Please use a PC Browser to access Register-Tadawul

Evaluating EMCOR Group (EME) After Recent Share Price Pullback And Conflicting Valuation Signals

EMCOR Group, Inc. EME | 812.79 | +1.15% |

EMCOR Group (EME) has drawn attention after recent performance data, with the stock showing a 1-day return of a 4.8% decline and a 7-day return of a 2.6% decline, prompting fresh interest in its valuation.

That 4.8% 1 day share price decline and 2.6% 7 day share price pullback sit against a stronger backdrop, with a 30 day share price return of 8.4% and a 1 year total shareholder return of 55.5%. This suggests momentum has cooled recently after a very strong longer term run.

If EMCOR Group’s move has you reassessing opportunities, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With EMCOR Group trading at US$708.62 and an indicated 21.8% intrinsic discount, plus room to the US$772 analyst target, you have to ask: is this a rare value gap or is the market already pricing in future growth?

Most Popular Narrative: 51.2% Overvalued

Compared with the $708.62 share price, the most followed narrative from Joey8301 points to a much lower fair value anchored at $468.79.

Based on a 9% revenue growth rate, 6.5% net profit margin, 20x P/E multiple, and an 8% discount rate, EMCOR’s intrinsic value today is estimated at $468.79 per share.

At this price, EMCOR appears fairly valued, reflecting its strong fundamentals and growth outlook.

Curious how a company with expanding margins and a steady growth profile can still screen as overvalued in this narrative? The answer sits in a tight mix of projected revenue compounding, profitability assumptions, and the earnings multiple that anchors the end valuation.

Result: Fair Value of $468.79 (OVERVALUED)

However, this thesis could be knocked off course if construction spending softens in a downturn, or if tight labor markets and higher wages pressure margins more than expected.

Another View: Market Ratios Point to Undervaluation

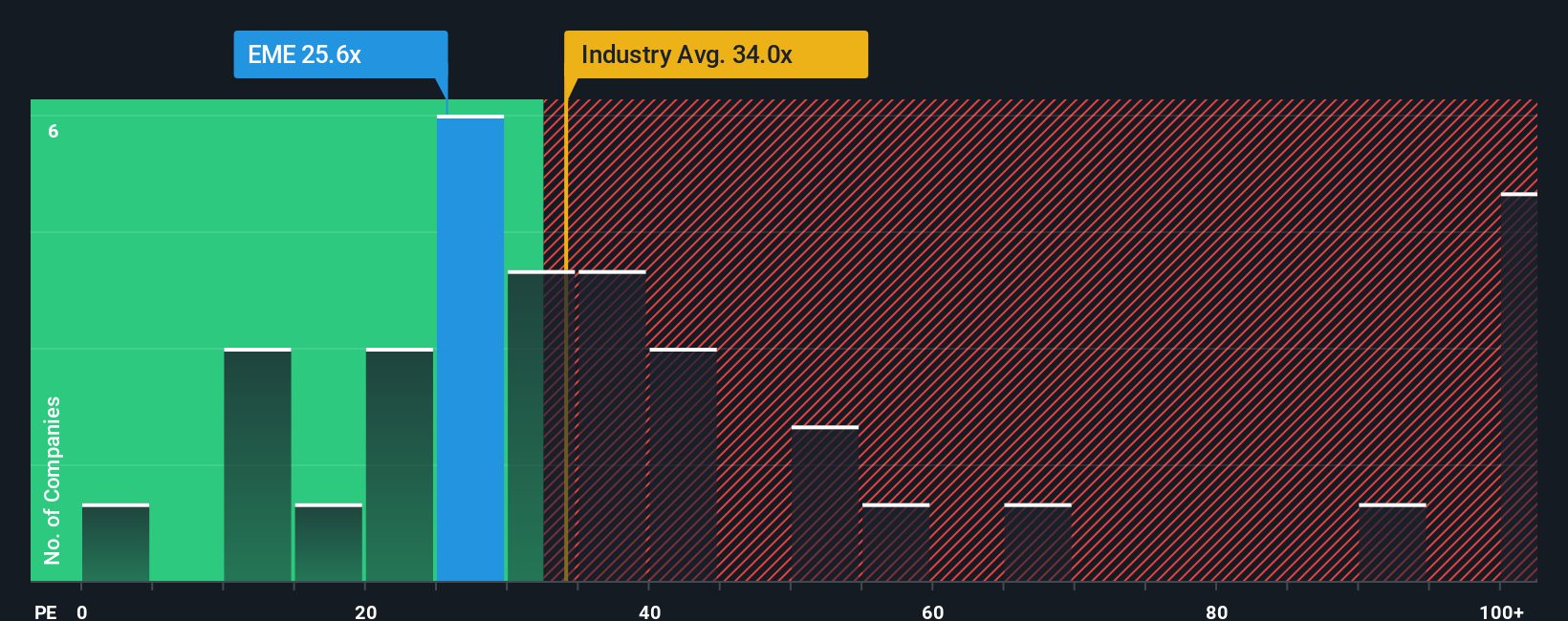

Joey8301’s $468.79 fair value suggests EMCOR Group is 51.2% overvalued, but the current P/E of 28.1x tells a different story. It sits below the fair ratio of 31.8x, below the US Construction industry at 36.4x, and below peers at 71.7x, which implies the market may be pricing in more risk than the numbers support. Which story do you think fits better with your own expectations?

Build Your Own EMCOR Group Narrative

If you see the data differently or prefer to run your own numbers, you can build a personalised EMCOR view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding EMCOR Group.

Looking for more investment ideas?

If EMCOR has caught your attention, do not stop here. Use the Simply Wall Street Screener to focus on other stock ideas that actually fit your plan.

- Spot potential value gaps by scanning these 867 undervalued stocks based on cash flows that align with your preferred cash flow profile and pricing discipline.

- Explore developments in healthcare by checking out these 105 healthcare AI stocks that link medical expertise with AI driven tools and data.

- Consider growth stories at the frontier of payments and digital infrastructure by reviewing these 19 cryptocurrency and blockchain stocks related to blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.