Please use a PC Browser to access Register-Tadawul

Despite currently being unprofitable, Clean Energy Fuels (NASDAQ:CLNE) has delivered a 57% return to shareholders over 5 years

Clean Energy Fuels Corp. CLNE | 2.27 | +0.66% |

Clean Energy Fuels Corp. (NASDAQ:CLNE) shareholders might be concerned after seeing the share price drop 27% in the last quarter. But at least the stock is up over the last five years. In that time, it is up 57%, which isn't bad, but is below the market return of 62%. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 48% decline over the last twelve months.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Clean Energy Fuels

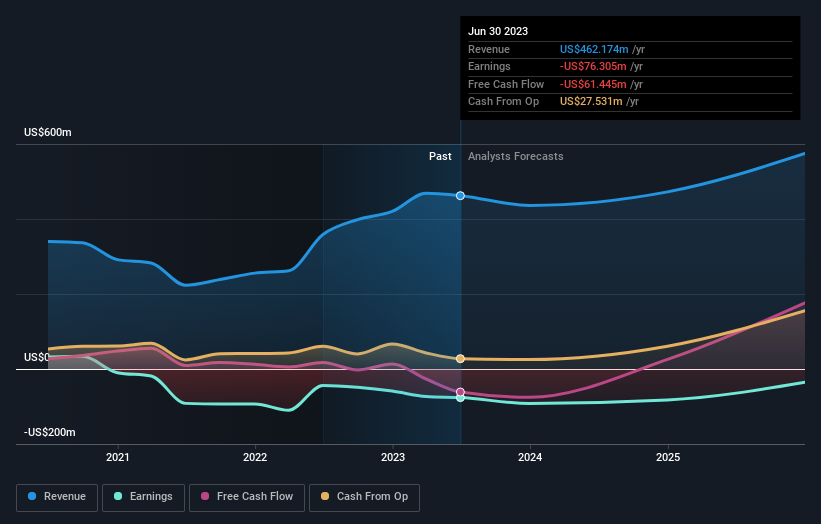

Clean Energy Fuels wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Clean Energy Fuels saw its revenue grow at 3.7% per year. That's not a very high growth rate considering the bottom line. The modest growth is probably broadly reflected in the share price, which is up 9%, per year over 5 years. We'd be looking for the underlying business to grow revenue a bit faster.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Clean Energy Fuels in this interactive graph of future profit estimates.

A Different Perspective

Clean Energy Fuels shareholders are down 48% for the year, but the market itself is up 9.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 9% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Clean Energy Fuels , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.