Please use a PC Browser to access Register-Tadawul

Does the Yankees Streaming Deal Change the Outlook for Netflix Shares in 2025?

Netflix, Inc. NFLX | 95.19 96.00 | +1.17% +0.85% Pre |

If you have ever found yourself hovering over the Netflix ticker, wondering whether to buy, sell, or just keep streaming, you are not alone. Netflix has been on a wild ride, surprising even seasoned investors. In the past week, the stock dipped by 4.7%, and over the last month, it slipped another 5.9%. On the surface, that might look worrisome. But step back, and the picture changes: Netflix has soared an impressive 30.1% year-to-date, 60.3% over the past year, and an eye-popping 413.2% in the last three years. That kind of performance definitely grabs attention.

So, what is fueling all this action? Recent headlines show Netflix pushing into unexpected territory as the company will stream the opening day Yankees-Giants game next year, marking a bold move into live sports. At the same time, Netflix flexed its entertainment muscle at the box office, with "KPop Demon Hunters" landing among the weekend’s top earners. On the flip side, news of its Chief Product Officer’s exit raised a few eyebrows among industry watchers and investors alike. These crosswinds make it tricky to predict what is coming next, but they also highlight just how much the market is reassessing Netflix’s future risks and rewards.

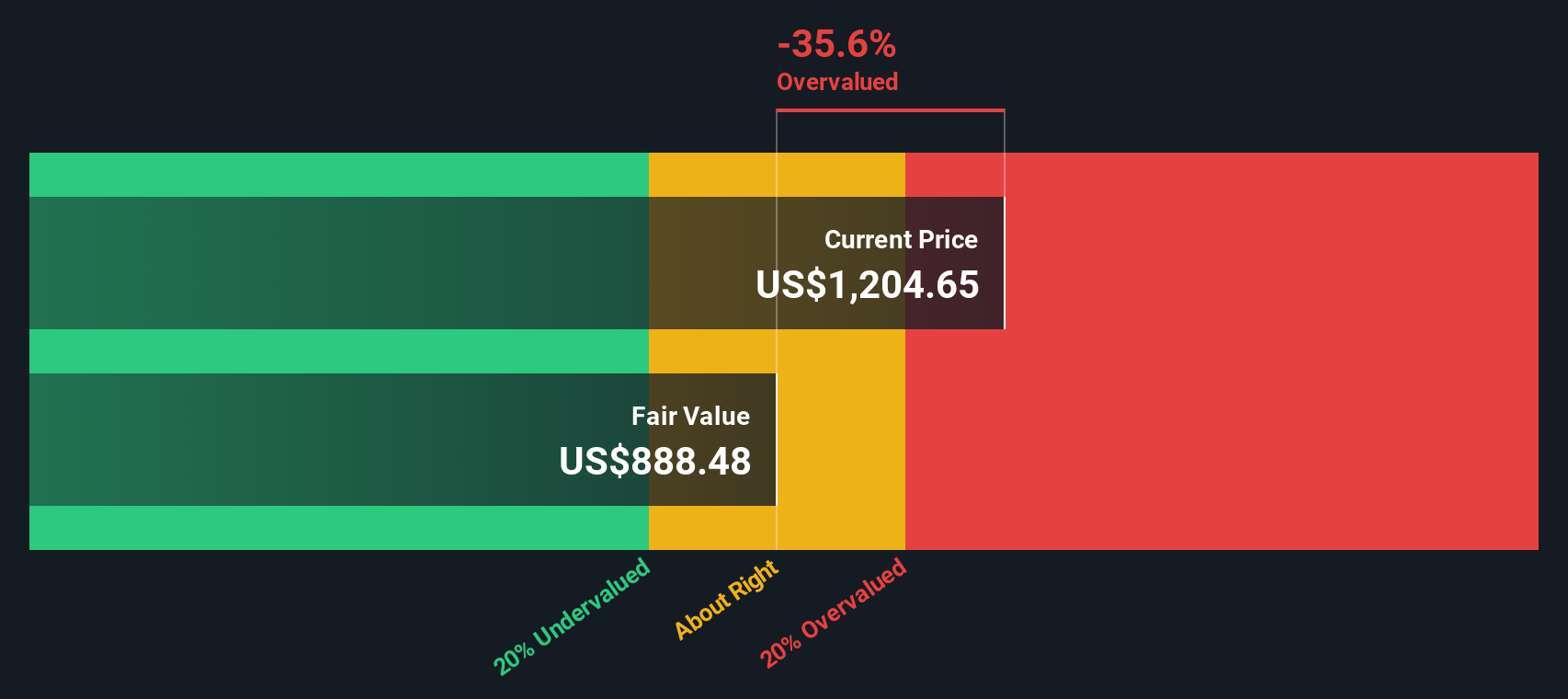

When we score Netflix’s current valuation using six established criteria, it gets a value score of just 1 out of 6 for being undervalued. That suggests most traditional checks see it as fully or even overly valued, but is the story really that simple? In the next section, we will break down those individual valuation approaches and reveal a perspective on Netflix’s worth that you will not want to miss.

