Please use a PC Browser to access Register-Tadawul

Datadog (DDOG) Valuation Spotlight After Wells Fargo Praises AI Growth Prospects and Platform Strength

Datadog DDOG | 143.59 | -1.65% |

Datadog (DDOG) shares climbed after Wells Fargo initiated coverage, praising the company’s unified monitoring platform and its position to benefit from rising enterprise AI adoption. Investors appear to be reacting to renewed sector optimism.

Datadog’s latest climb adds to a year marked by strong investor confidence, fueled by upbeat analyst reports, rapid product innovation, and prominent AI-driven partnerships. With total shareholder return up nearly 29% over the past 12 months and solid multi-year gains, momentum appears to be building as the company cements its leadership in cloud monitoring and AI observability.

If you're looking for other fast-moving opportunities beyond Datadog, this is a great time to broaden your investing search and discover fast growing stocks with high insider ownership

Yet with shares approaching analysts’ targets and fundamentals riding high on AI optimism, the central question now is whether Datadog still offers upside potential or if the market has already priced in its next phase of growth.

Most Popular Narrative: 5.2% Undervalued

Datadog’s most widely followed narrative sees fair value ahead of the last closing price, suggesting ongoing upside despite a strong recent run. The gap between the narrative’s valuation and the market price draws from bold projections around the digital transformation trend.

“Accelerating enterprise cloud migration and broader adoption of AI workloads are driving increased demand for unified observability and security platforms. This positions Datadog as a mission-critical vendor and supports continued topline revenue growth as digital transformation deepens across industries."

Want to know the financial storyline behind this valuation? The narrative hinges on eye-opening growth projections for both revenue and profits, and assumes Datadog maintains elite margins while expanding market share. Just what level of future performance supports this ambitious price? Dive in to see what drives the numbers.

Result: Fair Value of $159.93 (UNDERVALUED)

However, persistent cost pressures and stiff competition from industry giants could easily challenge Datadog's growth trajectory and its current valuation outlook.

Another View: Multiples Tell a Different Story

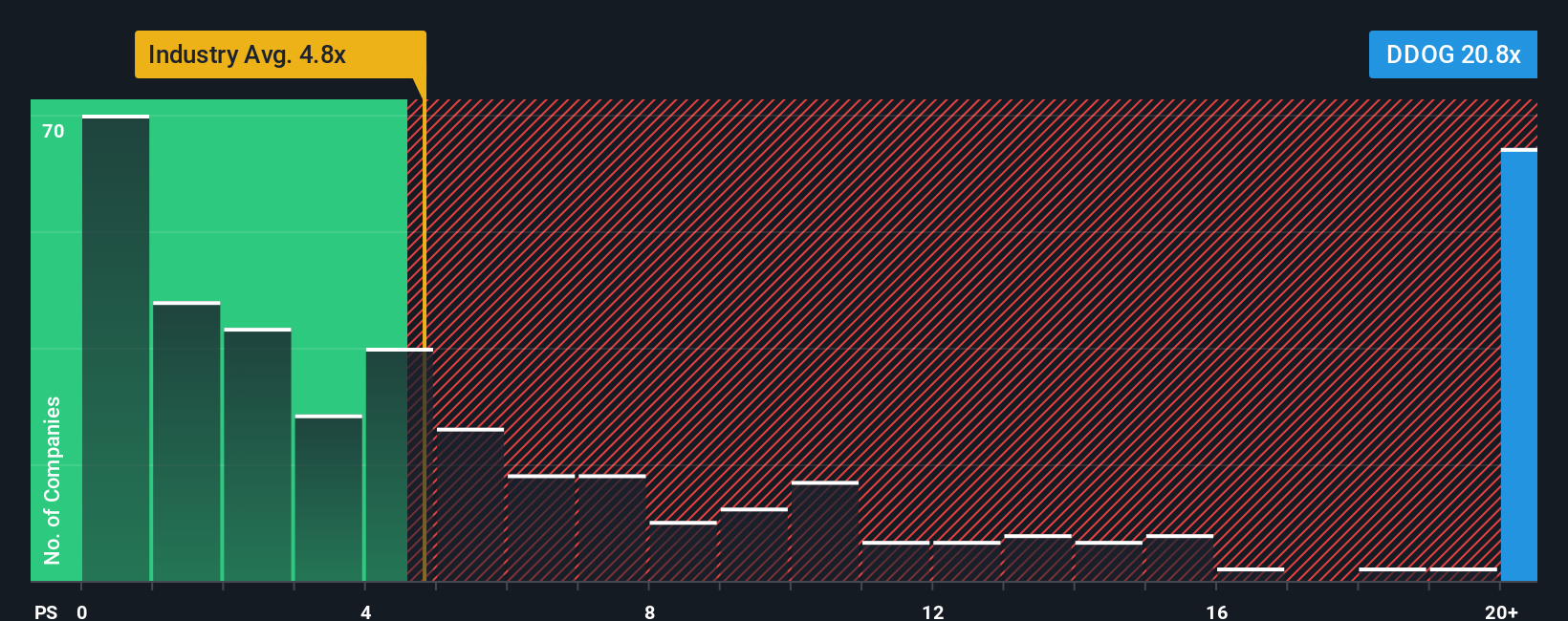

While the current valuation suggests Datadog is undervalued, a look at its price-to-sales ratio reveals caution signs. Shares trade at 17.5 times sales, which is steep compared to both the US software industry average of 5.3 and a peer average of 11. The fair ratio based on our analysis sits lower at 14.4. This hints that the market may be pricing in very robust growth, which leaves little room for disappointment. Could this premium signal future opportunity, or a risk if growth slows?

Build Your Own Datadog Narrative

If the current view doesn’t quite fit your take or you’re the kind to dig into the data yourself, it’s quick and easy to assemble your own take from the ground up. Do it your way.

A great starting point for your Datadog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait for the next trend to pass you by; get ahead of the market and give your portfolio a fresh edge with Simply Wall Street’s tailored stock ideas.

- Tap into high-yield strategies by reviewing these 19 dividend stocks with yields > 3% that continue to deliver impressive income and reward shareholders year after year.

- Fuel your search for long-term growth by analyzing these 910 undervalued stocks based on cash flows offering powerful upside potential based on solid fundamentals and attractive cash flow valuations.

- Step into the new era of technology by spotting future leaders among these 24 AI penny stocks at the cutting edge of artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.