Please use a PC Browser to access Register-Tadawul

Earnings Pulse | NVIDIA’s $5 Trillion Quest: Will AI King Crush Earnings Again With 73% Revenue Surge?

NVIDIA Corporation NVDA | 175.02 | -3.27% |

Alphabet Inc. Class C GOOG | 310.52 | -1.01% |

Meta Platforms META | 644.23 | -1.30% |

Microsoft Corporation MSFT | 478.53 | -1.02% |

Tesla Motors, Inc. TSLA | 458.96 | +2.70% |

NVIDIA Corporation(NVDA.US) is scheduled to release its Q4 FY2025 earnings report after the market closes on February 26th, Eastern Time. According to Bloomberg's consensus estimates, NVIDIA is expected to report:

- Revenue of $38.21 billion, a 73% year-over-year increase.

- Adjusted net income of $20.95 billion, up 63% year-over-year.

- Adjusted earnings per share (EPS) of $0.84, also a 63% year-over-year increase.

Over the past eight quarters, NVIDIA Corporation(NVDA.US) has consistently beaten market expectations for EPS, with an average stock price movement of ±9.20% on earnings day, peaking at a 24.4% increase and a maximum drop of 6.39%. The probability of the stock price rising on earnings day is 75%.

| Bank Rating | Target Price ($) | Ratings |

|---|---|---|

| Benchmark | 190 → 195 | Buy |

| UBS | 175 | Buy |

| Morgan Stanley | 152 | Buy |

| Updated on February 20, 2025 | ||

Related Read: How to Strategically Use Options for Expected Volatility on NVIDIA Earnings Day (with Examples)

1. NVIDIA Rebounds 15%, GPUs Still the Best Solution for AI Evolution?

Earlier this year, market disruptions caused by DeepSeek raised investor concerns about the necessity and efficiency of high capital expenditures by AI giants. This led to a single-day drop of 17% in NVIDIA's stock, with the price falling to $113.

However, as the Q4 earnings release approaches, NVIDIA Corporation(NVDA.US) has fully recovered from the DeepSeek crisis, rebounding over 15%. Market analysts believe that despite DeepSeek's impressive performance demonstrating the feasibility of low-cost AI, GPUs will remain the most effective way for "AI training."

On one hand, major clients of NVIDIA's GPUs, including Alphabet Inc. Class C(GOOG.US), Meta Platforms(META.US), Microsoft Corporation(MSFT.US), Tesla Motors, Inc.(TSLA.US), and Amazon.com, Inc.(AMZN.US), have announced a combined capital expenditure of $331 billion for 2025 to enhance their competitive edge in the AI era, significantly exceeding Wall Street's expectations.

On the other hand, this week, Elon Musk's xAI officially launched the Grok 3 model, which outperforms or rivals competitors like DeepSeek and ChatGPT. Notably, this model was built using 200,000 NVIDIA H100 GPUs, with plans to potentially expand GPU capacity to 1 million units in the future.

Wedbush analysts suggest that despite recent rumors surrounding DeepSeek, their customer surveys indicate that demand for NVIDIA's Blackwell GPUs far exceeds supply. Supported by this demand, the firm projects NVIDIA Corporation(NVDA.US) to reach a market cap of $5 trillion in the future.

2. Key Focus Areas for NVIDIA's Q4 Earnings

As the producer of the world's most advanced AI training chips, several aspects of NVIDIA's performance will be scrutinized, including the production capacity of the latest Blackwell series GPUs, data center revenue, gross margins, and market share. These factors will help investors assess whether NVIDIA can maintain its position in an era of significant AI price cuts.

a. Explosive Growth in Data Centers

Currently, nearly 90% of NVIDIA's revenue comes from data centers. The market generally expects data center revenue to be in the range of 33.5−34.5 billion this quarter, corresponding to an 84.5% year-over-year growth and a 10.5% quarter-over-quarter increase. However, this would mark the first time since 2023 that the business's year-over-year growth rate has fallen below triple digits.

b. Slight Decline in Gross Margins

With the increased shipment of the higher-cost and lower-yield Blackwell series, NVIDIA's gross margins may see a slight quarter-over-quarter decline. Due to inventory build-up and accelerated raw material procurement, the decline in net margins could be more pronounced.

c. Intensifying Market Share Challenges

NVIDIA faces several potential challenges, including competition from Broadcom Limited(AVGO.US) and Advanced Micro Devices, Inc.(AMD.US), large firms developing their own ASICs, reduced capital expenditures, and U.S. trade restrictions. Investors will look to management's guidance on future AI infrastructure to find answers to these challenges.