Netflix scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Netflix Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to present value. For Netflix, this involves looking at its expected streams of free cash flow over the next decade and calculating what they are worth in today’s dollars.

Currently, Netflix is generating free cash flow of approximately $8.6 billion. According to analyst estimates and further projections, Netflix’s free cash flow is forecasted to grow steadily and could potentially reach more than $32.9 billion by 2035. Most of the projections over the next five years are based on direct analyst estimates, while the longer-term projections are extrapolated by Simply Wall St using observed growth rates.

Bringing all these future cash flows back to today’s value, the DCF approach provides Netflix with an estimated intrinsic value of $924.73 per share. This model suggests the current market price is about 24.7% higher than what the company's discounted cash flows justify, which implies the stock is trading at a premium.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Netflix may be overvalued by 24.7%. Find undervalued stocks or create your own screener to find better value opportunities.

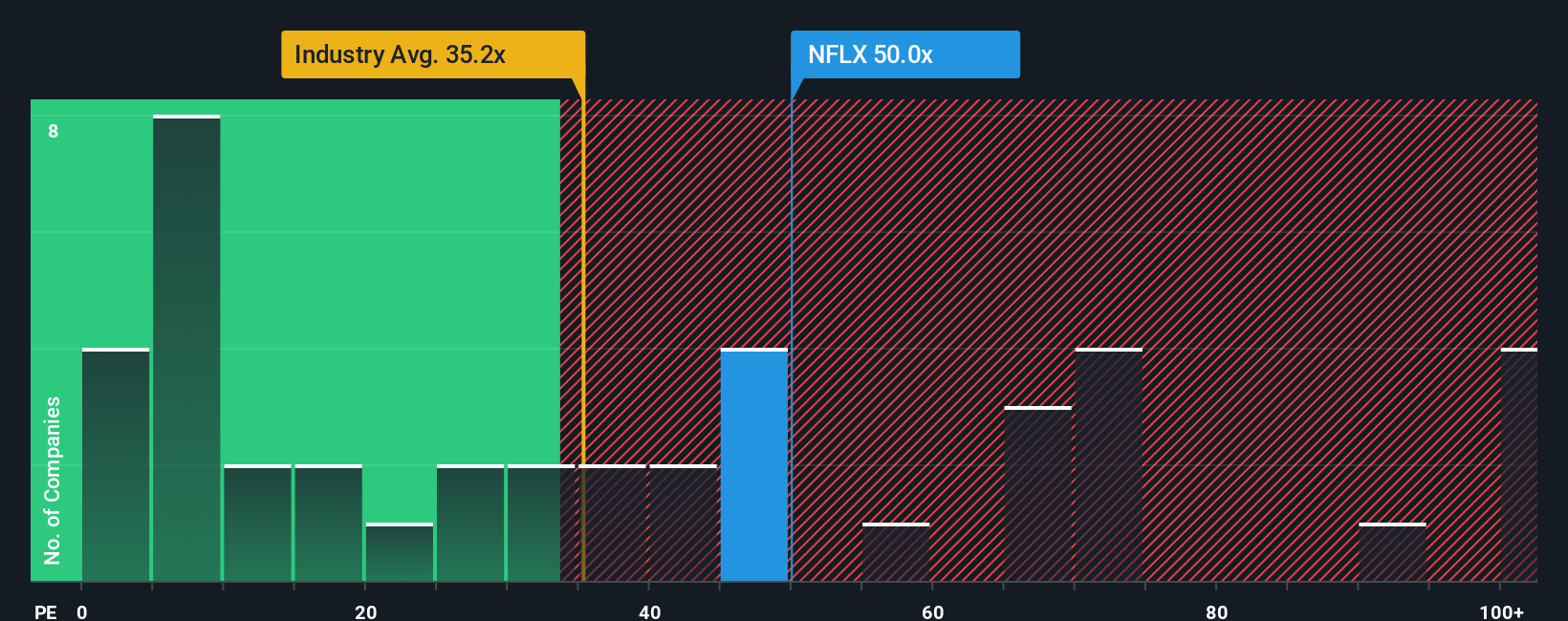

Approach 2: Netflix Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Netflix because it provides a straightforward way to gauge how much investors are willing to pay for each dollar of earnings. It is a particularly relevant metric for established businesses with consistent profits, as it reflects both current performance and future growth expectations.

When considering what a "fair" PE ratio should be, it is important to factor in a company’s long-term growth prospects and the risks it faces. Higher expected growth and lower risk generally justify a higher PE, while slow-growing or riskier companies typically trade at lower multiples. Netflix currently trades at a hefty 47.8x PE ratio. For context, this is well above the entertainment industry average of 30.9x and even higher than its peer group’s average of 75.8x.

Simply Wall St introduces the concept of a “Fair Ratio,” in Netflix’s case, 37.2x. This figure estimates the appropriate PE by weighing variables like earnings growth, profit margins, market position, business risks, industry trends, and company size. This proprietary metric goes further than comparing against the industry or peers because it incorporates a holistic view of what the company truly deserves given its specific situation.

