Please use a PC Browser to access Register-Tadawul

Does the Recent 3% Rebound Signal a New Value Opportunity for American Tower?

American Tower Corporation AMT | 180.70 | -0.56% |

If you are weighing what to do with your American Tower shares or thinking of buying in, you are far from alone. The name pops up again and again for investors seeking stability and long-term growth in the communications infrastructure world. But with a stock price closing at $192.37 most recently, and a year that has seen some dramatic ups and downs, figuring out if it is undervalued now takes more than a glance at recent returns.

Let’s talk recent action first. After a dip in late spring, American Tower has bounced back by 3.1% in just the last week. Year-to-date, the stock is up 6.3%, showing solid resilience, although the past year still clocks in at a negative 10.2%. Those swings reflect more than just market noise. Lately, the conversation around American Tower has centered on the company’s continued international expansion and partnerships with global wireless carriers. This momentum, coupled with ongoing demand for connectivity worldwide, has fueled a bit more optimism in the risk outlook and perhaps a slightly rosier view of growth ahead.

Still, the real question is whether American Tower is priced right. On a valuation scorecard, the company lands 5 out of 6, a strong sign that it is undervalued in most of the key metrics analysts care about. That said, not every angle points in the same direction, and getting a full picture means digging deeper into the details. Next up, we will walk through each valuation approach to see how American Tower stacks up, but stick around, because the most insightful way to understand its value might surprise you.

