Please use a PC Browser to access Register-Tadawul

CSP (NASDAQ:CSPI) Has Announced A Dividend Of $0.03

CSP Inc. CSPI | 14.39 | -3.23% |

CSP Inc.'s (NASDAQ:CSPI) investors are due to receive a payment of $0.03 per share on 11th of June. The dividend yield is 0.8% based on this payment, which is a little bit low compared to the other companies in the industry.

CSP Might Find It Hard To Continue The Dividend

If it is predictable over a long period, even low dividend yields can be attractive. CSP is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Assuming the trend of the last few years continues, EPS will grow by 38.8% over the next 12 months. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

Dividend Volatility

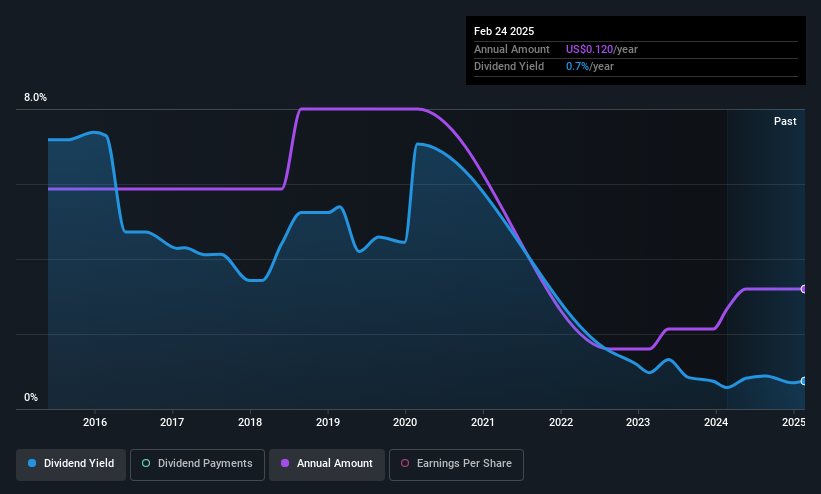

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2015, the annual payment back then was $0.22, compared to the most recent full-year payment of $0.12. Doing the maths, this is a decline of about 5.9% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Company Could Face Some Challenges Growing The Dividend

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. CSP has seen EPS rising for the last five years, at 39% per annum. The company hasn't been turning a profit, but it running in the right direction. If profitability can be achieved soon and growth continues apace, this stock could certainly turn into a solid dividend payer.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think CSP is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Are management backing themselves to deliver performance? Check their shareholdings in CSP in our latest insider ownership analysis. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.