Please use a PC Browser to access Register-Tadawul

Ecolab (ECL) Margin Slippage To 12.9% Tests Bullish Profitability Narratives

Ecolab Inc. ECL | 304.16 | +1.05% |

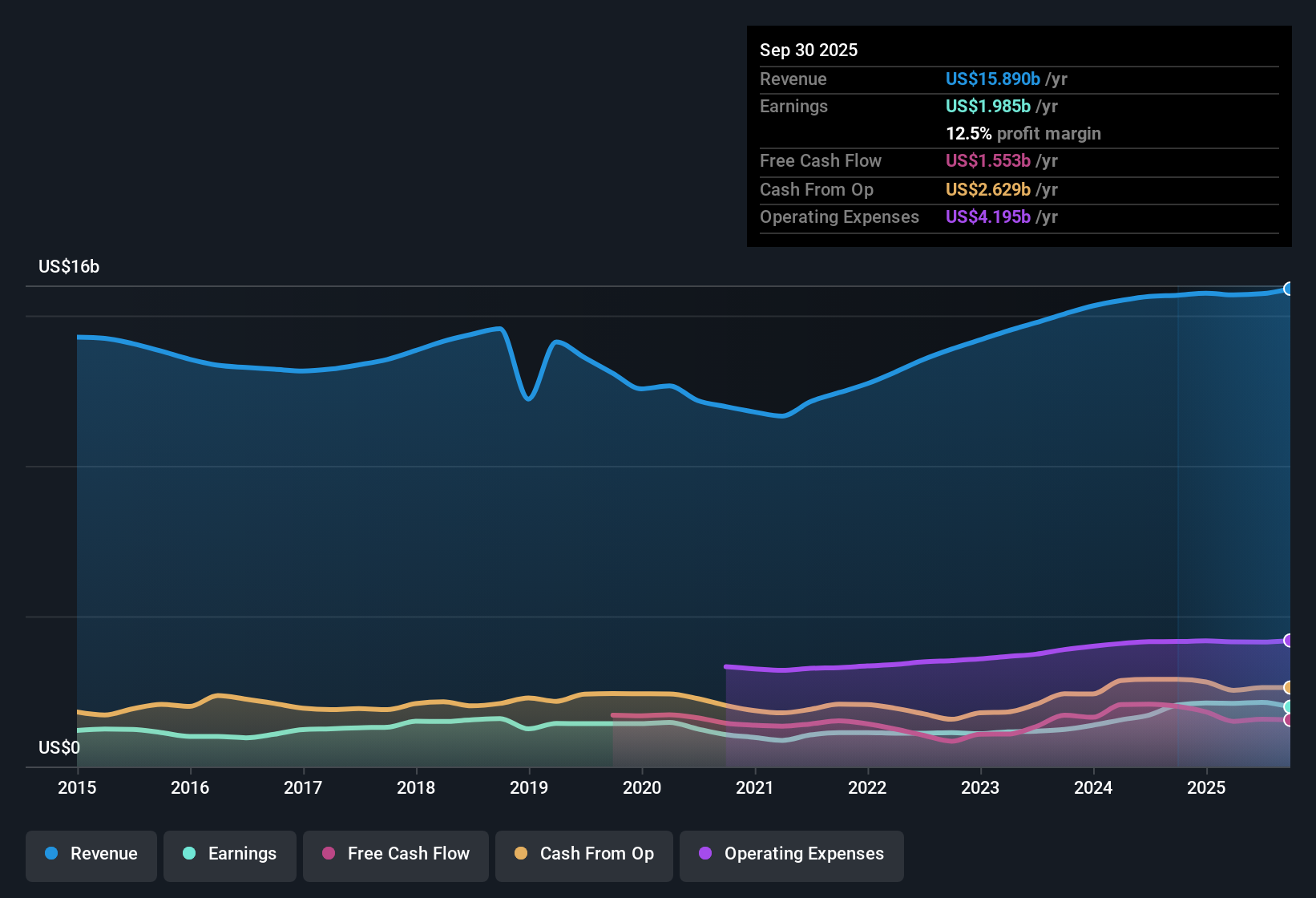

Ecolab (ECL) has wrapped up FY 2025 with fourth quarter revenue of US$4.2 billion and basic EPS of US$2.00, alongside net income of US$563.9 million. This capped a year in which trailing twelve month revenue came in at US$16.1 billion and EPS reached US$7.33. Over the past few quarters, the company has seen quarterly revenue range from US$3.7 billion to US$4.2 billion and basic EPS move between US$1.42 and US$2.06, while trailing twelve month EPS has stayed above US$7.00. With a 12.9% net margin on a trailing basis and a mix of multi year earnings growth and a recent dip in annual earnings, this update gives investors plenty to weigh up on the quality and resilience of Ecolab’s profitability.

See our full analysis for Ecolab.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the big narratives around Ecolab, and where the financials either support or push back against those stories.

TTM net margin edges down to 12.9%

- On a trailing twelve month basis, Ecolab converted US$16.1b of revenue into US$2.1b of net income, which works out to a 12.9% net margin compared with 13.4% a year earlier.

- Analysts' consensus view expects profit margins to move from 13.6% to 15.4% over the next three years, and the current 12.9% margin plus quarterly net income between US$402.5 million and US$585 million gives bulls some support but also shows that recent profitability is a little below where that bullish margin story is heading.

- Supportive for the bullish view, trailing EPS of US$7.33 and five year earnings growth of 18.6% a year show Ecolab has grown profits meaningfully over time even though the most recent year had negative earnings growth.

- At the same time, the small margin step down from 13.4% to 12.9% and quarterly EPS ranging from US$1.42 to US$2.06 highlight that the path to higher margins in the consensus narrative is not a straight line.

Revenue growth at 5.8% per year

- Over the last year, revenue grew 5.8% to around US$16.1b on a trailing basis, with quarterly sales moving from US$3.70b in Q1 2025 to US$4.20b in Q4 2025.

