Please use a PC Browser to access Register-Tadawul

Does Axon’s 20% Rally Signal Room for Growth After Latest DOJ Contract Win?

Axovant Sciences Ltd AXON | 556.52 | -1.38% |

If you have been watching Axon Enterprise, you are not alone. Whether you are sitting on gains or wondering if now is the right moment to jump in, the stock’s recent action probably has you feeling a mix of excitement and caution. After a modest 0.9% uptick in the last week and a slight 1.8% dip over the past month, Axon’s year-to-date rally of 20.0% and a stunning 69.6% surge over the last year stand out. Stretch that view further and the growth story only gets more impressive, with the stock up 478.2% over the last three years and a massive 622.8% in five.

These market moves hint at more than just hype. They reflect changing investor sentiment and, in some cases, a shift in how the market values Axon’s core business. Notable developments in public safety technology and growing demand for Axon’s solutions appear to be fueling this momentum, helping cement Axon as a leader in its space.

But the big question for investors is always the same: does the stock still offer value? Right now, Axon scores a 1 out of 6 on standard undervaluation checks, indicating that only one area suggests the stock is undervalued. That does not tell the whole story, though, so let’s dive deeper into the different valuation approaches. Before we wrap up, we will look at a perspective that can bring even more clarity to whether Axon Enterprise is truly worth your investment.

Axon Enterprise scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Axon Enterprise Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s dollars. This approach aims to assess what Axon Enterprise could be worth based on the cash it is expected to generate.

Currently, Axon Enterprise generates Free Cash Flow of $184 million. Analyst estimates show this figure could grow rapidly, with projections reaching $889 million by 2027. Looking further out, extrapolated forecasts suggest that by 2035, Axon’s annual Free Cash Flow could approach $1.9 billion, reflecting consistent double-digit growth. All figures are in US dollars.

