Please use a PC Browser to access Register-Tadawul

Evaluating Viridian Therapeutics (VRDN) After William Blair’s New ‘Outperform’ Rating and Rising Investor Optimism

Viridian Therapeutics, Inc. VRDN | 27.44 | -2.35% |

William Blair just kicked off coverage on Viridian Therapeutics (VRDN) with an Outperform rating, adding to a growing chorus of upbeat views that has quietly reshaped how investors are sizing up this biotech name.

The upbeat call lands on a stock that has already caught a strong bid, with a roughly 44% 1 month share price return helping drive a 65% 1 year total shareholder return and signalling building momentum around Viridian’s pipeline story.

If Viridian’s run has you rethinking your healthcare exposure, this could be a good moment to scout other ideas across healthcare stocks as potential next candidates for your watchlist.

With shares sprinting ahead of fundamentals but still sitting roughly 23% below consensus targets, the real question now is whether Viridian remains a mispriced growth story or if markets are already baking in the next leg of upside.

Price-to-Sales of 43.8x: Is it justified?

Viridian’s last close at $32.46 sits on a steep price-to-sales ratio of 43.8 times, signaling a rich valuation versus peers and implied fair value levels.

The price-to-sales multiple compares a company’s market value to its annual revenue. It is a commonly used yardstick for high growth, often loss making, biotech names where earnings are not yet meaningful.

In Viridian’s case, the market is assigning a far higher price-to-sales tag than both the estimated fair price-to-sales ratio of 0.2 times and the peer and industry averages. This implies investors are paying up aggressively for future revenue potential rather than current fundamentals.

That premium is stark. Viridian’s 43.8 times price-to-sales ratio towers over both the US Biotechs industry average of 11.6 times and the broader peer group at 18.7 times, a gap that highlights how far expectations have run ahead of what the SWS fair ratio framework suggests the multiple could eventually converge toward.

Result: Price-to-Sales of 43.8x (OVERVALUED)

However, setbacks in Viridian’s late stage thyroid eye disease trials or slower than expected revenue ramp could quickly challenge today’s premium growth narrative.

Another View: DCF Points the Other Way

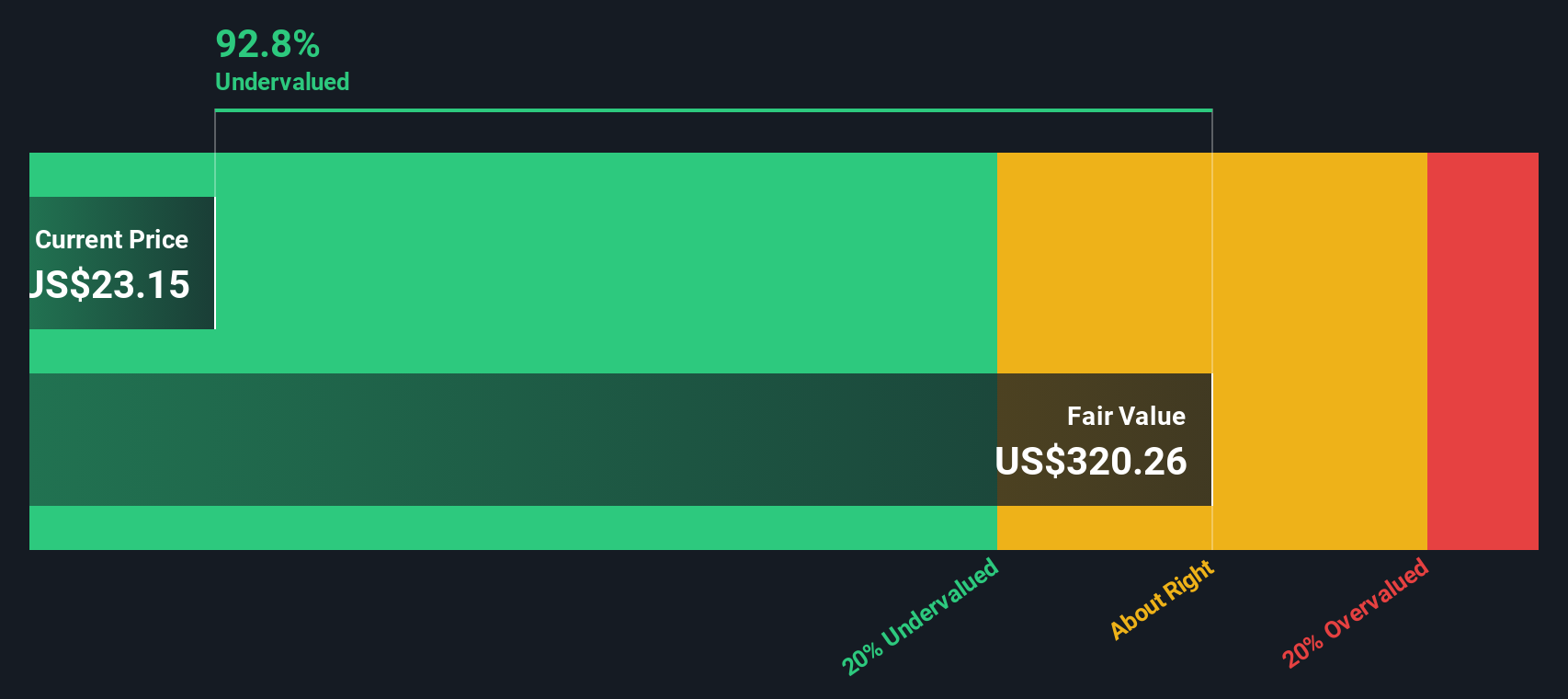

While the price to sales ratio appears expensive, our DCF model suggests something very different. It flags Viridian as trading about 89% below an estimated fair value of $296.88 per share. Is the market underpricing long term cash flows, or is the model too optimistic?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Viridian Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Viridian Therapeutics Narrative

If you see Viridian’s story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Viridian Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next potential winners by using the Simply Wall St Screener to pinpoint opportunities most investors will only notice later.

- Target reliable cash generators with these 15 dividend stocks with yields > 3% that can strengthen your portfolio with income while markets stay volatile.

- Capitalize on mispriced opportunities through these 909 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in share prices.

- Ride powerful innovation trends by tapping into these 26 AI penny stocks positioned at the front of the artificial intelligence wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.