Please use a PC Browser to access Register-Tadawul

Event Reminder | Get Ready for Tuesday-Friday (July 15-18th)

S&P 500 index SPX | 6800.26 | -0.24% |

NASDAQ IXIC | 23111.46 | +0.23% |

Dow Jones Industrial Average DJI | 48114.26 | -0.62% |

NASDAQ-100 NDX | 25132.94 | +0.26% |

S&P 500 index GSPC | 6800.26 | -0.24% |

01

Event Overview

Including the start of the earnings season, this week is undoubtedly a very busy one.

This week, three key US economic indicators—June CPI, retail sales, and the University of Michigan’s July consumer sentiment index—will be closely watched by markets.

These reports will shape expectations around inflation trends, consumer spending resilience, and the Federal Reserve’s next policy moves, particularly as Trump’s escalating tariffs begin to ripple through the economy.

- CPI (Tue, July 15) – Expected to show accelerating price pressures, potentially signalling tariff-driven inflation.

- Retail Sales (Thu, July 17) – Forecast to rebound slightly after two months of declines, but consumer caution persists.

- Michigan Consumer Sentiment (Fri, July 18) – Likely to remain subdued amid tariff anxiety and economic uncertainty.

These data points will influence Fed rate-cut bets, bond yields, and equity markets, with investors weighing whether stagflation risks are rising or if the economy remains on a soft-landing path.

| Date | Riyadh Time | Event | Previous | Consensus | Forecast |

|---|---|---|---|---|---|

| July 15, 2025 (Tue.) | 03:30 PM | Core Inflation Rate MoM JUN | 0.1% | 0.3% | 0.2% |

| 03:30 PM | Core Inflation Rate YoY JUN | 2.8% | - | 2.9% | |

| 03:30 PM | Inflation Rate MoM JUN | 0.1% | 0.3% | 0.2% | |

| 03:30 PM | Inflation Rate YoY JUN | 2.4% | 2.6% | 2.5% | |

| 03:30 PM | CPI JUN | 321.465 | - | 322 | |

| 03:30 PM | CPI s.a JUN | 320.580 | - | 321.2 | |

| July 17, 2025 (Thu.) | 03:30 PM | Retail Sales MoM JUN | -0.9% | 0% | 0.2% |

| 03:30 PM | Export Prices MoM JUN | -0.9% | -0.1% | - | |

| 03:30 PM | Import Prices MoM JUN | 0% | 0.2% | 0.1% | |

| 03:30 PM | Initial Jobless Claims JUL/12 | 227K | 225K | 230.0K | |

| July 18, 2025 (Fri.) | 05:00 PM | Michigan Consumer Sentiment Prel JUL | 60.7 | 61.5 | 60.5 |

02

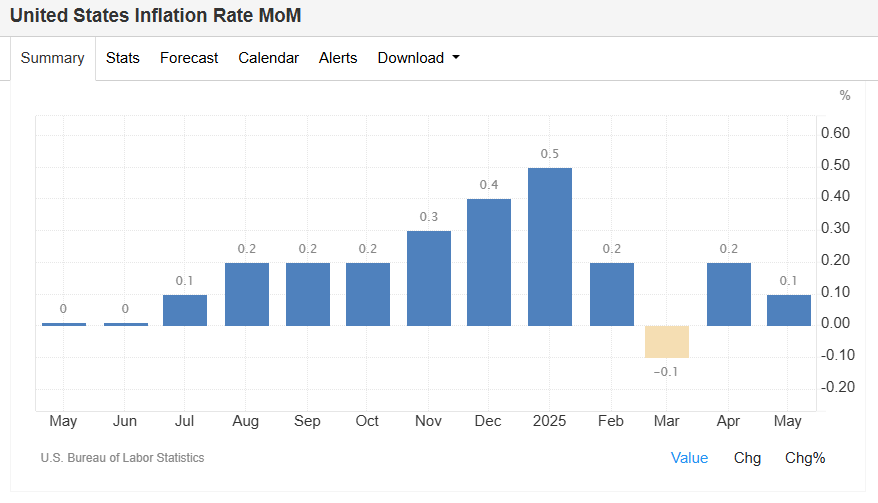

CPI Expectations & Market Implications

Key Forecasts:

- Headline CPI (MoM): +0.3% (vs. +0.1% in May)

- Headline CPI (YoY): 2.6% (vs. 2.4%)

- Core CPI (MoM): +0.3% (vs. +0.1%)

- Core CPI (YoY): 2.9% (vs. 2.8%)

What to Watch:

Tariff Impact: Economists expect higher core goods inflation (e.g., autos, electronics, furniture) due to Trump’s tariffs, but services inflation (57% of CPI) may stay subdued.

Fed Reaction: A hotter-than-expected CPI could delay September rate cuts, pushing Treasury yields higher and pressuring stocks. Conversely, a soft reading (e.g., +0.2% MoM core) may revive dovish bets.

Market Risks: If both goods and services inflation surges, traders may fear broader demand-driven price pressures, forcing the Fed to stay hawkish longer.

