Please use a PC Browser to access Register-Tadawul

Datadog (DDOG) Valuation Reassessed After Analyst Downgrades And Rotation Out Of Technology Stocks

Datadog DDOG | 119.02 | -1.52% |

Recent analyst downgrades and a rotation out of technology stocks have put Datadog (DDOG) back under the microscope as investors weigh valuation concerns against its strong earnings beat and ongoing positive business outlook.

That pullback has been sharp, with a 1 day share price return of a 4.0% decline, a 30 day share price return of a 14.1% decline and a year to date share price return of a 6.2% decline. Even so, the 3 year total shareholder return of 78.1% still points to strong longer term gains. Recent momentum appears to be fading as investors reassess growth expectations and risk around competition and AI budgets.

If Datadog’s swings have you thinking about where else AI spending might flow, this could be a good moment to check out high growth tech and AI stocks as potential next ideas.

So with Datadog now at US$125.49, strong recent results and a roughly 49.6% intrinsic discount signal one story, while fresh Sell ratings and AI competition suggest another. Is this a reset worth considering, or is future growth already priced in?

Most Popular Narrative: 39.8% Undervalued

With Datadog last closing at US$125.49 versus a most followed fair value estimate of about US$208.49, the valuation story hinges on how much earnings power and AI driven demand you think can be sustained over time.

Ongoing product innovation (e.g., autonomous AI agents, enhanced security modules, expanded log and data observability) is increasing platform breadth and relevance, providing cross-selling opportunities and driving higher average revenue per user and net retention rate, which in turn improves recurring revenue predictability and gross margins. Datadog's focus on internal cloud cost optimization, platform efficiency, and leveraging its own solutions for cost savings is already contributing to higher gross margins, and further improvements are expected to flow through to operating income and net earnings as volume scales.

Curious what kind of revenue trajectory and margin profile need to materialise to back that fair value, plus what future P/E is being baked in? The full narrative lays out a detailed path involving rapid earnings expansion, shifting profitability and a rich earnings multiple that goes well beyond typical software names.

Result: Fair Value of $208.49 (UNDERVALUED)

However, there are still clear pressure points, including potential pricing compression from rivals and heavier spending that could squeeze margins if revenue growth does not keep pace.

Another View: Rich Sales Multiple Keeps Expectations High

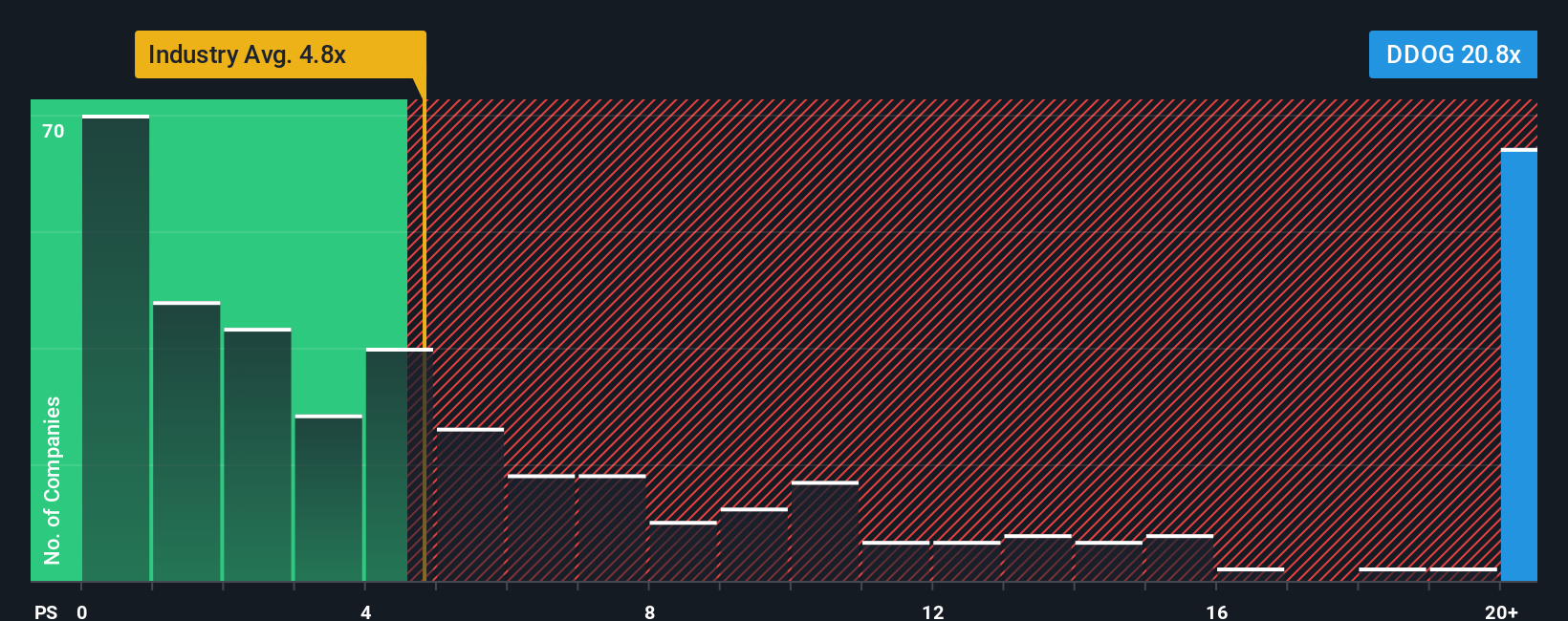

While our fair value estimate suggests Datadog trades at a roughly 49.6% discount, its P/S ratio of 13.7x tells a different story. That is well above the US Software industry at 4.9x, the peer average at 9.7x, and even the 12.5x fair ratio our model suggests the market could move toward. For you, that gap can either look like a valuation cushion or a sign that expectations still sit high, especially if growth or margins come in softer than hoped.

Build Your Own Datadog Narrative

If you see the numbers differently, or simply want to stress test your own assumptions against the data, you can quickly build a custom thesis that reflects your view, then Do it your way.

A great starting point for your Datadog research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop your research with a single stock, broaden your watchlist using focused screeners that surface opportunities you might otherwise miss.

- Target reliable cash generators by scanning for companies in these 12 dividend stocks with yields > 3% that may add income strength to your portfolio.

- Chase future facing themes by reviewing these 79 cryptocurrency and blockchain stocks that are building real businesses around blockchain and digital assets.

- Hunt for potential mispricings by checking these 885 undervalued stocks based on cash flows that currently trade at a discount to their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.