Please use a PC Browser to access Register-Tadawul

Estée Lauder Companies (NYSE:EL) Has Affirmed Its Dividend Of $0.66

Estee Lauder Companies Inc. Class A EL | 104.39 | +3.33% |

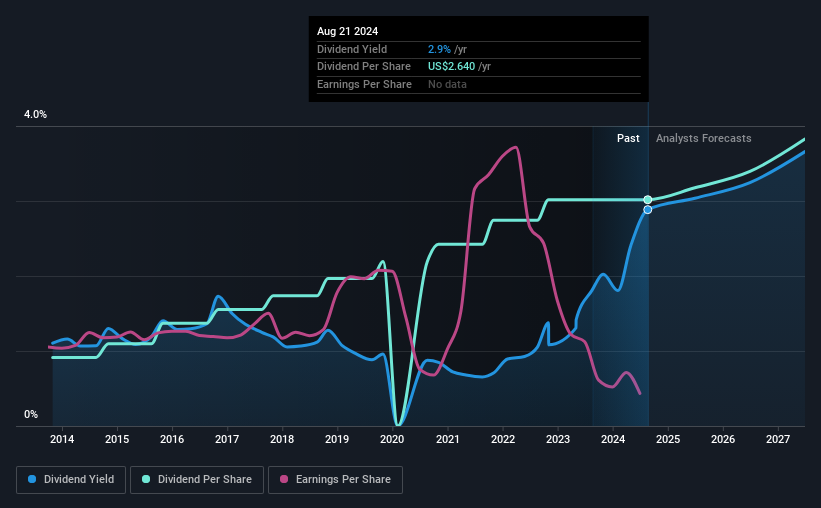

The Estée Lauder Companies Inc.'s (NYSE:EL) investors are due to receive a payment of $0.66 per share on 16th of September. This means the dividend yield will be fairly typical at 2.9%.

Estée Lauder Companies' Earnings Easily Cover The Distributions

Unless the payments are sustainable, the dividend yield doesn't mean too much. Prior to this announcement, the company was paying out 243% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 66%. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

According to analysts, EPS should be several times higher next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 64% which is fairly sustainable.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was $0.80 in 2014, and the most recent fiscal year payment was $2.64. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Earnings per share has been sinking by 26% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Estée Lauder Companies' Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.