries.

- Target quality businesses at compelling prices through these 902 undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.