Please use a PC Browser to access Register-Tadawul

Equifax (EFX) Valuation Check After Launch Of AI Fraud Product Synthetic Identity Risk

Equifax Inc. EFX | 191.01 191.05 | +5.51% +0.02% Pre |

AI fraud product puts Equifax in focus for risk conscious investors

Equifax (EFX) has put synthetic identity fraud in the spotlight with its new Synthetic Identity Risk product, which uses AI and machine learning to help lenders flag suspicious identities before losses mount.

Despite the launch of Synthetic Identity Risk and recent announcements around new data partnerships and the upcoming fourth quarter results, Equifax’s recent momentum has been soft, with the share price at US$209.74 and a 1 year total shareholder return of 21.36% decline, while the 5 year total shareholder return of 22.74% points to a more resilient longer term picture.

If this kind of fraud focused AI push has your attention, it could be a good moment to see what else is on the move across high growth tech and AI stocks.

With Equifax shares at US$209.74 after a 21.36% 1-year total return decline but a 22.74% 5-year total return, plus an indicated 46.12% intrinsic discount, you have to ask: is there real value here, or is the market already baking in future growth?

Most Popular Narrative: 20.2% Undervalued

At a last close of $209.74 versus a narrative fair value of $262.75, Equifax is framed as trading at a meaningful discount, with that gap tied closely to earnings and margin expectations over the next few years.

Global cloud migration and investments in proprietary technology platforms are now largely complete, enabling margin expansion through operating leverage, efficiency gains, and scalable innovation, which is expected to increase EBITDA and net margins over time.

Curious what kind of earnings and revenue mix this narrative is banking on, and how rich a future profit multiple it assumes to back that $262.75 figure?

Result: Fair Value of $262.75 (UNDERVALUED)

However, elevated litigation costs and tighter state government budgets, along with rising credit score competition, could easily disrupt the earnings and margin story behind that US$262.75 fair value.

Another View: Earnings Multiple Sends A Caution Flag

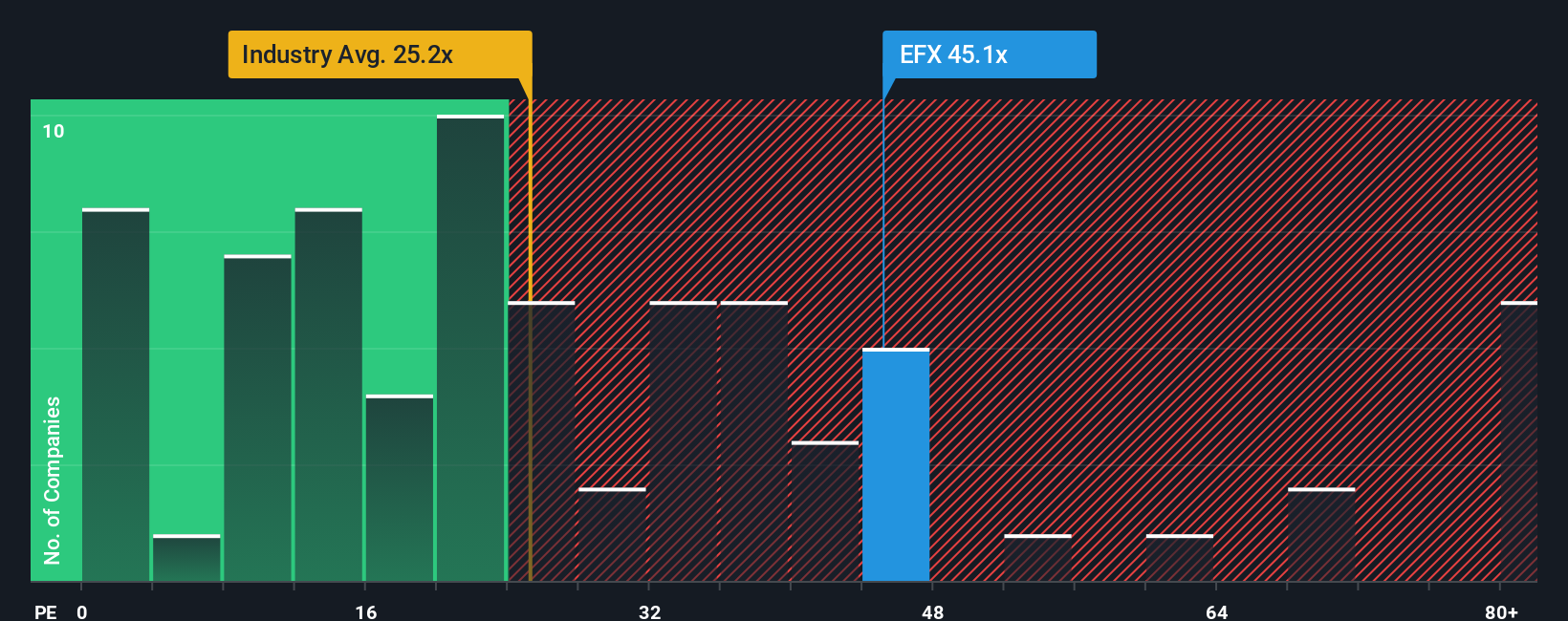

That 46.1% discount to our fair value and a US$262.75 narrative target both lean toward upside, but the current P/E of 39x tells a different story. It sits above the Professional Services industry at 24.4x and above the peer average of 33.6x, while also exceeding our 33x fair ratio.

In plain terms, the market is already paying a premium for each dollar of Equifax earnings, even with the share price well below some fair value estimates. Is that premium a sign of confidence in the AI and data story, or does it leave less room for error if growth or margins fall short?

Build Your Own Equifax Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a complete Equifax story in just a few minutes: Do it your way.

A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Equifax has sharpened your focus, do not stop here. Broaden your watchlist with targeted stock ideas that match how you like to invest and manage risk.

- Spot potential value plays early by scanning these 872 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Tilt toward future facing themes by zeroing in on these 24 AI penny stocks that are plugged into the growth of artificial intelligence.

- Strengthen your income side by reviewing these 13 dividend stocks with yields > 3% that offer yields above 3% for a more cash focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.