Approach 1: American Tower Discounted Cash Flow (DCF) Analysis

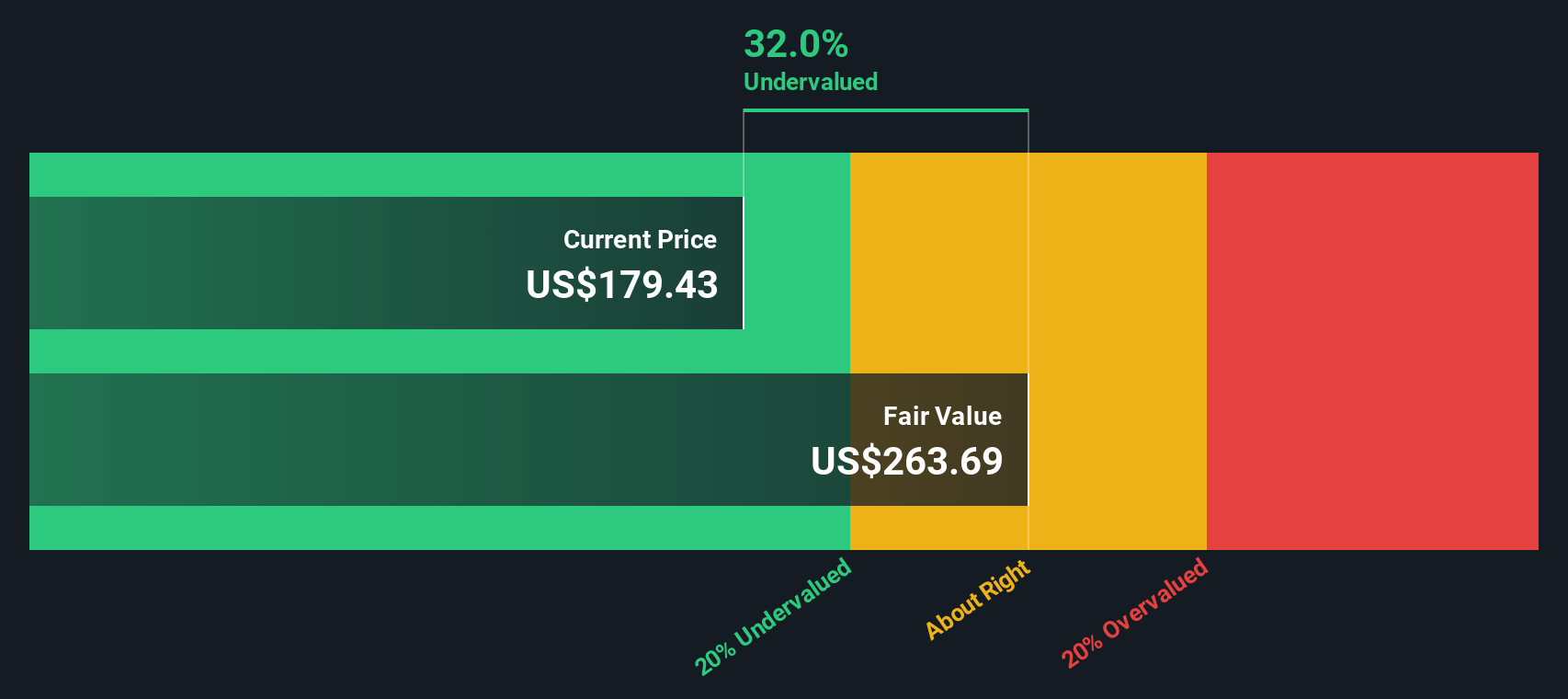

A Discounted Cash Flow (DCF) valuation looks ahead and adds up all the cash American Tower is expected to generate in the future, then discounts it back to today's dollars using a reasonable rate. In this case, the model starts with American Tower’s latest twelve months free cash flow, which reached $4.93 billion. Analysts guide the next five years with steadily rising forecasts, projecting free cash flow to climb to about $6.04 billion by 2029. Beyond that, the growth outlook continues upward, with estimates extending out to over $7.42 billion by 2035. For these later years, figures are extrapolated based on long-term assumptions, since detailed analyst predictions usually stop around year five.

All these future billions are then discounted back to a present value, resulting in an estimated intrinsic value of $258.10 per share. With the stock recently trading at $192.37, this implies that shares are 25.5% undervalued according to the DCF approach. This sizable margin of safety is a positive for risk-conscious investors, suggesting the current price does not fully reflect American Tower’s future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Tower is undervalued by 25.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: American Tower Price vs Earnings

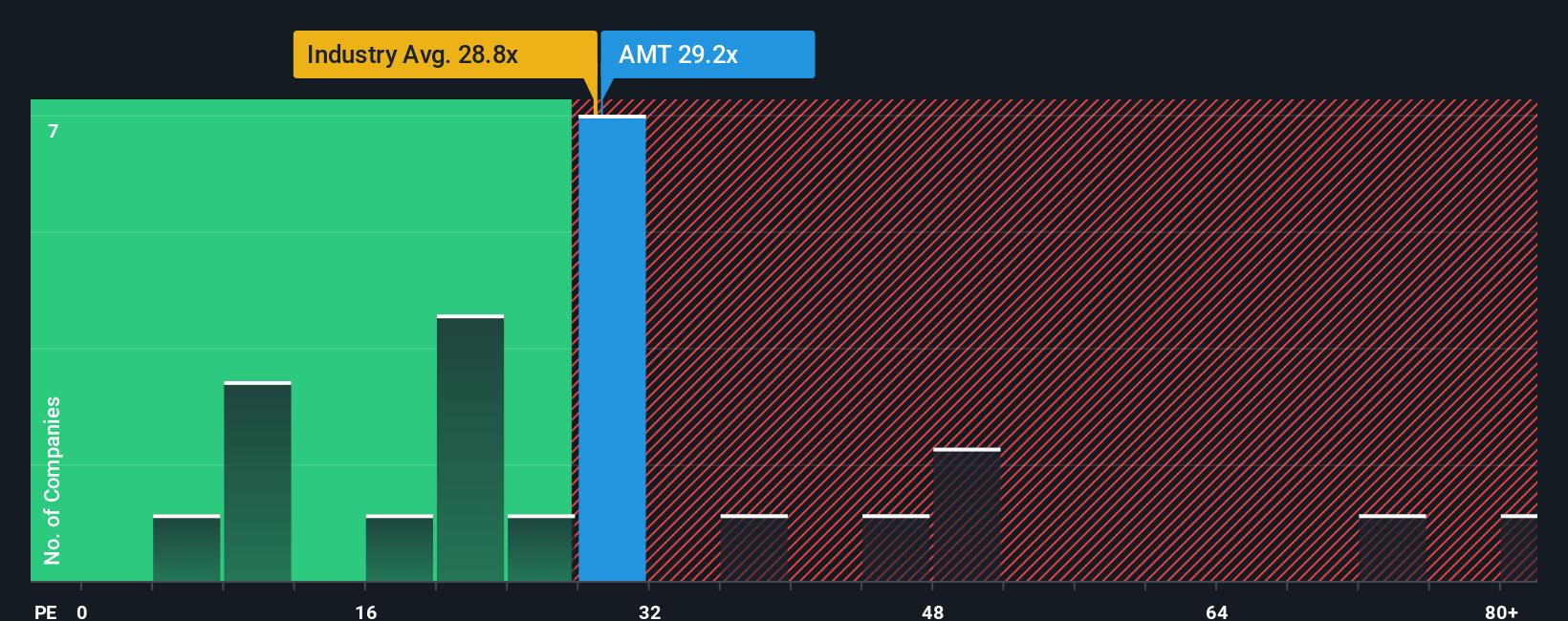

For profitable companies like American Tower, the Price-to-Earnings (PE) ratio is a widely used valuation measure because it connects the company’s market value directly to its ability to generate earnings. In companies with steady profits, this metric helps investors quickly gauge how much they are paying for each dollar of earnings, making it especially relevant for established businesses in mature industries.