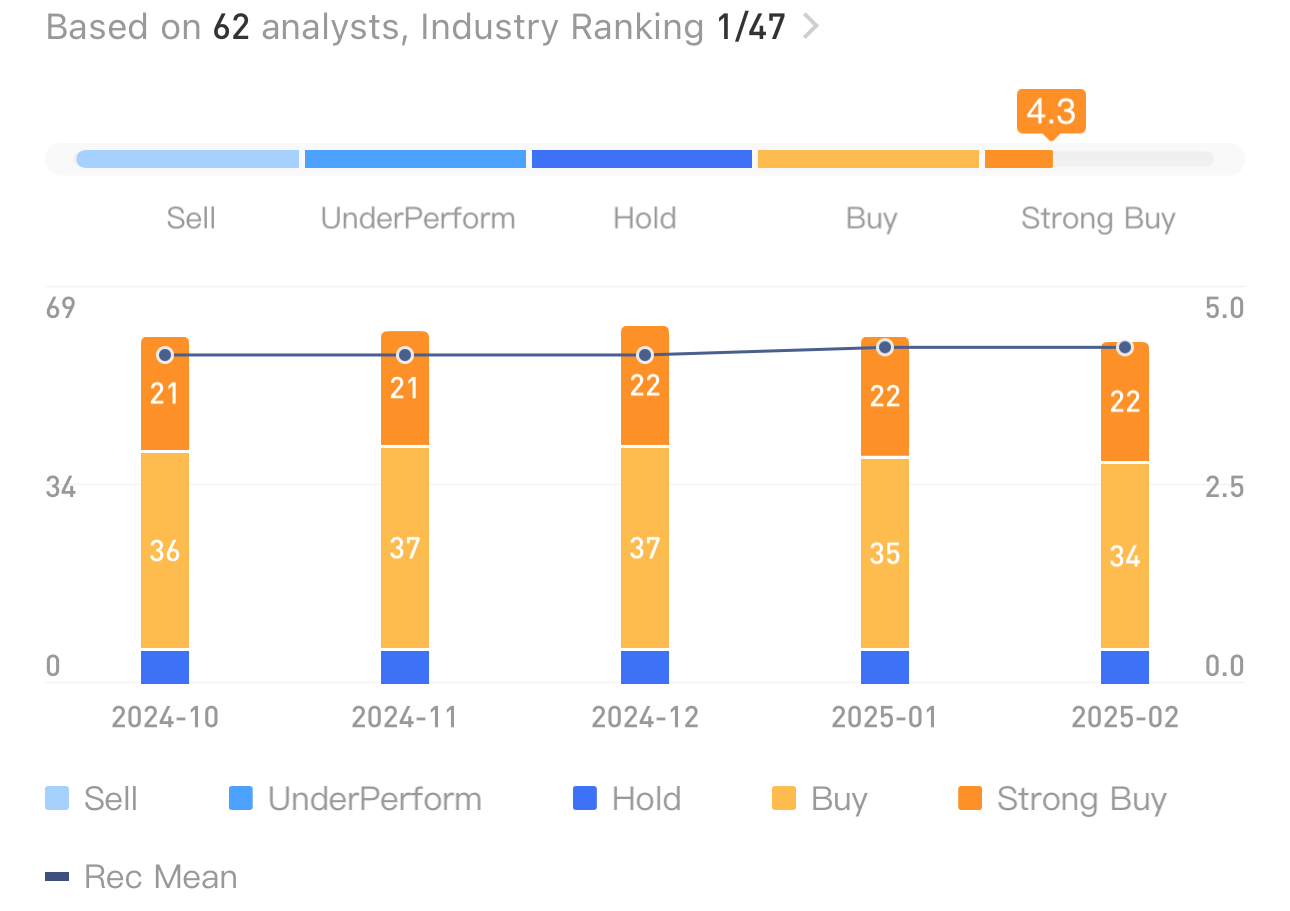

3. Wall Street's Bullish Sentiment Ahead of Earnings

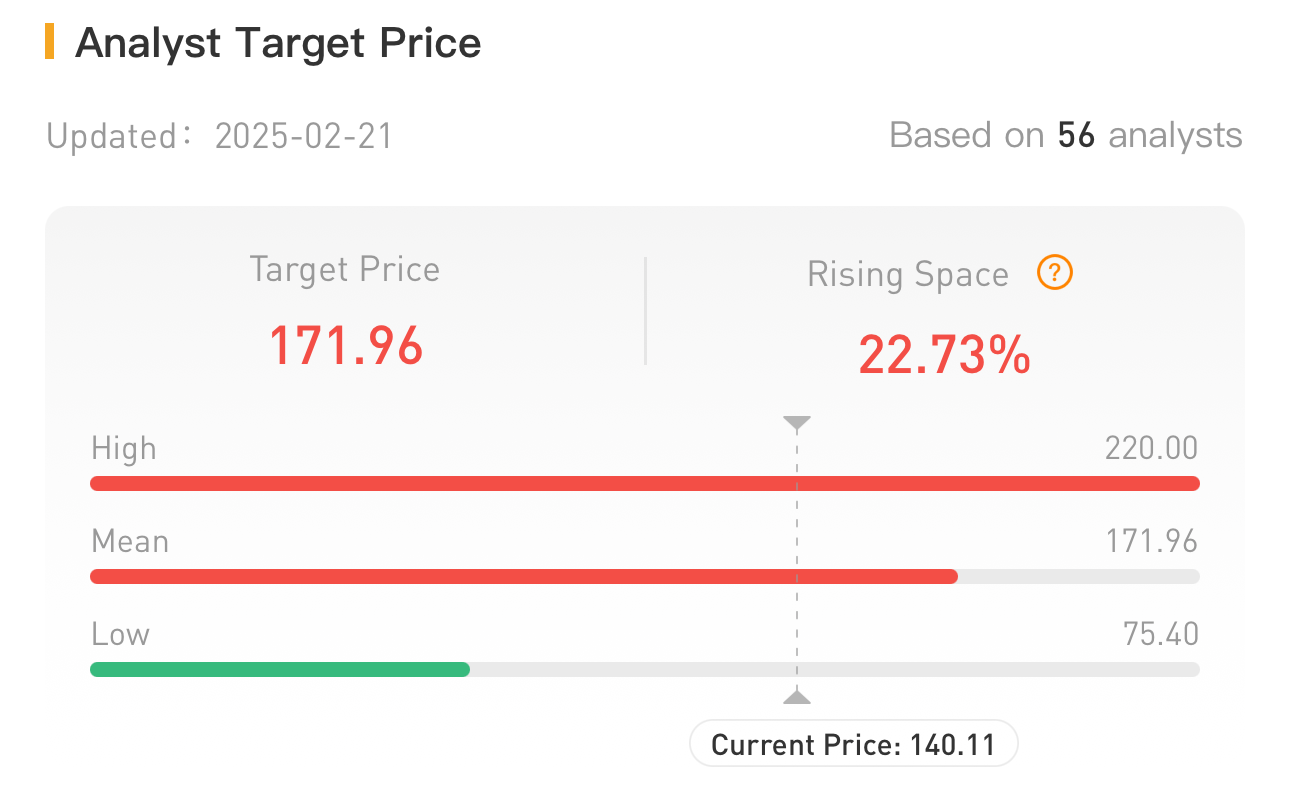

According to the latest data from TipRanks, several major banks are optimistic about NVIDIA Corporation(NVDA.US)'s earnings exceeding expectations. Wall Street's current average target price is 179.03, suggesting an upside of 27.8%, with the highest target price reaching 220 dollars per share.

Morgan Stanley: Recommends buying NVIDIA Corporation(NVDA.US) ahead of earnings. The bank expects NVIDIA's short-term business to remain strong, with increased visibility in Blackwell's supply and evident customer spending willingness. They anticipate NVIDIA's stock price will rise following the earnings release.

HSBC: Expect Q4 Blackwell revenue to meet expectations. HSBC's report indicates that investors are increasingly focused on the growth momentum of Blackwell's revenue rather than overall sales momentum. They project Q4 sales to reach $40 billion, surpassing both management guidance and market expectations, and foresee Q1 and Q2 FY2026 sales of $42.2 billion and $55.4 billion, respectively.

UBS: Anticipates "strong" Q4 results and a positive outlook. UBS expects NVIDIA Corporation(NVDA.US) to report strong Q4 earnings, with Blackwell revenue projected to reach around $9 billion. They also forecast that NVIDIA will sell approximately 700,000 chips in Q1 FY2026, generating over $25 billion in revenue.

