Please use a PC Browser to access Register-Tadawul

Does Macerich’s (MAC) Dividend Consistency Reflect Financial Strength or Limited Growth Ambitions?

Macerich Company MAC | 18.67 18.50 | +0.70% 0.00% Pre |

- The Board of Directors of Macerich declared a quarterly cash dividend of US$0.17 per share, payable on September 23, 2025, to shareholders of record as of September 9, 2025.

- This continued commitment to shareholder dividends may signal management’s confidence in the company’s liquidity and ability to generate consistent cash flows.

- Next, we’ll examine how Macerich’s ongoing dividend payments reinforce the investment narrative focused on cash flow stability and shareholder returns.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Macerich Investment Narrative Recap

To be a Macerich shareholder, you need confidence in the company’s capacity to maintain steady cash flows and preserve shareholder value despite ongoing operational and financial headwinds. The latest dividend announcement at US$0.17 per share continues a familiar pattern and is unlikely to materially alter the most important short-term catalyst, improving rental revenue from new leases, or the main risk, which remains higher capital and tenant improvement costs straining free cash flow.

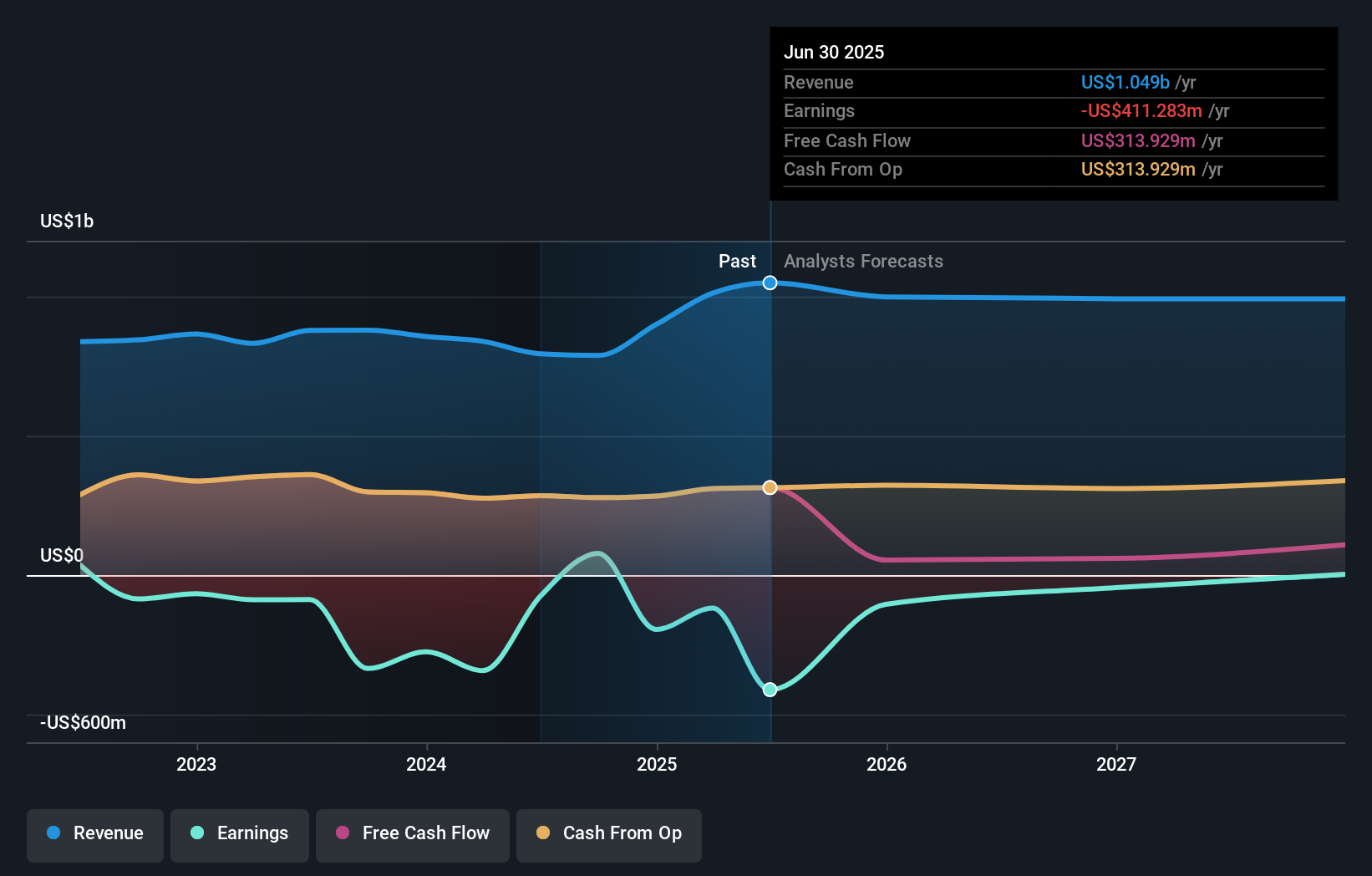

Among recent announcements, the company’s Q1 2025 earnings update stands out for its improved year-on-year revenue and reduced net loss. While this signals some progress towards stabilizing operations, it’s important to weigh these trends against the ongoing pressures from higher interest expenses and the increased costs associated with attracting new tenants.

However, even as dividend consistency might seem reassuring, investors should be mindful of near-term pressures on free cash flow as...

Macerich's narrative projects $1.0 billion in revenue and $6.1 million in earnings by 2028. This requires a 0.1% annual revenue decline and a $124.5 million increase in earnings from the current earnings of -$118.4 million.

Uncover how Macerich's forecasts yield a $19.07 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$19.07 to US$28.15 based on 2 independent perspectives. Some see improved revenue and narrowing losses as reasons for optimism, while others weigh ongoing free cash flow strain and future lease transitions, so it pays to see which scenario feels most plausible to you.

Explore 2 other fair value estimates on Macerich - why the stock might be worth as much as 69% more than the current price!

Build Your Own Macerich Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macerich research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Macerich research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macerich's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.