Please use a PC Browser to access Register-Tadawul

Event Reminder | Get Ready for Thursday (Jul. 3rd)

S&P 500 index SPX | 6816.51 | -0.16% |

NASDAQ IXIC | 23057.41 | -0.59% |

Dow Jones Industrial Average DJI | 48416.56 | -0.09% |

NASDAQ-100 NDX | 25067.26 | -0.51% |

S&P 500 index GSPC | 6816.51 | -0.16% |

This week, the US labour market data will be in the spotlight as the Department of Labour releases the June non-farm payroll (NFP) and unemployment rate figures on Thursday, July 3, at 8:30 AM ET.

Due to the Independence Day holiday, the release has been moved up by a day.

| Riyadh Time | Event | Previous | Consensus | Forecast |

|---|---|---|---|---|

| 03:30 PM | Non Farm Payrolls JUN | 139K | 110K | 100.0K |

| 03:30 PM | Unemployment Rate JUN | 4.2% | 4.3% | 4.2% |

| 03:30 PM | Average Hourly Earnings MoM JUN | 0.4% | 0.3% | 0.2% |

| 03:30 PM | Average Hourly Earnings YoY JUN | 3.9% | 3.9% | 3.9% |

| 03:30 PM | Balance of Trade MAY | $-61.6B | $-71B | $-72B |

| 03:30 PM | Exports MAY | $289.4B | - | $278.0B |

| 03:30 PM | Imports MAY | $351B | - | $350.0B |

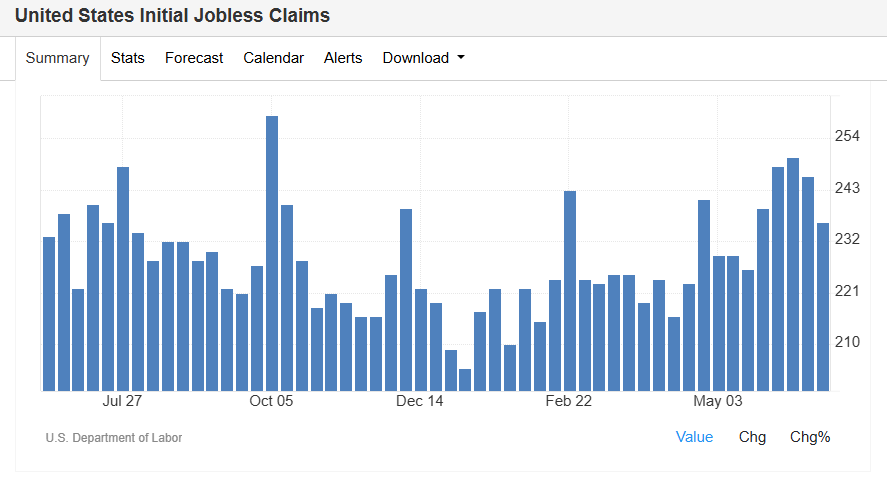

| 03:30 PM | Initial Jobless Claims JUN/28 | 236K | 240K | 240.0K |

| 03:30 PM | Participation Rate JUN | 62.4% | - | 62.3% |

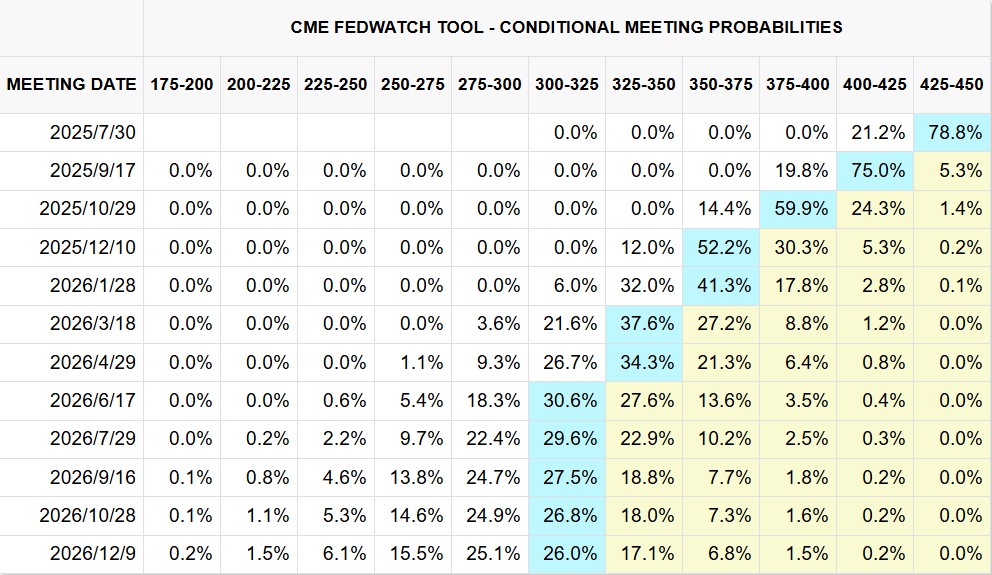

Economists anticipate an addition of 115,000 jobs, down from May's 139,000, with the unemployment rate expected to tick up to 4.3% from 4.2%. This report comes amidst significant market interest, as it might reinforce expectations of a dovish shift by the Federal Reserve. The Fed has maintained interest rates between 4.25% and 4.5% following its June meeting, citing uncertainty from trade policies.

Therefore, the upcoming employment data will be pivotal in shaping market expectations for the Fed's monetary policy decisions.

Recent Events Impacting Employment Data

The labour market has been under scrutiny, especially with recent developments affecting economic conditions.

High-profile discussions within the Federal Reserve have highlighted internal divisions regarding the timing of potential interest rate cuts. Goldman Sachs has adjusted its forecast, suggesting that the Fed may begin cutting rates as early as September, citing diminished inflationary effects from tariffs and potential labour market weakness.

Despite these discussions, the employment market remains relatively healthy, says Fed's Goolsbee on July 1st, although factors such as seasonal changes and immigration policy adjustments could pose short-term risks. The Fed's next meeting on July 29-30 will be crucial, with current probabilities heavily favouring stable rates unless employment data significantly underperforms.

Moreover, the international landscape has seen Canada retract its digital services tax proposal, which had previously stalled trade talks with the US.

Potential Impact on Asset Prices

The upcoming employment data could have profound implications for asset prices, particularly in the bond, currency, and equity markets.

- US Treasury yields have been declining, with the 10-year yield at 4.260%, reflecting market anticipation of potential Fed rate cuts. Should the employment data fall in line with expectations, it might bolster the view that the Fed will adopt a more accommodative stance, impacting yields further.

- The dollar index (DXY) has recently hit a three-year low amid concerns about rate cuts. However, ING analysts suggest that the employment report might provide temporary support for the dollar if the data is not weak enough to trigger immediate rate cut expectations. A stronger employment report could lead investors to reassess their positions, potentially stabilising the dollar.

- In the equity markets, strategists from Morgan Stanley and JPMorgan have expressed concerns about the impact of a weakening labour market on stock performance. While the prospect of rate cuts typically supports equities, a significant downturn in employment could overshadow these benefits. The S&P 500, in particular, might face pressure if employment figures disappoint, despite the anticipated easing of monetary policy.