- Analysts' consensus view links this 5.8% revenue growth to the One Ecolab initiative, value based pricing and Life Sciences expansion, and the numbers partly support that, although the growth rate is below the 10.3% cited for the broader US market.

- Supportive for the bullish narrative, the Life Sciences and digital businesses are described as higher margin areas and the company already generates more than US$2.0b of net income, which can benefit if those segments keep gaining share within the US$16.1b revenue base.

- Challenging for the most optimistic take, the 5.8% revenue growth rate is some way behind the market figure and the modest step down in net margin suggests that higher value offerings have not yet translated into a higher overall margin line in the reported numbers.

Premium P/E and DCF gap

- The shares trade on a trailing P/E of 40.9x at a price of US$299.62, compared with an industry P/E of 25.6x and a peer average of 26.2x, and also sit above a DCF fair value estimate of US$253.55.

- Bears argue that paying 40.9x earnings plus a price above both peers and the US$253.55 DCF fair value builds in a lot of optimism, and the recent mix of 5.8% revenue growth and a small net margin step down gives that cautious view some numerical backing.

- Valuation concerns are reinforced by the gap between the current US$299.62 share price and the 296.33 analyst price target, which leaves limited room if the slower than market revenue growth and recent negative earnings growth persist.

- At the same time, the five year earnings growth rate of 18.6% a year and forecast earnings growth of about 11% a year explain why some investors are still willing to pay a premium P/E multiple despite the minor risk flagged from elevated debt.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ecolab on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers that points to a different story? Shape that into your own narrative in just a few minutes and Do it your way

A great starting point for your Ecolab research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Ecolab combines a premium 40.9x P/E and a price above a US$253.55 DCF estimate with 5.8% revenue growth and a slightly softer 12.9% net margin.

If paying up for slower growth and a valuation gap feels uncomfortable, take a few minutes to look through 51 high quality undervalued stocks which pair more modest prices with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.