Comparing Netflix’s current PE of 47.8x with its Fair Ratio of 37.2x, the stock appears priced above where fundamentals would suggest. Investors are paying a premium, likely in anticipation of sustained outperformance or future growth, but based on this metric, Netflix looks overvalued using the PE approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Netflix Narrative

Earlier, we mentioned there is an even better way to understand valuation, and now is the time to introduce you to Narratives. A Narrative is essentially your personalized story—a way to connect your unique view of a company’s future with concrete financial forecasts and ultimately an estimated fair value. It's an approach that goes beyond just looking at the numbers by letting you outline the reasons behind your fair value and your expectations for revenue, profit margins, and risks.

With Narratives, you bridge the gap between what’s happening with the business and how that translates into future performance. This combines your perspective, new information, and the latest company results into one evolving outlook. On Simply Wall St’s Community page, Narratives are easy and accessible for everyone, powering millions of smarter investing decisions. They make it simple to compare your fair value to the current share price so you can decide if it’s time to buy, sell, or hold. Narratives are automatically updated when fresh news or earnings are released.

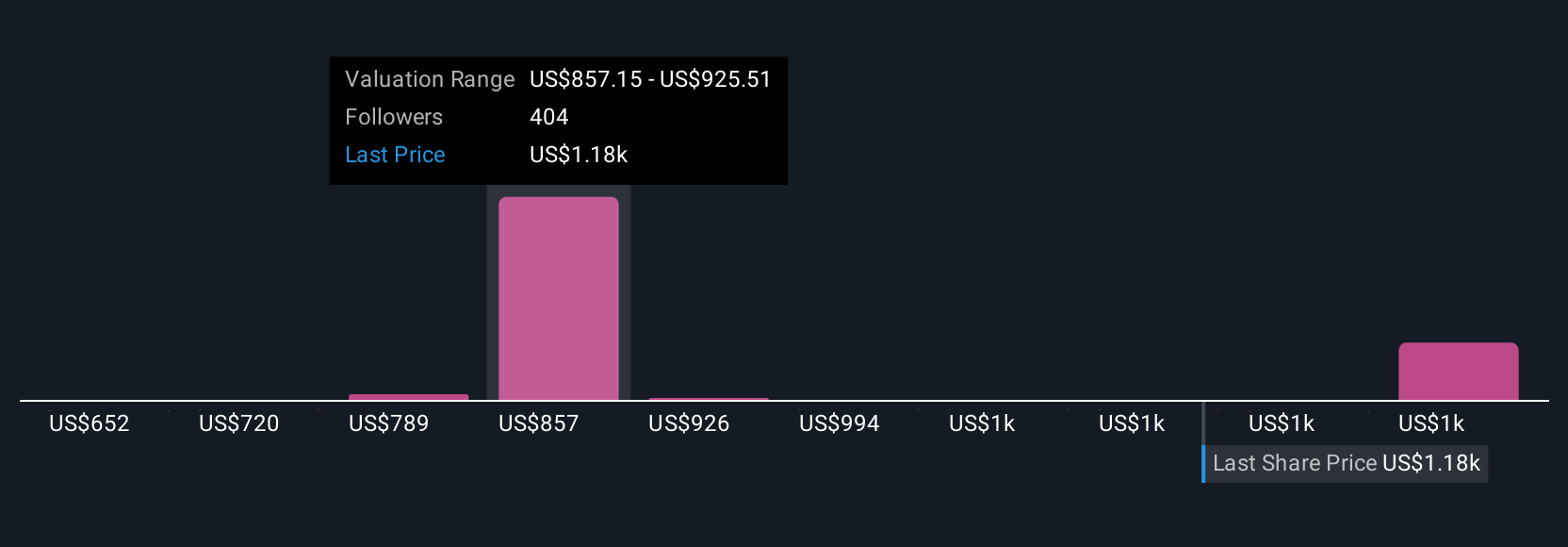

For example, some Netflix investors believe ad-supported growth and global expansion will drive revenue to $59.4 billion and value the stock north of $1,350 per share. Others see risks capping value nearer $750, showing just how powerful and dynamic Narratives can be.

For Netflix, however, we'll make it really easy for you with previews of two leading Netflix Narratives:

Fair Value: $1,350.32

Current price is 14.6% below this fair value

Expected annual revenue growth: 12.5%

- Accelerated global monetization from Netflix's proprietary ad tech rollout and strong international content partnerships fuel robust subscriber and revenue growth.

- Operational efficiencies, AI-driven user experience enhancements, and diversified content contribute to higher engagement and margins even as competition intensifies.

- Key risks include market saturation, rising content costs, industry competition, regulatory pressures, and shifting viewer habits. However, analysts' consensus price target remains above the current share price.

Fair Value: $797.74

Current price is 44.5% above this fair value

Expected annual revenue growth: 13%

- Industry consolidation and Netflix's scale support subscriber and revenue growth, but user growth is expected to slow compared to historical highs.

- Ad-supported and paid sharing plans are anticipated to decrease churn and eventually lift revenue per member, although short-term ARPM may decline.

- While cost control and margin expansion improve profitability, high expectations and execution risks on new business initiatives could present challenges for long-term returns at current valuations.

Do you think there's more to the story for Netflix? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.