Please use a PC Browser to access Register-Tadawul

Denali Therapeutics (DNLI): Assessing Valuation After FDA Advances Key Pipeline Approvals

Denali Therapeutics Inc. DNLI | 20.84 | -1.14% |

If you have been following Denali Therapeutics (DNLI), this latest announcement is hard to ignore. The FDA’s acceptance of its biologics license application for tividenofuspalfa for priority review sets the stage for a key regulatory milestone. Not only has the company signaled progress in its lead programs, but it has also reached an important agreement with the FDA on a surrogate endpoint for accelerated approval of DNL126. This move could expedite access for patients with Sanfilippo syndrome type A. The undertone here is clear: Denali is making a push on multiple fronts as it advances its clinical pipeline.

This flurry of regulatory activity comes at a time when Denali’s stock has been under pressure. Over the past year, shares have recorded a decline of 54%, even as the company reports nearly 60% annual revenue growth and expanding clinical initiatives. Recent weeks have also included several high-profile conference presentations, yet the market response has remained cautious. While long-term momentum has faded, these latest regulatory updates inject some fresh optimism and may prompt investors to revisit their views on future potential.

With the share price hovering well below last year's level, is Denali Therapeutics now trading at a discount that underestimates its pipeline progress, or is the market simply pricing in the risks ahead?

Price-to-Book of 2x: Is it justified?

Based on its price-to-book ratio, Denali Therapeutics currently appears undervalued in comparison to both its industry peers and the wider US biotechs sector.

The price-to-book (P/B) ratio compares a company’s market value to its book value and offers investors a quick read on how the market is valuing a company’s underlying assets. In the biotech sector, where profits can be irregular and R&D spending is high, the P/B ratio is a commonly referenced metric to assess valuation relative to the sector.

Denali’s P/B of 2x sits below the peer average (4.4x) and the US biotechs industry average (2.2x). This may suggest the market is assigning less value to Denali’s assets and future growth prospects, potentially underestimating recent progress in its clinical pipeline. Still, the company’s unprofitable status and negative return on equity highlight that expectations may be tempered despite its asset base.

Result: Fair Value of $14.19 (ABOUT RIGHT)

See our latest analysis for Denali Therapeutics.However, investor caution persists, as Denali remains unprofitable and future clinical outcomes, given ongoing R&D risks, could quickly shift sentiment again.

Find out about the key risks to this Denali Therapeutics narrative.Another View: Discounted Cash Flow Challenges the Multiple

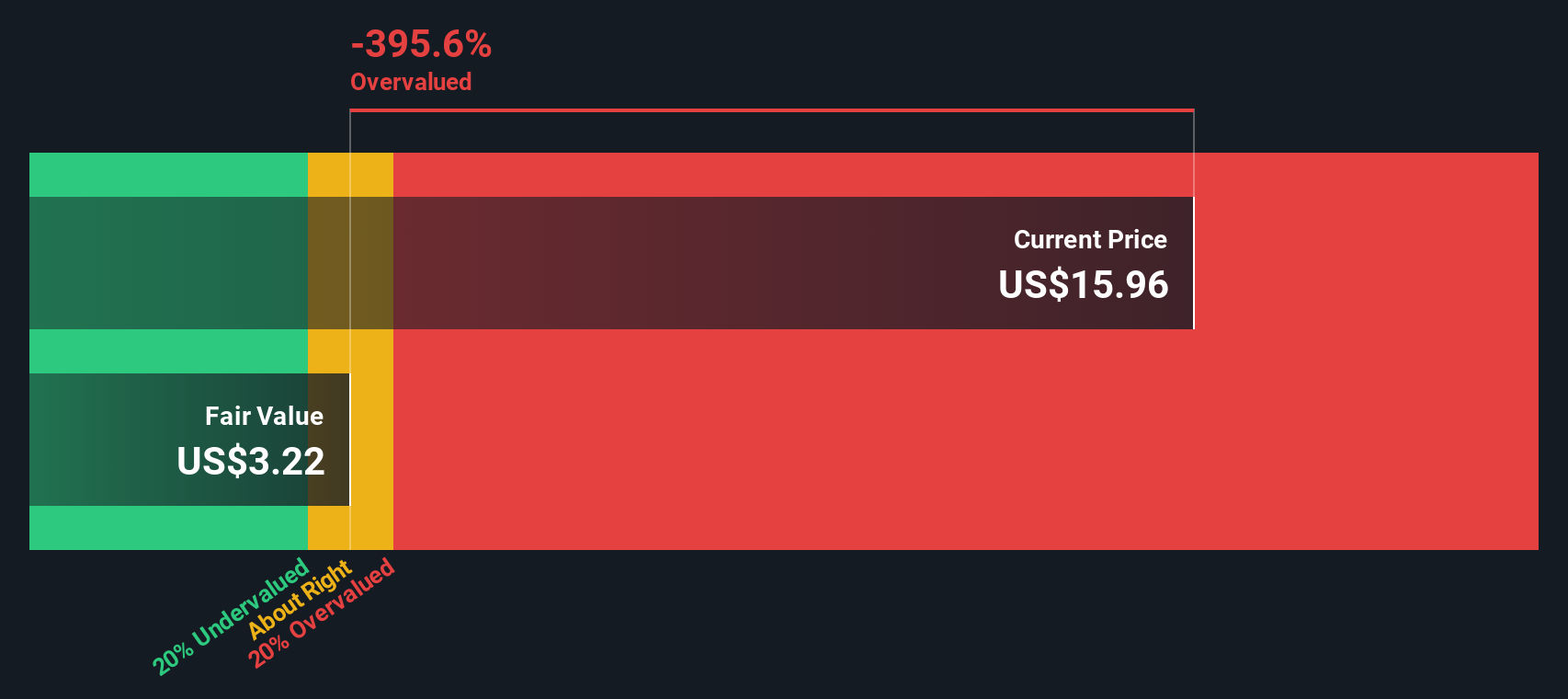

Looking through the lens of our DCF model paints a very different picture for Denali. While the asset-based approach suggests fair value, the DCF method implies the stock could be overvalued, which raises questions about how much optimism is factored into the market price. Which way should investors lean?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Denali Therapeutics Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own view in just a few minutes. Do it your way

A great starting point for your Denali Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Why stop here? The Simply Wall Street Screener brings exciting investment ideas to your fingertips, giving you the chance to seize potential winners before everyone else does.

- Uncover companies harnessing artificial intelligence to revolutionize industries by checking out the innovators behind AI penny stocks.

- Kickstart your search for reliable income sources with a curated selection of dividend stocks with yields > 3% featuring strong yields and solid fundamentals.

- Jump ahead of the crowd by targeting hidden bargains with our powerful tool for undervalued stocks based on cash flows which may be poised for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.