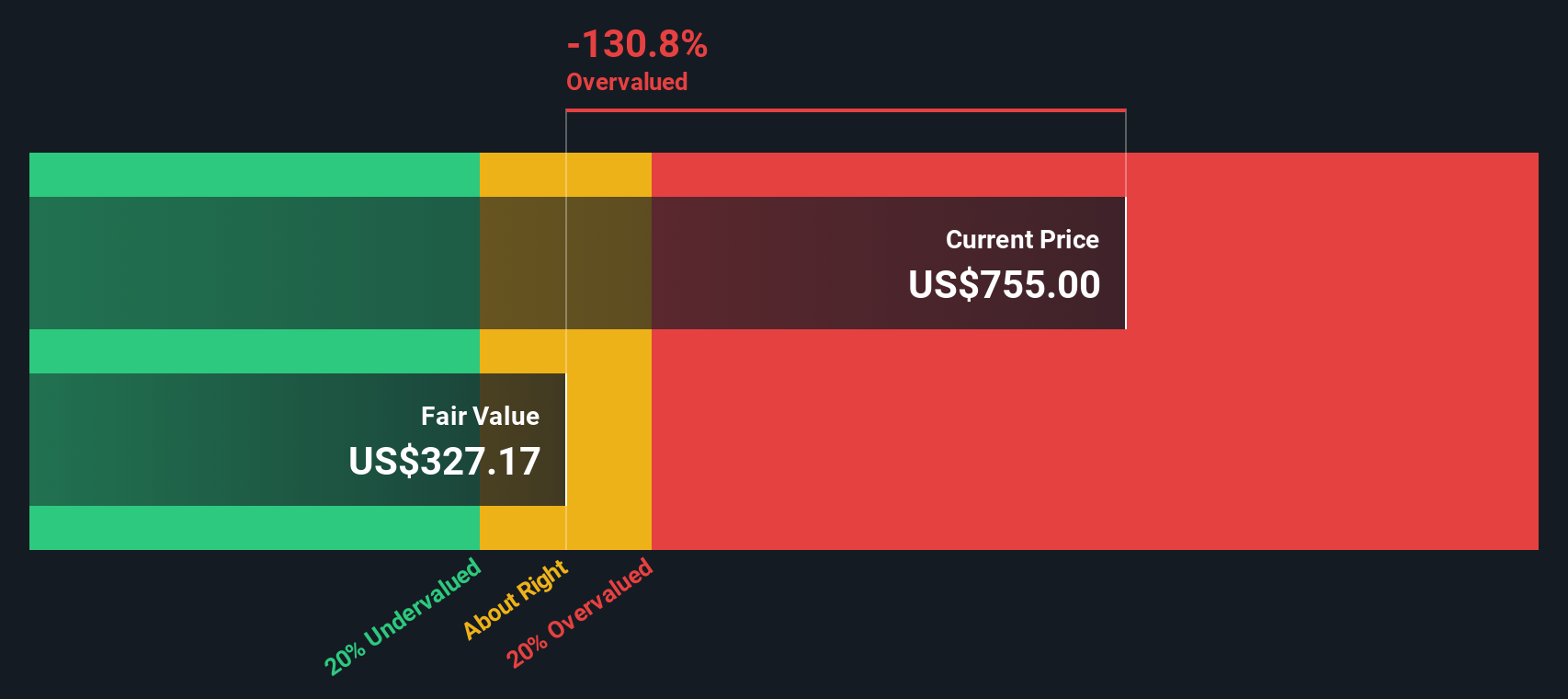

Applying the two-stage Free Cash Flow to Equity method, the DCF model calculates an intrinsic value of $368.63 per share for Axon Enterprise. However, when compared to the stock’s current market price, this suggests the shares are approximately 94.1% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Axon Enterprise may be overvalued by 94.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Axon Enterprise Price vs Sales

For fast-growing companies like Axon Enterprise, the Price-to-Sales (PS) ratio is often a more reliable valuation tool, especially when profits are expanding but still volatile. The PS multiple helps investors compare how much they are paying for each dollar of revenue. Companies with strong growth prospects or unique market positions often justify a premium PS ratio, but risk and long-term sustainability still play key roles in determining what is considered “fair.”

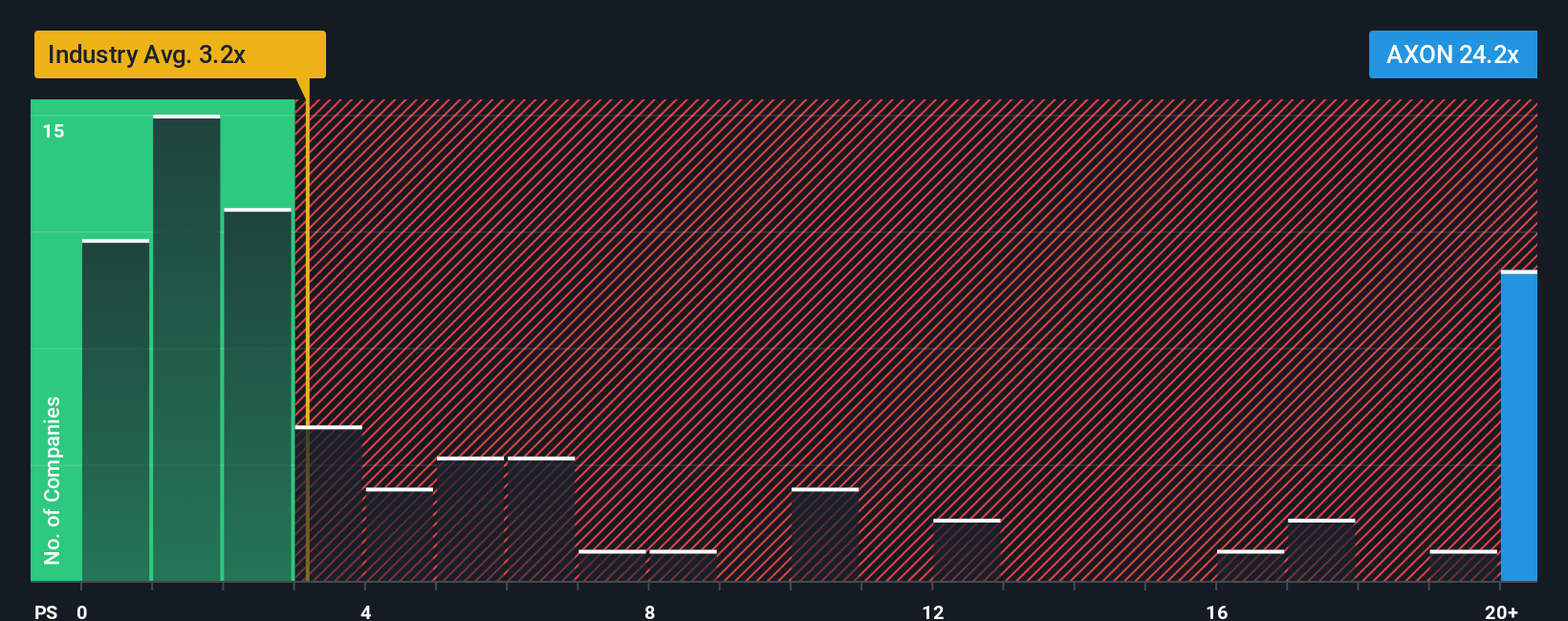

Axon Enterprise currently trades at a hefty 23.5x PS ratio. This is significantly above the Aerospace & Defense industry average of 3.3x and also well higher than its key peers, who average 7.8x. By traditional standards, this could suggest that the stock is expensive compared to similar businesses. However, Axon's growth, recurring revenue streams, and expanding market presence complicate this simple comparison.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio for Axon, based on elements like its revenue growth, margins, industry characteristics, size, and risk, is 16.1x. Unlike generic benchmarks, the Fair Ratio considers aspects that really set a company apart, such as growth rates and profitability. This holistic view helps investors avoid undervaluing unique market leaders or overvaluing those facing risks their peers do not.

