Please use a PC Browser to access Register-Tadawul

E-Home Household Service Holdings Limited (NASDAQ:EJH) Stock Rockets 99% But Many Are Still Ignoring The Company

E-Home Household Service Holdings Ltd Ordinary Shares EJH | 0.82 | +5.93% |

Those holding E-Home Household Service Holdings Limited (NASDAQ:EJH) shares would be relieved that the share price has rebounded 99% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 92% share price drop in the last twelve months.

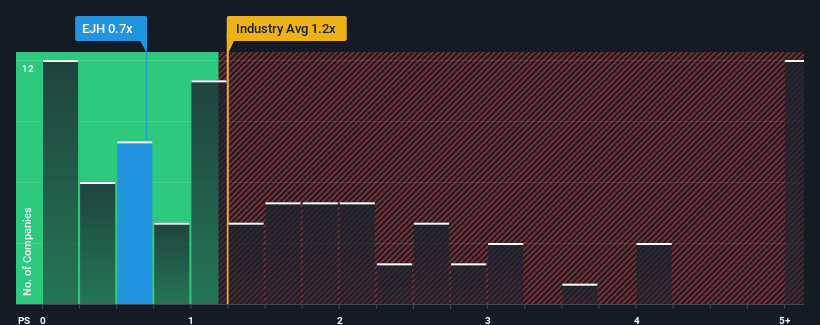

In spite of the firm bounce in price, it would still be understandable if you think E-Home Household Service Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.7x, considering almost half the companies in the United States' Consumer Services industry have P/S ratios above 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for E-Home Household Service Holdings

What Does E-Home Household Service Holdings' P/S Mean For Shareholders?

The recent revenue growth at E-Home Household Service Holdings would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. Those who are bullish on E-Home Household Service Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on E-Home Household Service Holdings will help you shine a light on its historical performance.How Is E-Home Household Service Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as E-Home Household Service Holdings' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.2%. The latest three year period has also seen an excellent 49% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 16% shows it's about the same on an annualised basis.

With this information, we find it odd that E-Home Household Service Holdings is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

The latest share price surge wasn't enough to lift E-Home Household Service Holdings' P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that E-Home Household Service Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Before you take the next step, you should know about the 4 warning signs for E-Home Household Service Holdings (3 make us uncomfortable!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.