Please use a PC Browser to access Register-Tadawul

Danaher (DHR): Valuation Insights After Strong Q3 Earnings Beat and Upbeat Outlook

Danaher Corporation DHR | 226.63 | +0.13% |

Danaher (NYSE:DHR) delivered strong third quarter results, with both sales and net income rising year-on-year. The company beat Wall Street’s revenue expectations, powered in part by steady demand for monoclonal antibody production and earlier than usual respiratory testing orders.

Danaher’s upbeat third quarter sealed a turn in sentiment, with the stock jumping nearly 6% in a single day and gaining over 20% in the past month alone. While the 1-year total shareholder return is still down 8.6%, recent momentum reflects growing belief that the worst may be behind the company. This is especially true as management points to steady bioprocessing demand and new cost efficiencies shaping up for 2026.

If Danaher’s resurgence has you thinking about what’s next in the market, it could be the perfect time to discover fast growing stocks with high insider ownership

With Danaher's rally gaining speed, investors face a pivotal question: does the recent strength signal an undervalued opportunity in a recovering leader, or is the market already pricing in all the company’s future growth?

Most Popular Narrative: 9.8% Undervalued

Danaher’s narrative fair value sits noticeably above its last closing price, with analysts projecting a substantial upside. This disconnect is driven by confidence in margin growth and innovation, even with tempered revenue expectations.

The sustained advancement of precision medicine and personalized therapies, including new AI-assisted diagnostic solutions and groundbreaking launches in genomics (such as support for in vivo CRISPR therapies), positions Danaher's technology portfolio to capture higher-margin growth and drive long-term EBITDA expansion.

Curious how analysts justify this higher valuation? The narrative is grounded in expectations for rapid improvement in profitability and aggressive expansion in advanced healthcare markets. Want a glimpse into the projections driving that bullish target? Click to decode the pivotal assumptions shaping this fair value estimate.

Result: Fair Value of $247.30 (UNDERVALUED)

However, lingering uncertainty in China and softness in core tools markets could quickly reverse the current optimism if the recovery stalls or policy risks worsen.

Another View: Caution from Earnings Multiples

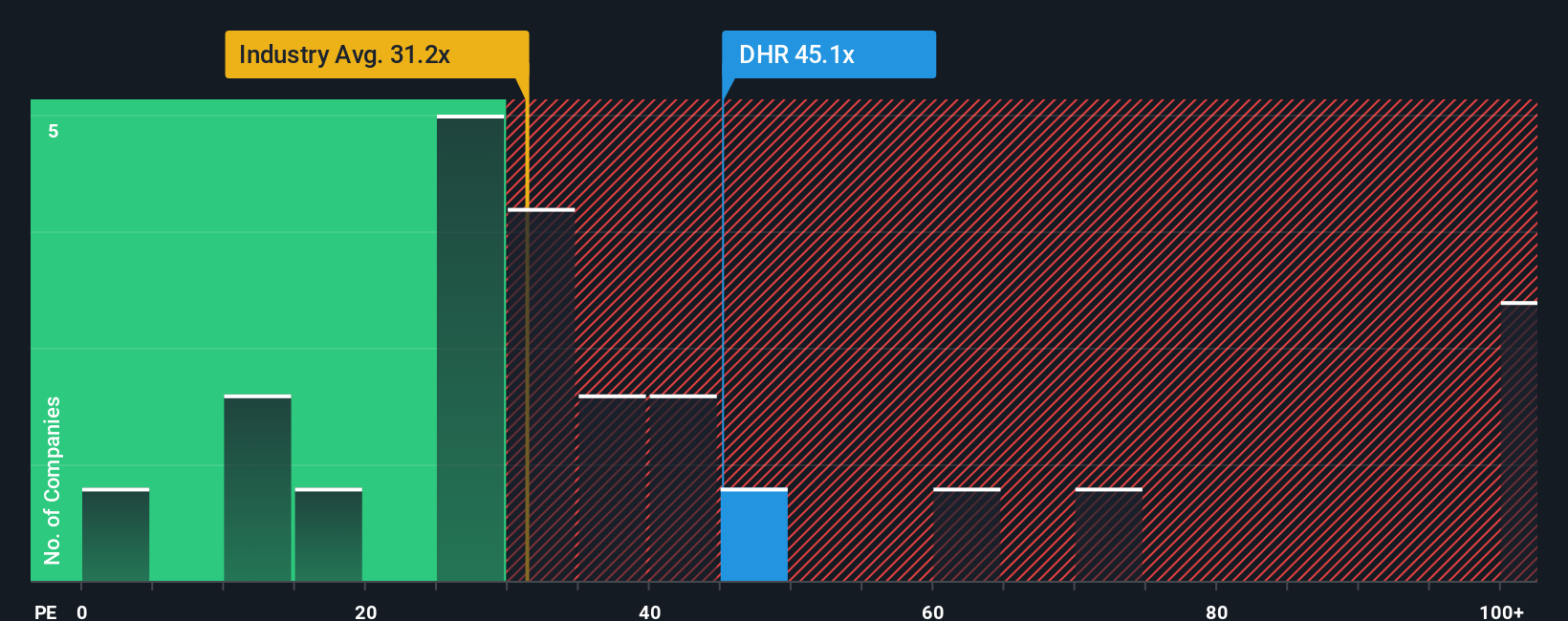

While the fair value narrative points to an undervalued opportunity, a look at Danaher’s current price-to-earnings ratio tells a different story. At 45 times earnings, Danaher is significantly more expensive than both its industry peers (34.1x) and the calculated fair ratio (28.9x). This gap suggests the market may be pricing in more future growth than is certain to materialize.

Build Your Own Danaher Narrative

If the current analysis doesn't align with your perspective or you'd rather dig into the numbers firsthand, you can easily assemble your own personalized thesis in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Danaher.

Looking for more investment ideas?

Step up your investing game with handpicked opportunities that others might overlook. Make your next smart move and tap into fresh market momentum before someone else does.

- Target reliable returns and get ahead of the curve with these 17 dividend stocks with yields > 3% offering attractive yields above 3% for income-focused investors.

- Capture the AI-fueled growth story by joining early rounds on these 27 AI penny stocks and find companies redefining what's possible in tech.

- Uncover hidden value and catch promising opportunities before they’re widely recognized with these 877 undervalued stocks based on cash flows based on powerful cash flow insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.