Please use a PC Browser to access Register-Tadawul

Evolent Health, Inc. (NYSE:EVH) Stock Catapults 35% Though Its Price And Business Still Lag The Industry

Evolent Health Inc Class A EVH | 4.07 | -1.21% |

Evolent Health, Inc. (NYSE:EVH) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

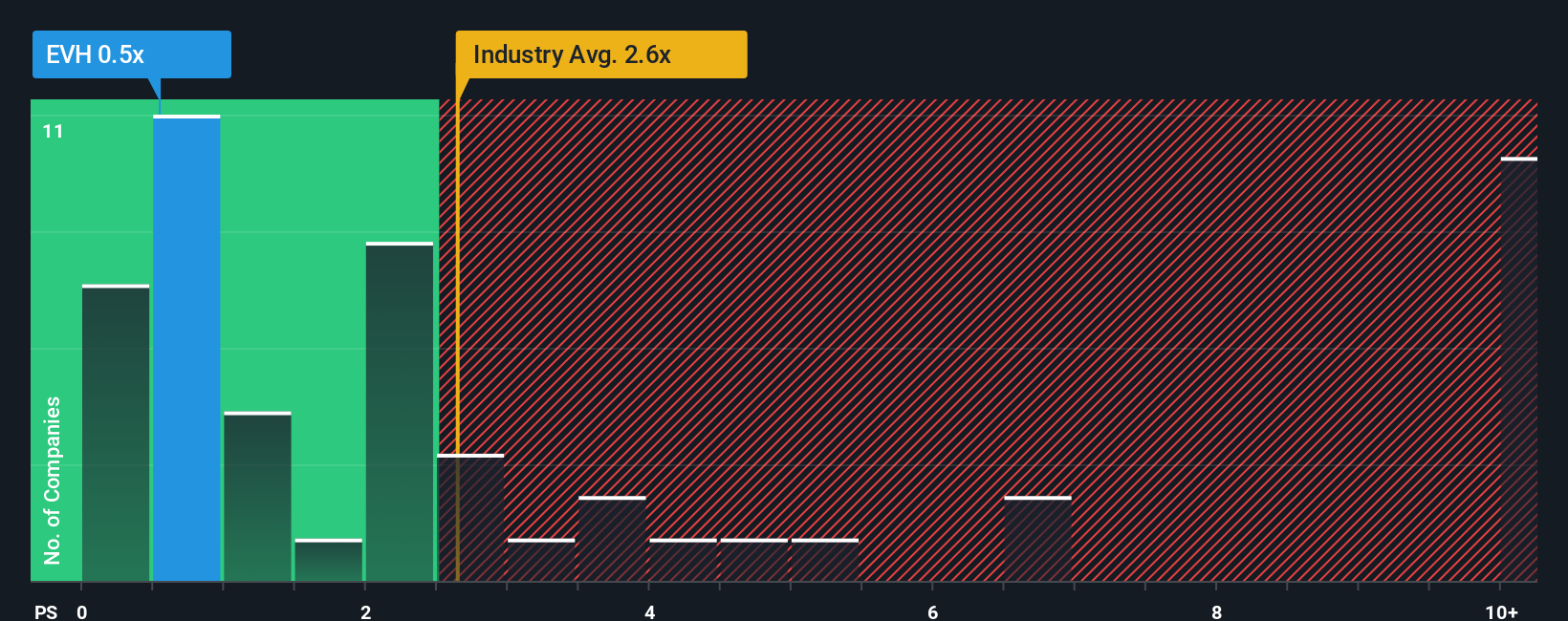

In spite of the firm bounce in price, Evolent Health may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Evolent Health Has Been Performing

With revenue growth that's inferior to most other companies of late, Evolent Health has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Evolent Health's future stacks up against the industry? In that case, our free report is a great place to start.How Is Evolent Health's Revenue Growth Trending?

Evolent Health's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 142% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 6.0% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 11% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Evolent Health's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Even after such a strong price move, Evolent Health's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Evolent Health's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Evolent Health with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Evolent Health, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.