Please use a PC Browser to access Register-Tadawul

Evaluating Cohen & Steers (CNS) Valuation After Mixed Short And Long Term Share Returns

Cohen & Steers, Inc. CNS | 67.12 | +0.42% |

Cohen & Steers (CNS) has drawn fresh attention after recent share performance diverged between shorter and longer timeframes, with a modest gain over the past month contrasting with weaker moves across the past 3 months and year.

At a latest share price of US$64.26, Cohen & Steers has paired a 30 day share price return of 2.36% with a year long total shareholder return decline of 25.10%. This suggests recent momentum is still trying to recover from a tougher stretch.

If you are weighing up asset managers like Cohen & Steers and want a broader watchlist, it could be a good moment to look at fast growing stocks with high insider ownership.

With Cohen & Steers trading at US$64.26, showing mixed recent returns, analyst targets above the current price, and an intrinsic estimate that appears richer, you have to ask: is there real value here, or is the market already pricing in future growth?

Most Popular Narrative: 11.2% Undervalued

With Cohen & Steers last closing at $64.26 against a most followed fair value estimate of about $72.33, the narrative is clearly asking investors to compare current pricing with a higher long term potential value built on detailed forecasts.

Strategic expansion into active ETFs and broader product diversification (including the launch of integrated listed/private real estate strategies) is expected to attract new investor segments and improve client retention, supporting future AUM growth and revenue stability.

Want to see what is backing that higher fair value? Revenue expectations, margin rebuild, and a future earnings multiple all sit at the core of this story.

Result: Fair Value of $72.33 (UNDERVALUED)

However, steady client outflows or higher costs tied to ETF launches and global expansion could pressure margins and challenge the idea that current pricing is conservative.

Another Angle On Value

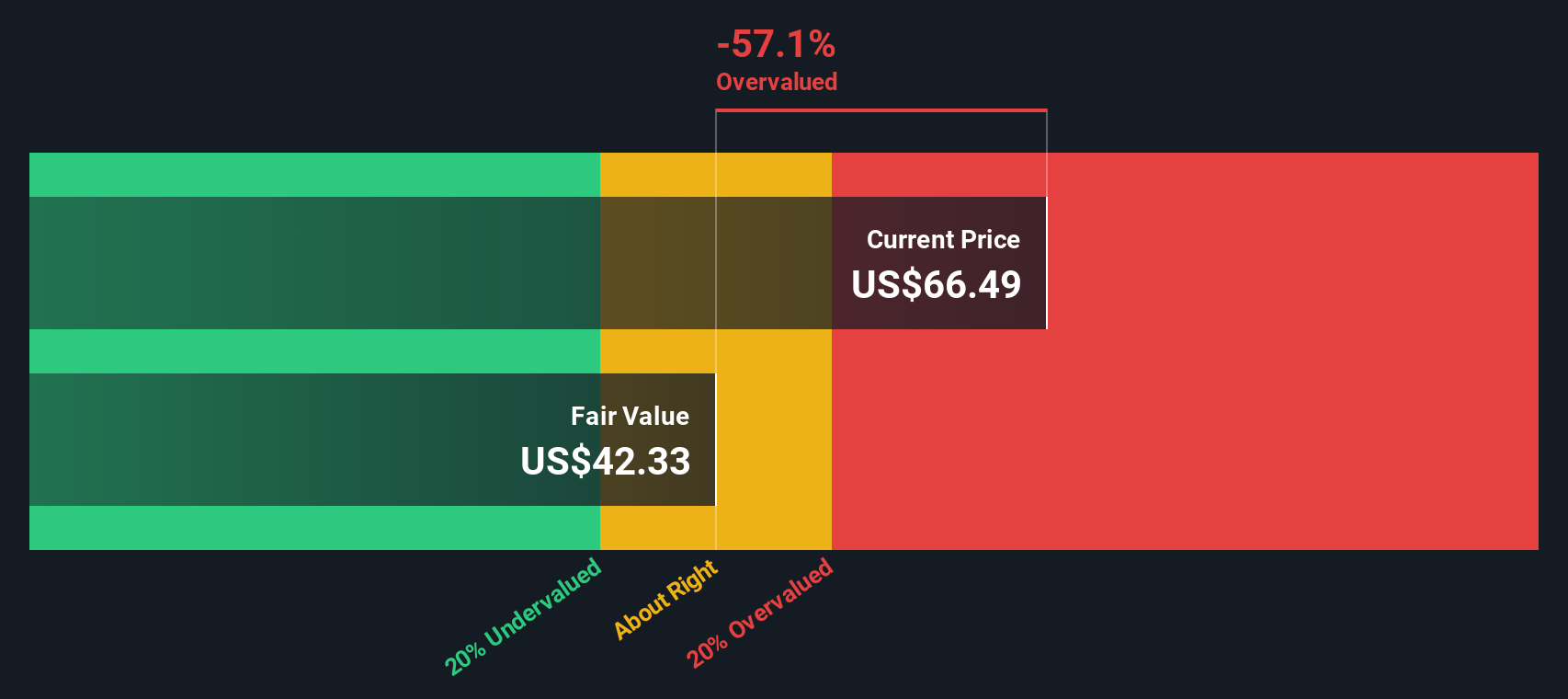

Those fair value estimates point to upside, but our DCF model tells a different story. On that measure, Cohen & Steers at $64.26 is trading above an estimated future cash flow value of $49.13, which screens as overvalued. So which signal do you trust more: earnings power or cash flows?

Build Your Own Cohen & Steers Narrative

If you see the story differently or prefer to weigh the numbers yourself, you can pull the data together and build a custom view in just a few minutes, then Do it your way.

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about tightening your process, do not stop at one stock. Use targeted screens to surface fresh ideas that match your preferences.

- Spot potential high risk high reward opportunities early by scanning these 3531 penny stocks with strong financials that already pass strict financial filters.

- Position yourself for long term themes by focusing on these 110 healthcare AI stocks that connect medical expertise with AI driven solutions.

- Strengthen your passive income watchlist by zeroing in on these 14 dividend stocks with yields > 3% that could support more reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.