Comparing Axon's current 23.5x PS ratio to its Fair Ratio of 16.1x shows the stock is trading at a significant premium relative to what fundamentals might justify. While exceptional growth may back some of this premium, the market is still pricing in a lot of optimism.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Axon Enterprise Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company’s future, connecting your perspective on its business, industry developments, and key risks to a clear set of financial forecasts and a fair value estimate.

Rather than relying only on numbers or analyst models, Narratives help you capture why you believe Axon will succeed or face challenges. These beliefs are then automatically translated into forward-looking revenue, earnings, and margin projections. This links the company’s story directly to its financial future and turns your view into an actionable valuation.

On Simply Wall St’s Community page, which is used by millions of investors, building your own Narrative is as easy as sharing your insights and adjusting a few key assumptions. Narratives instantly show whether Axon’s current stock price is above or below your calculated Fair Value, giving you a visual guide to when to buy, hold, or sell.

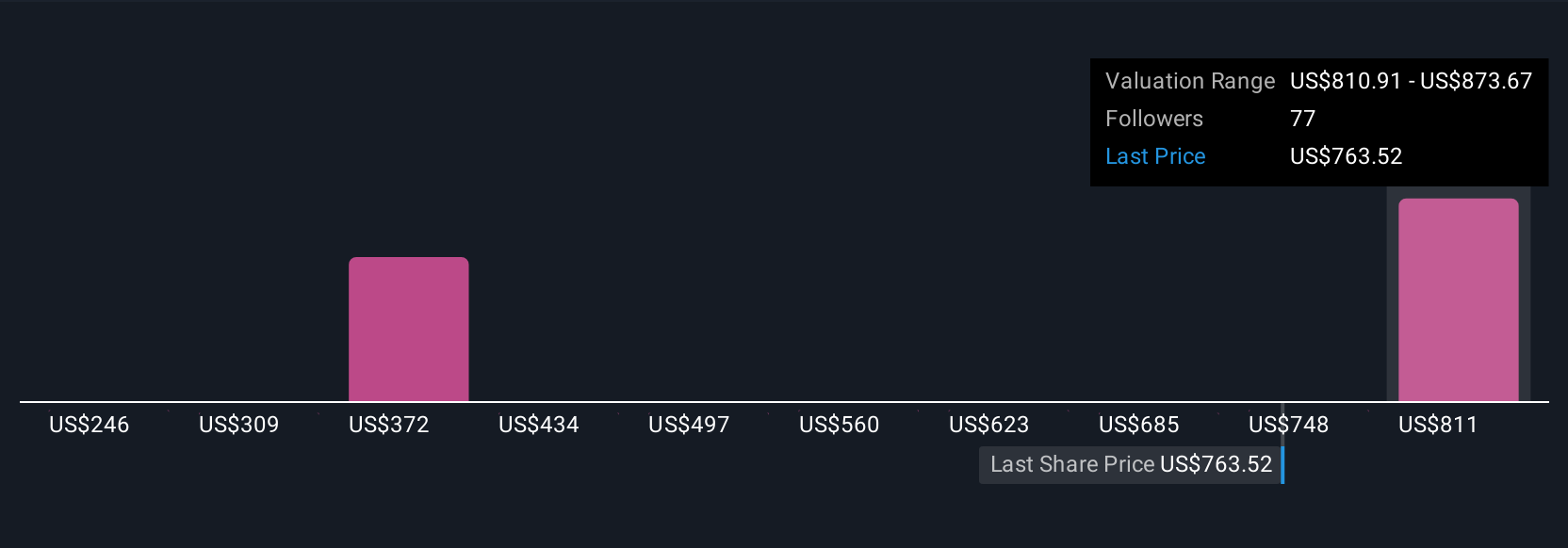

Best of all, Narratives update dynamically as news and quarterly results roll in, so your outlook can always reflect the latest developments. For example, one investor might believe in Axon's global expansion and accelerating SaaS adoption, projecting a Fair Value north of $1,000 per share. Another investor, focused on international risks and rising competition, might see a value closer to $800.

Do you think there's more to the story for Axon Enterprise? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.