Bank of America: Sees potential for NVIDIA Corporation(NVDA.US)'s stock to hit new highs. Despite market concerns about the necessity of high AI development expenditures following DeepSeek's large language model, Bank of America believes NVIDIA remains well-positioned. Recent earnings reports from Meta Platforms(META.US) and Microsoft Corporation(MSFT.US), which have not reduced capital expenditure plans, suggest that NVIDIA's sales will continue to grow robustly.

4. Focus on Related Investment Opportunities

With NVIDIA's Q4 earnings approaching, here are some related stocks and ETFs worth watching:

Related ETFs:

| Category | ETF Description | Symbols | |

| Leveraged ETFs | 2x Long Nvidia | GraniteShares 2x Long NVDA Daily ETF(NVDL.US) | T-Rex 2X Long NVIDIA Daily Target ETF(NVDX.US) |

| Inverse ETFs | 2x Short Nvidia | T-Rex 2X Inverse NVIDIA Daily Target ETF(NVDQ.US) | GraniteShares 2x Short NVDA Daily ETF(NVD.US) |

| 1x Short Nvidia | Direxion Shares ETF Trust Direxion Daily NVDA Bear 1X Shares(NVDD.US) | ||

Dear investors, do you believe NVIDIA Corporation(NVDA.US) will deliver a strong performance this quarter? Feel free to leave your comments and join the discussion!