Please use a PC Browser to access Register-Tadawul

Costco (COST) Valuation in Focus After Strong Earnings, Solid Sales Growth, and Expanding Membership Base

Costco Wholesale Corporation COST | 860.62 | -2.70% |

If you’ve been watching Costco Wholesale (COST) lately and wondering whether now’s the moment to revisit your position, you’re in good company. Costco’s latest earnings release offered plenty to digest. Reported numbers came in above Wall Street expectations, thanks to an 8% boost in net sales and steady traffic, even as the retailer cited softer-than-hoped comparable sales growth. The company’s active expansion, high renewal rates, and growing Executive member base are all signaling resilience, especially as Costco rolls out perks like extended store hours to loyal shoppers.

This past year, Costco shares have drifted upward, with humble gains of about 4%, a far cry from the double-digit surges some investors might hope for. Still, the underlying business shows consistent momentum, driven by a mix of strategic tweaks in store operations, a strong push in e-commerce, and a steady cadence of warehouse openings. Even with occasional hiccups in discretionary spending or pressures from tariffs, Costco seems to balance scale and value, protecting its edge in a landscape where consumers are both picky and price-conscious.

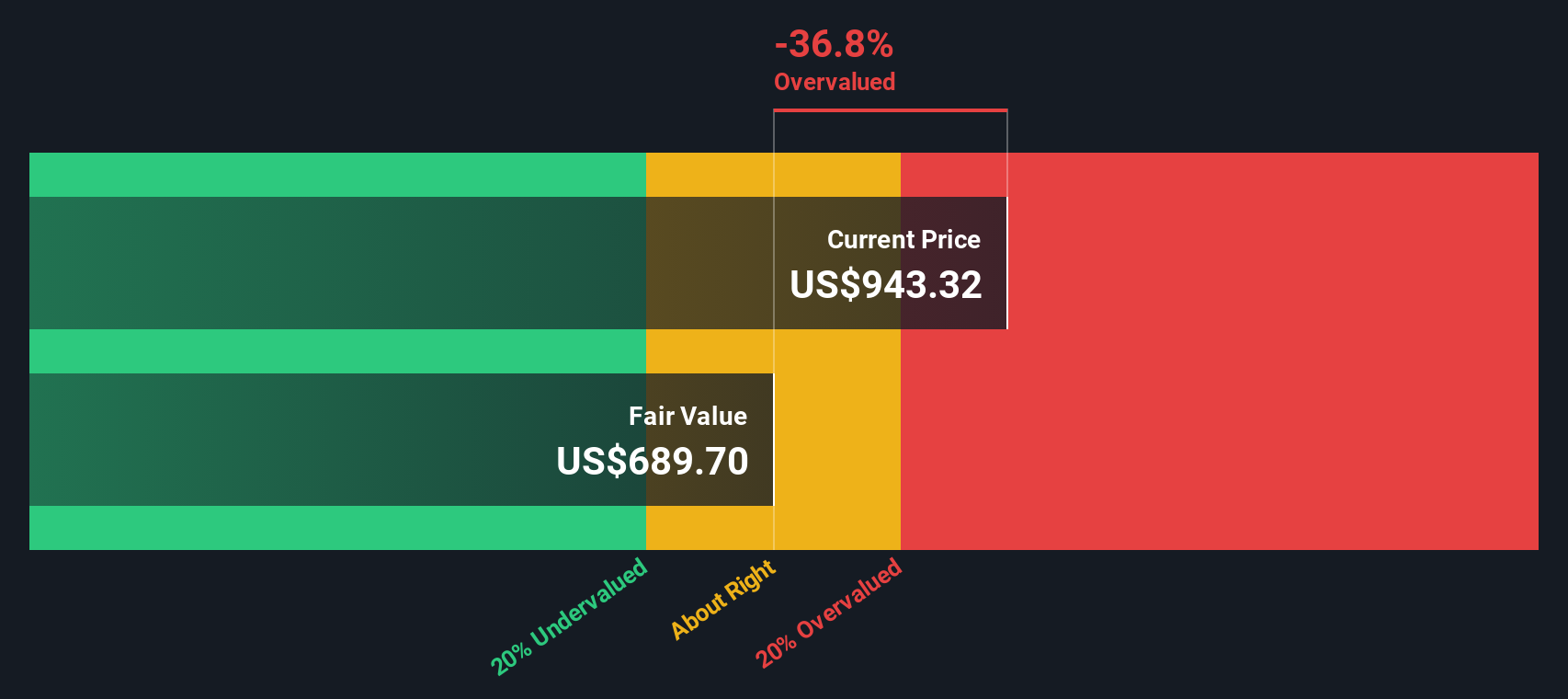

With markets rewarding consistency but also showing a touch of caution, the key question becomes: is Costco stock undervalued amid all these steady wins, or is every ounce of future growth already built into the price?

Most Popular Narrative: 87% Overvalued

According to the leading narrative by Goran_Damchevski, Costco stock appears significantly overvalued compared to its projected fair value. The narrative points to strong fundamentals but expresses skepticism about the sustainability of its current premium pricing.

Costco is a customer-centric company, with a $300B market cap and $246B in annual revenue. Its substantial purchasing power allows it to negotiate favorable deals with suppliers, enabling it to pass on savings to its members. This bulk buying strategy is crucial in maintaining Costco's competitive edge, enabling it to offer consistently low prices across a wide range of products. The difference between Costco and traditional retail is that the latter strives to maximize the margin on every product. In contrast, Costco strives to act as a procurement agent for customers, minimizing the profit margin on products while maintaining profitability from memberships.

Curious how Costco’s unique membership-driven model is stirring up the valuation conversation? The narrative’s bold projections hinge on profit sources and growth rates that may surprise you. What is the major lever behind the current fair value call? Just how aggressive are Costco’s future margin targets? Uncover the full story to see which assumption could make or break this outlook.

Result: Fair Value of $485 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent investor optimism or unexpected profit margin expansion could keep Costco’s valuation elevated and challenge even the most cautious forecasts.

Find out about the key risks to this Costco Wholesale narrative.Another View: The DCF Model Steps In

While the main narrative questions if Costco’s price can be justified by future growth, the SWS DCF model tells a similar story. The model suggests the stock is trading well above its fair value. But do two approaches cement the same conclusion, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Costco Wholesale Narrative

If the analysis here doesn't quite match your perspective, or you want to dig deeper into the numbers, you can craft your own view in just a few minutes, your way, Do it your way.

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Your investment strategy deserves more than just one perspective. Don’t let fresh opportunities slip by. Imagine where your portfolio could go with the right stocks on your radar.

- Unlock consistent income streams when you review companies offering dividend stocks with yields > 3%. This can help you build stability and growth into your holdings.

- Catalyze your returns by targeting innovative companies that are transforming healthcare and medicine using healthcare AI stocks for tomorrow’s breakthroughs.

- Spot game-changing tech leaders set to benefit from industry shifts with our selection of AI penny stocks shaping the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.