Please use a PC Browser to access Register-Tadawul

eToro (NasdaqGS:ETOR): Assessing Valuation After Recent Share Price Recovery

eToro Group Ltd. ETOR | 37.95 37.95 | -3.36% 0.00% Pre |

Shares of eToro Group (NasdaqGS:ETOR) have seen a modest uptick recently, gaining 3% in the past day and 5% over the past week. This performance comes as discussions continue regarding the company’s strategy and recent financial trends.

After a sizable jump over the past week, eToro Group’s momentum follows a sharp decline. Its 90-day share price return sits at -39.66%, leaving it well below where it started the year. In the bigger picture, the stock’s recent uptick comes after tough stretches for shareholders, but any sustained rebound will likely depend on shifts in sentiment around its longer-term growth and profitability.

If you’re curious about what else is catching investors’ attention lately, now’s the perfect moment to expand your search and discover fast growing stocks with high insider ownership

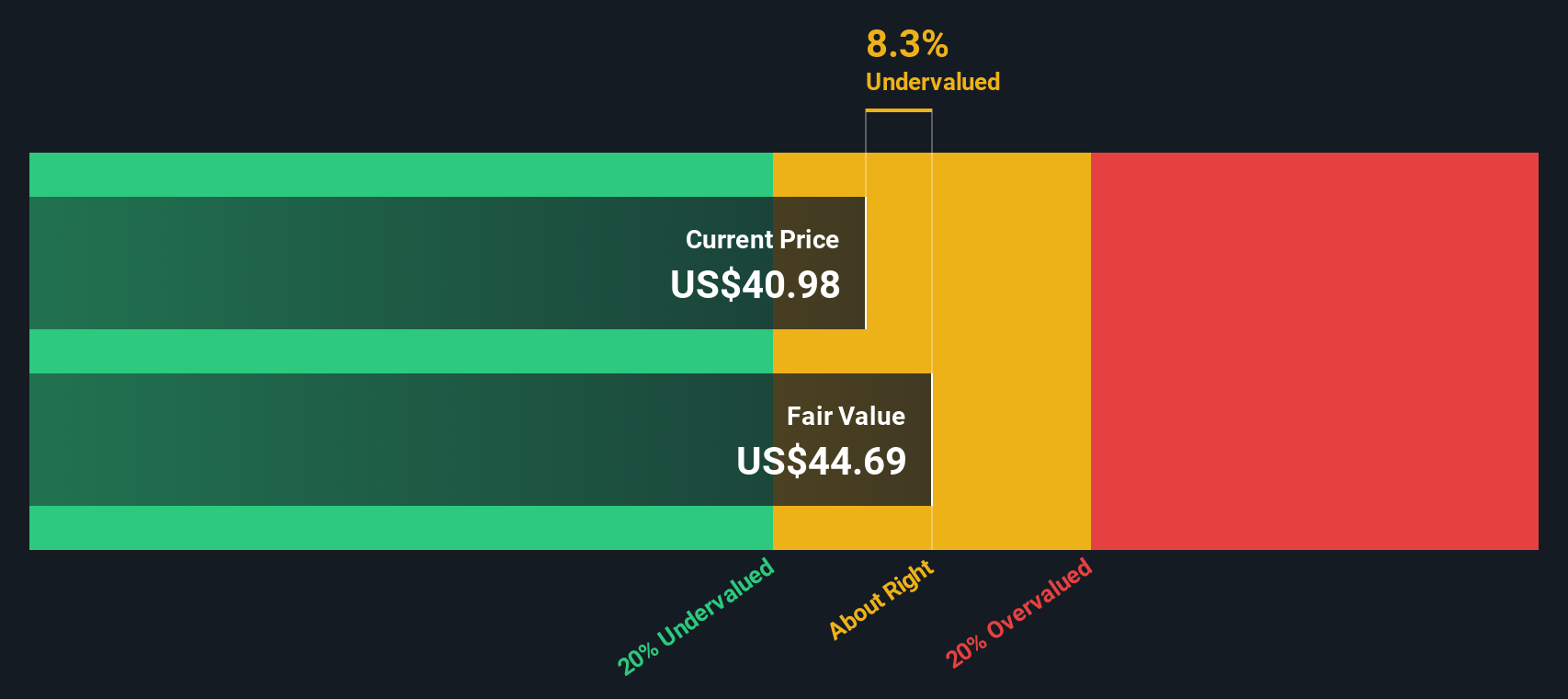

With shares still far from analyst price targets and mixed financial signals in play, the question remains: Is eToro Group now undervalued and primed for a turnaround, or are markets already factoring in all future growth potential?

Price-to-Earnings of 17.5x: Is it justified?

eToro Group’s shares currently trade at a price-to-earnings (P/E) ratio of 17.5x, which is notably higher than the average of its direct peers. This makes the stock appear expensive on this metric and suggests investors are assigning a premium relative to similar companies trading at just 6.5x.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of a company’s earnings. For capital markets firms like eToro Group, it is a widely used tool to compare valuation standing, especially as earnings can fluctuate meaningfully year to year in this sector.

With eToro Group’s P/E significantly above peer averages, the market may be pricing in above-average future profit growth or rewarding its recent performance. While the company has posted standout earnings acceleration, this premium leaves little room for error if results disappoint. Compared to the broader US Capital Markets industry, however, eToro’s P/E is a relative bargain, with the industry average at 26.6x. This signals a more nuanced valuation backdrop.

Result: Price-to-Earnings of 17.5x (OVERVALUED)

However, with annual revenue shrinking by nearly 95% and shares still trading below analyst targets, there are clear risks that could quickly shift sentiment.

Another View: Discounted Cash Flow Puts a Different Lens on Value

While the price-to-earnings ratio suggests eToro Group is expensive, our SWS DCF model values the shares at $45.25, which is about 13% above today’s price. This points to a potential undervaluation from a long-term cash flow perspective. This raises the question: which lens will the market trust?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out eToro Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own eToro Group Narrative

If you see things differently or want to build your own outlook, it's quick and easy to create a personalized perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding eToro Group.

Looking for more investment ideas?

Don't sit on the sidelines while other investors uncover new opportunities. Use the Simply Wall Street Screener to spot fresh prospects that match your interests and goals.

- Tap into market momentum by checking out these 877 undervalued stocks based on cash flows, where stocks are trading below their true worth based on cash flows and future potential.

- Uncover income opportunities by reviewing these 17 dividend stocks with yields > 3%, featuring companies offering solid yields above 3% for those who value stable returns.

- Stay ahead of technology trends by investigating these 27 AI penny stocks to find emerging AI leaders making waves with innovative solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.