The “right” PE ratio to pay often depends on growth expectations and the perceived risks facing the business. Higher growth and lower risk typically justify a higher PE, while slower growth or greater risk push the multiple downward. American Tower currently trades on a PE of 36x, which stands above the industry average of 17.7x for Specialized REITs but sits noticeably below the peer average of 45.6x. This suggests that the market is pricing in more growth and stability than the typical industry player but less so than some peers.

Simply Wall St offers a proprietary benchmark called the Fair Ratio, which refines this approach by including not just growth and profit margin but also risk, industry context, and market cap. This provides an expectation that is more tailored than simply averaging peers or industry numbers. For American Tower, the Fair Ratio comes in at 39.6x. Comparing this to the current PE of 36x indicates that the stock is a little below what might be considered “fair” after considering the company’s strengths and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Tower Narrative

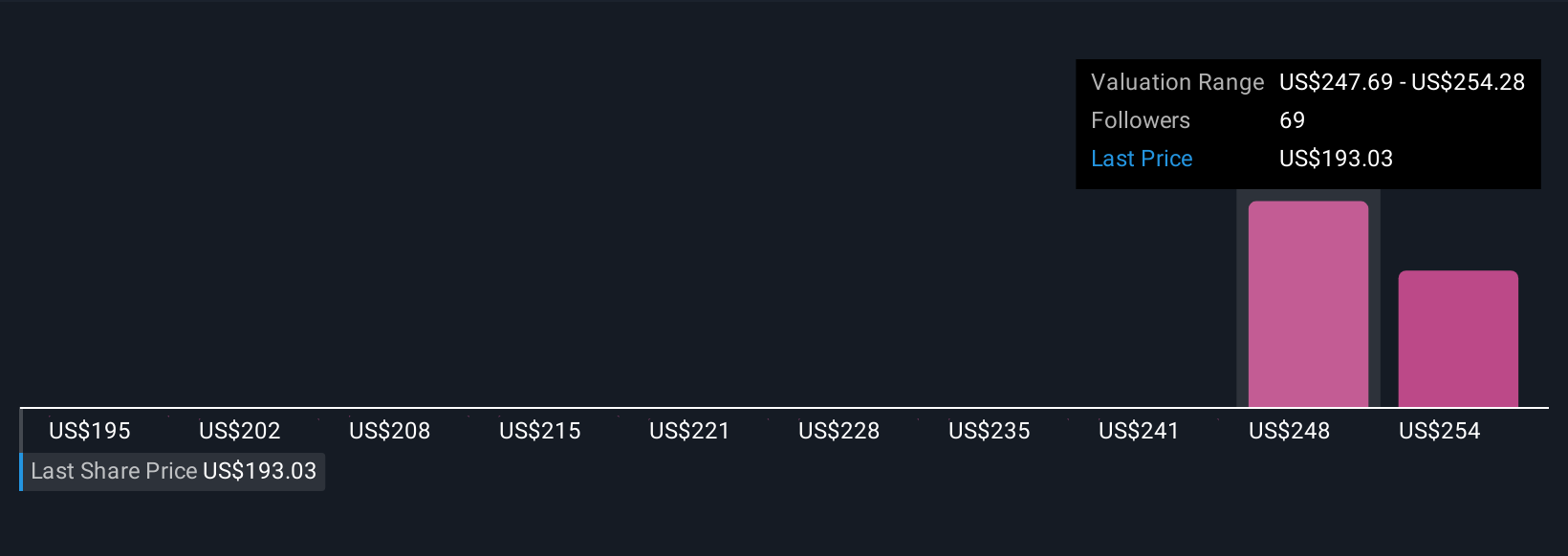

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal take on a company; it is the story behind the numbers where you connect your own view of American Tower's future (such as its expected revenue, growth, and margins) to a financial forecast, which then creates your assumed fair value.

On Simply Wall St's Community page (used by millions of investors), Narratives make this process easy and accessible for anyone, helping you make more informed buy or sell decisions by directly comparing your Fair Value against the current share price. Narratives are dynamic and update automatically when new information or news is released, so your valuation always reflects the latest data.

For American Tower, for example, one investor might create a bullish Narrative based on steady 5G demand and see a fair value as high as $281 per share. Another, focusing on sector risks, might rate the stock’s fair value closer to $217. Narratives empower you to turn your own insights, expectations, and the latest facts into smarter, more confident investment decisions, all in one place.

Do you think there's more to the story for American Tower? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.