Please use a PC Browser to access Register-Tadawul

Evaluating Shopify (SHOP) After Partnerships Restructuring AI Push And Legal Victory

Shopify, Inc. Class A SHOP | 131.23 130.90 | -8.64% -0.25% Post |

Shopify (NasdaqGS:SHOP) is back in focus after restructuring its partnerships division, cutting roles tied to third party collaborators, while simultaneously emphasizing AI driven commerce projects and celebrating a major overturned patent verdict.

Those partnership layoffs and AI commerce pushes are unfolding against a weaker recent tape, with a 30 day share price return of 18.62% and a 90 day share price return of 20.27% showing fading near term momentum, while a 1 year total shareholder return of 28.06% and a very large 3 year total shareholder return of about 18x keep the longer term picture stronger.

If Shopify’s recent swings have you thinking about where else growth and AI themes could show up, it might be worth scanning high growth tech and AI stocks as a next step.

With Shopify shares down over the past 3 and 12 months but still up 28.06% on a 1 year basis, and trading at a roughly 19% premium to some intrinsic estimates plus a 30% discount to analyst targets, is this weakness creating an entry point or is the market already paying up for future growth?

Most Popular Narrative: 26.1% Undervalued

Shopify’s last close of $137.89 sits well below a narrative fair value of $186.64. This frames the current pullback very differently compared to the recent price action.

“Social commerce” presents a massive tailwind with $6.23T market opportunity by 2030.

Social commerce market is growing at 30.71% CAGR with 91% occurring on mobile devices: https://www.mordorintelligence.com/industry-reports/social-commerce-market

Curious how that huge addressable market turns into a specific fair value per share? The narrative leans on revenue compounding, widening margins and a rich future earnings multiple. Want to see exactly how those moving parts stack up to $186.64?

Result: Fair Value of $186.64 (UNDERVALUED)

However, there are clear pressure points here, including weaker consumer confidence readings and competitive pushback from Amazon, payment providers, and social platforms that could limit Shopify’s potential upside.

Another View Using Market Ratios

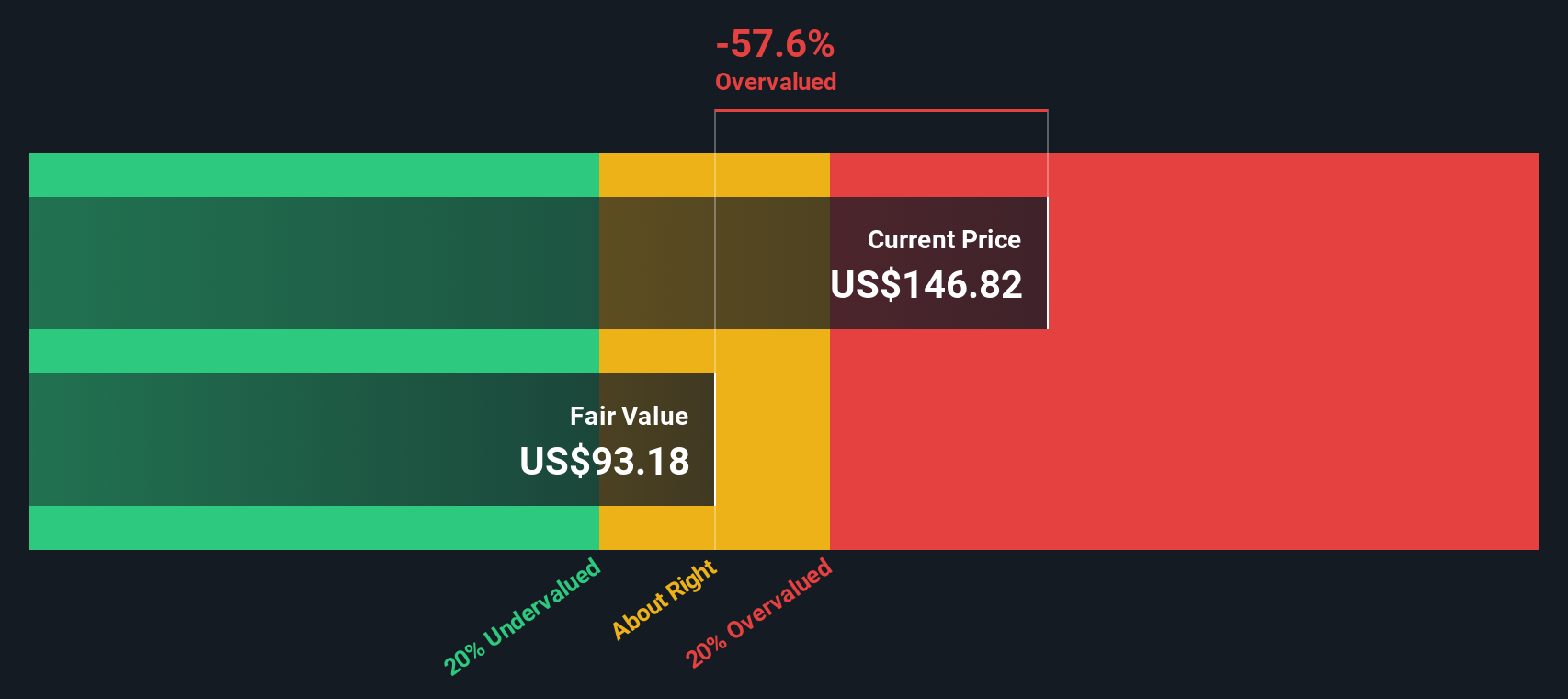

Our SWS DCF model flags Shopify as trading above its estimated future cash flow value of $116.35 per share, which contrasts with the $186.64 narrative fair value. That gap raises a simple question: is the story leading the numbers or are the numbers underrating the story?

Build Your Own Shopify Narrative

If you do not fully buy into this view or prefer to stress test the assumptions yourself, you can spin up your own narrative in minutes: Do it your way.

A great starting point for your Shopify research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at Shopify. Use the Screener to hunt for ideas that others may be missing.

- Target potential growth by checking out these 3526 penny stocks with strong financials. These pair smaller market caps with stronger balance sheets and healthier fundamentals.

- Zero in on future tech themes by scanning these 24 AI penny stocks that are tied to artificial intelligence trends across multiple sectors.

- Prioritise price discipline by reviewing these 874 undervalued stocks based on cash flows. These currently screen as cheaper based on their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.