Please use a PC Browser to access Register-Tadawul

Crescent Energy Company (NYSE:CRGY) Might Not Be As Mispriced As It Looks After Plunging 27%

Crescent Energy Company Class A CRGY | 9.40 | -1.05% |

Crescent Energy Company (NYSE:CRGY) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

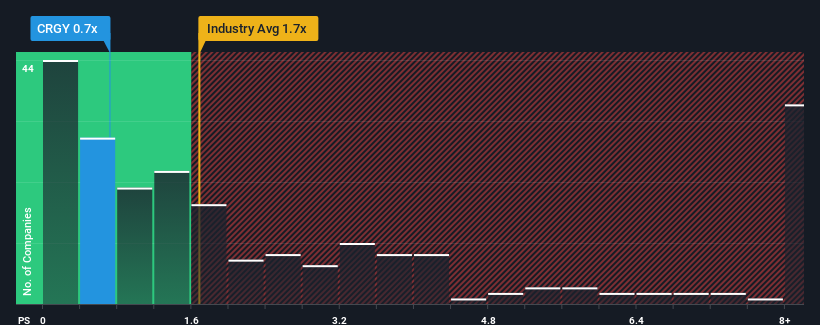

After such a large drop in price, Crescent Energy may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Oil and Gas industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Crescent Energy's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Crescent Energy has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Crescent Energy's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Crescent Energy?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Crescent Energy's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. Pleasingly, revenue has also lifted 98% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.0% each year during the coming three years according to the six analysts following the company. That's shaping up to be similar to the 4.9% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Crescent Energy's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Crescent Energy's recently weak share price has pulled its P/S back below other Oil and Gas companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Crescent Energy's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Crescent Energy is showing 3 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.