Please use a PC Browser to access Register-Tadawul

Evaluating SentinelOne (S) After CFO Exit And One-Time Tax Charge On IP And Acquisition

SentinelOne, Inc. Class A S | 13.83 | +1.99% |

SentinelOne (S) is back in focus after a busy stretch, with the CFO transition, an interim finance chief stepping in, and a sizable one time tax charge all landing just ahead of earnings.

The CFO change, interim appointment and one-time tax charge all land against a backdrop where the latest share price of US$14.93 sits alongside a 7 day share price return of 8.19%, while the 1 year total shareholder return shows a 36.92% decline and the 3 year total shareholder return shows a 5.63% decline, suggesting that short term momentum has picked up but longer term returns remain under pressure.

If this kind of volatility has your attention, it could be a good moment to widen your watchlist with high growth tech and AI stocks that are also tied to the AI and cybersecurity theme.

With revenue growth running at 15% year over year, a reported net loss of US$411.29 million, and shares trading around US$14.93 at a discount to analyst targets, is there real value here or is the market already pricing in future growth?

Preferred Price to Sales of 5.3x: Is it justified?

On the numbers, SentinelOne trades on a P/S of 5.3x, which screens as expensive versus the broader US software group but cheaper than its closer peer set.

P/S compares the company’s market value to its annual revenue, which can be useful for loss making software names where earnings are not yet a meaningful signal.

For SentinelOne, that 5.3x sits above the US Software industry average of 4.5x, so the market is assigning a richer tag than the sector overall. At the same time, it is below the estimated fair P/S of 6x and below the peer average of 6.9x, which suggests some room for sentiment to shift if revenue growth and cash flow trends move closer to what the market assigns to similar cybersecurity and AI focused platforms.

Result: Price to Sales of 5.3x (ABOUT RIGHT)

However, you still have to weigh execution risk around the CFO change and interim setup, as well as the ongoing net loss of US$411.29 million against that revenue base.

Another View: What Our DCF Model Says

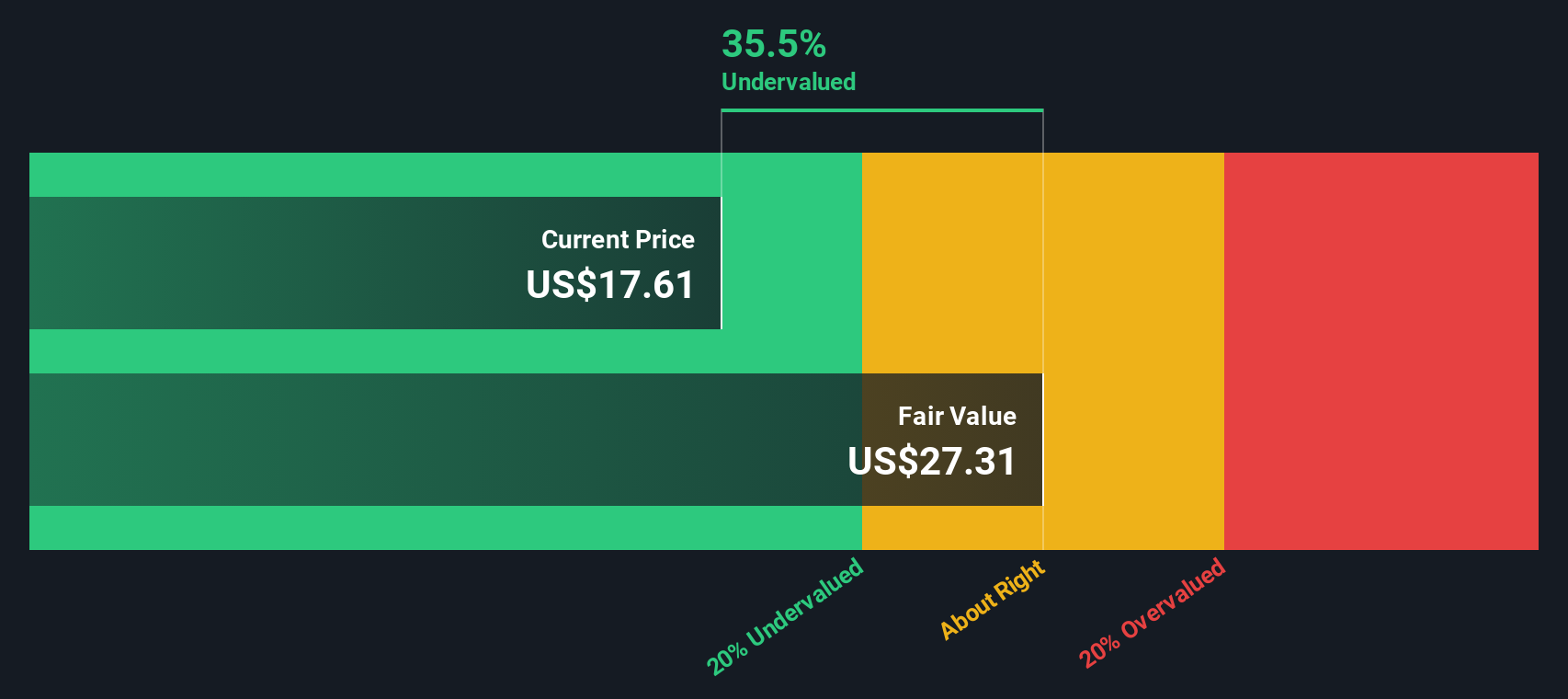

While the 5.3x P/S ratio paints one picture, our DCF model points to something different. With SentinelOne at US$14.93 and our estimate of future cash flow value at US$23.53, the shares appear to be trading at a 36.5% discount. The question is whether the cash flow path needed to support that gap seems realistic to you.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SentinelOne for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SentinelOne Narrative

If you would rather weigh the numbers yourself and come to your own conclusions, you can build a full story in just a few minutes, starting with Do it your way.

A great starting point for your SentinelOne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If SentinelOne is on your radar, do not stop here. Broaden your watchlist with a few focused idea lists that keep you close to where capital is moving.

- Spot potential mispricings by checking out these 878 undervalued stocks based on cash flows, where cash flow based valuations help you sort through companies that might not be fully appreciated.

- Zero in on the AI theme with these 25 AI penny stocks, so you can quickly compare businesses positioned around artificial intelligence without sifting through hundreds of tickers alone.

- Lock in an income focused watchlist using these 14 dividend stocks with yields > 3%, concentrating on companies offering dividend yields above 3% that could complement growth oriented holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.