Please use a PC Browser to access Register-Tadawul

Fannie Mae (FNMA): Exploring Valuation Following Privatization Push, Merger Speculation, and Renewed Market Interest

FEDERAL NATIONAL MORTGAGE ASSOC FNMA | 10.69 | -0.09% |

If you’ve been watching the headlines, you know the Federal National Mortgage Association (FNMA), better known as Fannie Mae, is back in the spotlight. The Trump administration is pressing forward with plans to privatize Fannie Mae and Freddie Mac, moves that could reshape the mortgage landscape. Between chatter about an initial public offering and even the prospect of a merger, investors are facing a string of regulatory twists, CEO updates, and sudden surges in analyst coverage. Altogether, these developments are enough to make anyone reconsider what FNMA might be worth.

The renewed push from Washington has coincided with a wave of volatility for the stock. FNMA’s share price logged an impressive 37% rise in the past month, only to slide 9.5% shortly after following the latest merger talk and executive news. Looking at a broader timeframe, the stock remains up nearly 9.5% over the past year and has built momentum in recent months. This shows that shifting expectations around privatization and future earnings are being quickly reflected by the market.

After these swings and speculation, the real question is whether FNMA is now undervalued or if all this action means the market has already priced in what comes next.

Price-to-Sales Ratio of 2.6x: Is It Justified?

Based on its price-to-sales (P/S) ratio of 2.6x, FNMA appears to be trading at a good value compared both to its industry peers and the broader Diversified Financial sector. This suggests the market has not priced FNMA at a premium, despite its recent volatility and headlines.

The price-to-sales ratio measures how much investors are willing to pay for a dollar of the company’s revenue, making it especially relevant for firms like FNMA where traditional earnings-based metrics are complicated by unprofitability or volatile earnings. Given the sometimes lumpy nature of financial results in this sector, the P/S ratio can provide a stable lens for comparison.

FNMA’s current P/S is lower than both the industry average and its closest peer group. This could mean there is latent value the market has yet to recognize, perhaps due to caution over regulatory shifts or inconsistent profitability. Still, the numbers indicate the stock is currently undervalued versus competitors on this basis.

Result: Fair Value of $10.25 (UNDERVALUED)

See our latest analysis for Federal National Mortgage Association.However, continued regulatory unpredictability or slower-than-expected revenue growth could quickly alter FNMA's outlook and negatively impact its perceived undervaluation.

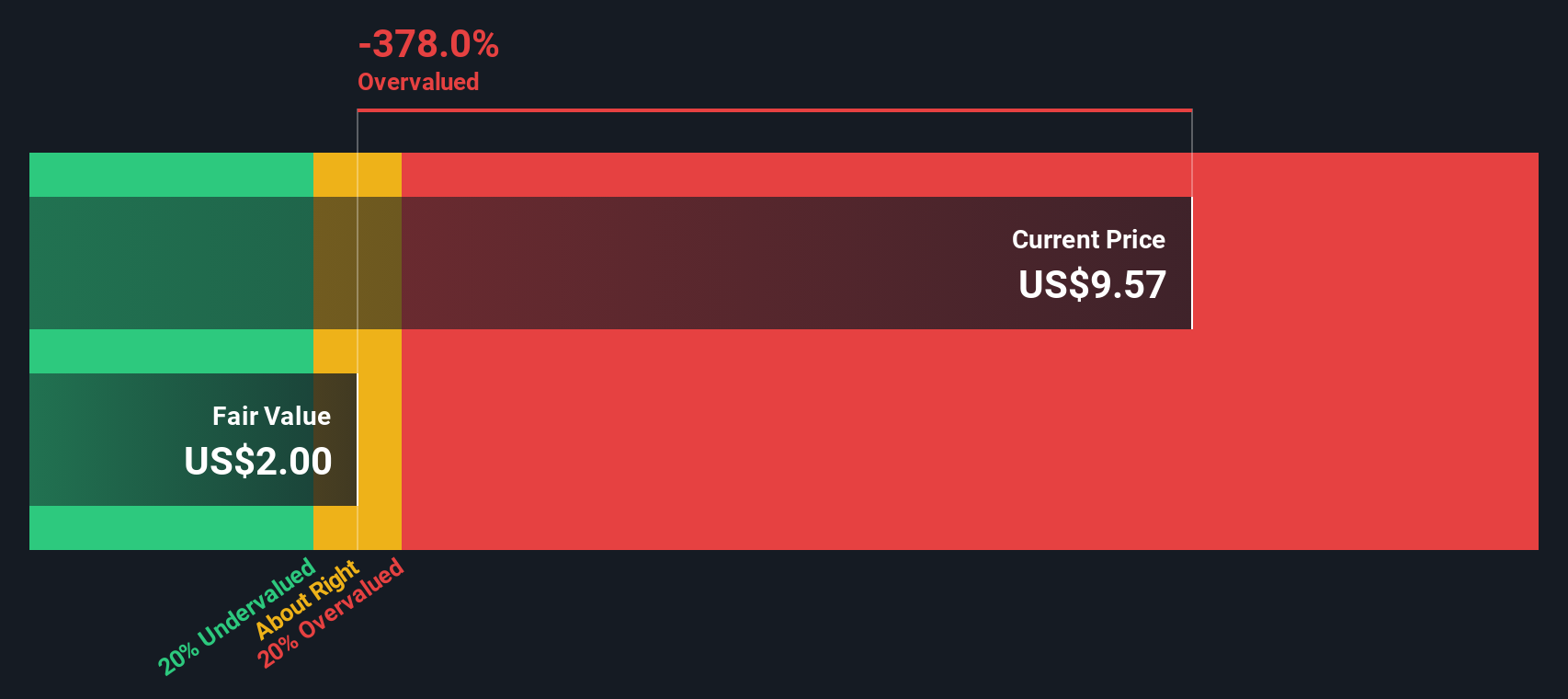

Find out about the key risks to this Federal National Mortgage Association narrative.Another View: The DCF Model Lens

While the multiples approach points to value, our DCF model tells a different story. There is insufficient data available to confidently determine if FNMA is truly undervalued. Does the numbers-based view capture the whole picture, or does something vital go unseen?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Federal National Mortgage Association Narrative

If you have your own interpretation of FNMA’s story or want to dig deeper into the data, you can explore the numbers and build a fresh narrative in just a few minutes. Do it your way.

A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to level up your portfolio? The next breakthrough stock could be just a click away. Don’t miss the chance to find unique and promising investments that others might overlook.

- Spot opportunities for reliable passive income when you scan the latest dividend stocks with yields > 3% to see which companies are paying out yields above 3%.

- Capitalize on the AI revolution by targeting the most promising AI penny stocks that are working on tomorrow’s intelligent technology solutions.

- Seize value stocks that others are missing by searching through our collection of the most attractively priced shares undervalued stocks based on cash flows based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.