Please use a PC Browser to access Register-Tadawul

Enovix (ENVX) Valuation Check As New Manufacturing Hires And AI 1 Battery Validation Support Mass Production Plans

Enovix Corporation ENVX | 5.95 | -1.33% |

Enovix (ENVX) has been in focus after a fresh reshuffle of its operations leadership and third party validation of its AI 1 smartphone battery, as the company prepares to start mass production.

Recent executive hires in manufacturing and the independent validation of the AI 1 battery have arrived against a weaker share price backdrop, with a 90 day share price return of 37.5% decline and a 1 year total shareholder return of 36.4% loss. Together these indicate that positive news is emerging while longer term momentum has been under pressure.

If Enovix’s battery story has caught your attention, this could be a good moment to look across other high growth tech and AI names through high growth tech and AI stocks.

With the share price down sharply over the past year despite third party validation of its AI 1 battery and new manufacturing leadership, is Enovix quietly on sale today, or is the market already paying up for future growth?

Price to Book of 5.5x, Is it justified?

On a P/B basis, Enovix trades at 5.5x, which sits below its peer group average of 6.2x but above the broader US Electrical industry at 2.7x.

P/B compares a company’s market value to its net assets and is often used for asset heavy or early stage businesses where earnings are still negative. For Enovix, a higher P/B can reflect expectations around future revenue growth and eventual profitability rather than current earnings, especially with earnings still in a loss position.

Against its closest peers, a 5.5x P/B suggests the market is not assigning the highest premium in the group, yet it is still pricing Enovix well above the sector norm. Compared with the US Electrical industry average of 2.7x, the current multiple is roughly double. This indicates that investors are paying more relative to the sector for Enovix’s balance sheet and growth profile.

Result: Price to book of 5.5x (ABOUT RIGHT)

However, you still have to weigh execution risk around scaling production, as well as the ongoing net income loss of US$159.216 million on revenue of US$30.273 million.

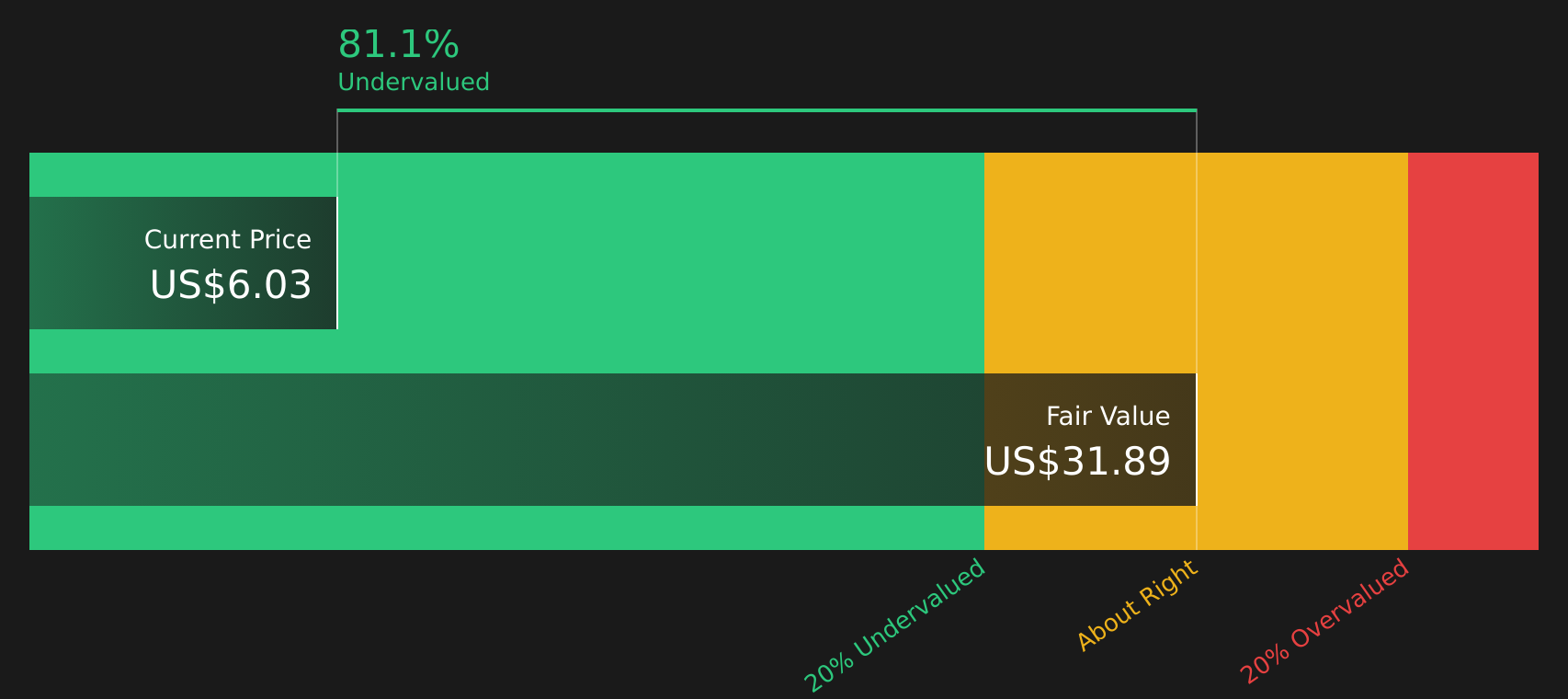

Another View: What Our DCF Model Suggests

The P/B of 5.5x points to a market that already assigns Enovix a premium over the broader US Electrical industry, but our DCF model indicates something different. At a share price of US$7.70 versus a DCF value of US$33.29, the stock screens as heavily undervalued. This raises the question of which signal is more informative: the balance sheet multiple or the cash flow analysis.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Enovix for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Enovix Narrative

If parts of this analysis do not fully line up with your own view, or you would rather ground your decisions in your own work, you can review the same data and shape a complete story for yourself in just a few minutes: Do it your way.

A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one company, you could miss opportunities that fit you better, so take a few minutes to scan a wider set of possibilities.

- Spot underappreciated value by checking out these 878 undervalued stocks based on cash flows that might trade at prices below what their cash flows suggest.

- Tap into cutting edge themes through these 23 quantum computing stocks that are working on next generation computing breakthroughs.

- Prioritise consistent income potential with these 12 dividend stocks with yields > 3% offering yields above 3% that may suit a return focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.