03

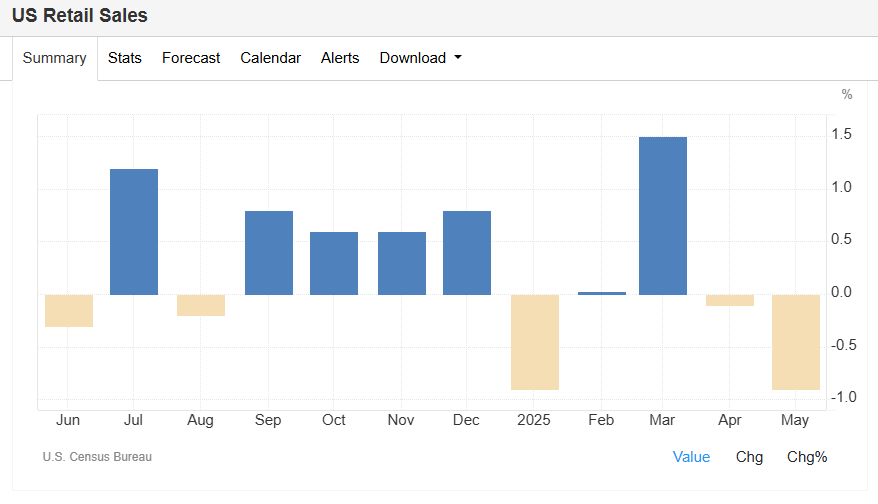

Retail Sales Outlook & Consumer Behaviour

Key Forecasts:

- June Retail Sales (MoM): +0.0% (vs. -0.9% in May)

- Ex-Auto/Gas: Slight rebound expected after NRF data showed a 0.33% MoM drop in June.

What to Watch:

Tariff-Driven Caution: Consumers are delaying big-ticket purchases (e.g., cars, appliances) due to uncertainty over future price hikes.

Sector Trends:

- Weakness: Electronics (-1.03% MoM), general merchandise (-0.15%)

- Strength: Digital products (+24.11% YoY), health/personal care (+3.47%).

Economic Signal: If spending remains sluggish, it may confirm softening demand, reinforcing Fed rate-cut expectations.

04

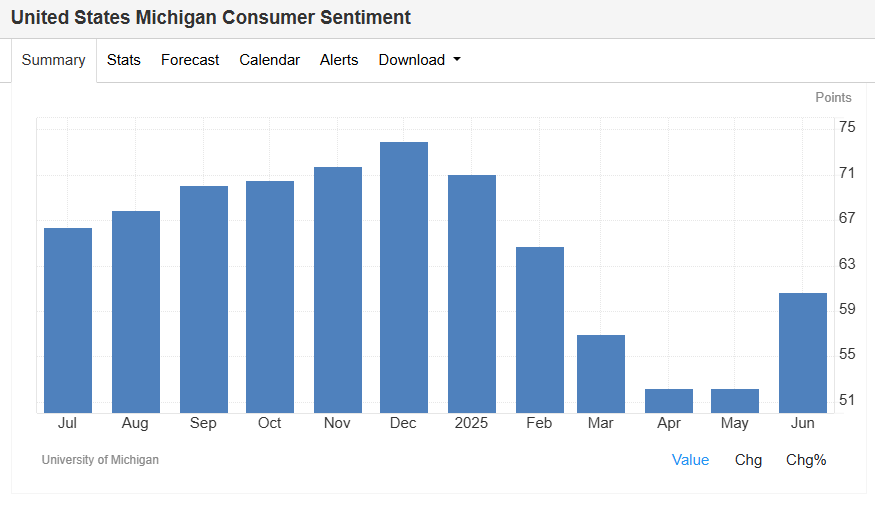

Michigan Consumer Sentiment: Stuck Near Lows

Key Forecasts:

- July Preliminary Sentiment: 60.5 (vs. 60.7 in June, consensus: 61.5)

- 1-Year Inflation Expectations: 5.0% (down from 6.6% in May but still elevated).

What to Watch:

Tariff Anxiety: 74% of consumers cited tariffs as a top concern, up from 60% in April.

Political Divide: Republican sentiment dropped 7% MoM, outweighing gains among independents.

Market Impact: Persistent pessimism could weigh on discretionary stocks, while falling inflation expectations may support bonds.

05

Impact on Markets

Bullish Scenario (Soft CPI + Strong Retail Sales + Improving Sentiment):

- Stocks rally (especially consumer discretionary, tech) as Fed cut bets rise.

- Bonds gain (yields dip) if inflation fears ease.

Bearish Scenario (Hot CPI + Weak Retail + Low Sentiment):

- Stocks drop (cyclicals, small-caps hit hardest) on stagflation fears.

- Bonds sell off (yields spike) if traders price fewer/delayed Fed cuts.

- Defensive sectors (utilities, healthcare) outperform.

Baseline View:

CPI likely shows mild tariff pass-through, keeping September rate cuts (~70% priced) intact.

Retail sales stay tepid, reflecting consumer caution.

Sentiment remains depressed, capping equity upside but limiting bond sell-offs.

Bottom Line

This week’s data will test whether tariffs are finally fueling inflation—and whether consumers can withstand higher prices. Markets will be volatile around CPI, but unless all three reports surprise sharply, the Fed’s September rate-cut timeline may hold.

Key Risks:

- Upside CPI shock → Delayed cuts, bond sell-off.

- Retail collapse → Recession fears, equity outflows.

- Sentiment plunge → Further demand weakening.

Stay tuned for Fed speakers’ reactions post-data, with Powell’s tariff warnings still looming