Please use a PC Browser to access Register-Tadawul

Fluence Energy (FLNC) Valuation Check After Earnings Jump Revenue Guidance And Backlog Update

Fluence Energy, Inc. Class A FLNC | 16.55 | -0.06% |

Fluence Energy (FLNC) is in focus after first quarter earnings showed revenue of US$475.23 million compared with US$186.79 million a year earlier, alongside a wider net loss and reaffirmed full year revenue guidance.

The latest earnings release and reaffirmed guidance arrived after a volatile stretch for the stock, with a 7 day share price return of a 36.82% decline and a year to date share price return of a 15.52% decline. At the same time, the 1 year total shareholder return of 55.15% remains positive, suggesting recent momentum has faded despite earlier gains.

If you are looking beyond a single energy storage name, this could be a good moment to see how other grid and storage enablers are trading through our 24 power grid technology and infrastructure stocks.

With revenue guidance reaffirmed and a US$5.5b backlog on one side, and widening losses plus recent share price weakness on the other, is Fluence Energy now trading below its potential or are markets already pricing in its future growth?

Most Popular Narrative: 13.5% Overvalued

Fluence Energy's most followed narrative points to a fair value of about $17.13, which sits below the last close of $19.44 and frames a premium price.

The growing backlog exceeding $4.9 billion, expanding international pipeline, and initial traction for next-generation products (e.g., Smartstack) set the stage for an eventual rebound in order volumes, margin expansion from operational efficiencies, and a path back to positive free cash flow as uncertainty recedes and the storage market resumes robust growth.

Curious what kind of revenue ramp, margin lift, and future earnings multiple need to line up to support that fair value? The full narrative lays out a detailed glide path, from top line expansion through to profitability, that goes far beyond a simple backlog headline.

Result: Fair Value of $17.13 (OVERVALUED)

However, the story could change quickly if tariff uncertainty lingers or large projects are delayed again, which would stretch backlog conversion and put extra pressure on margins.

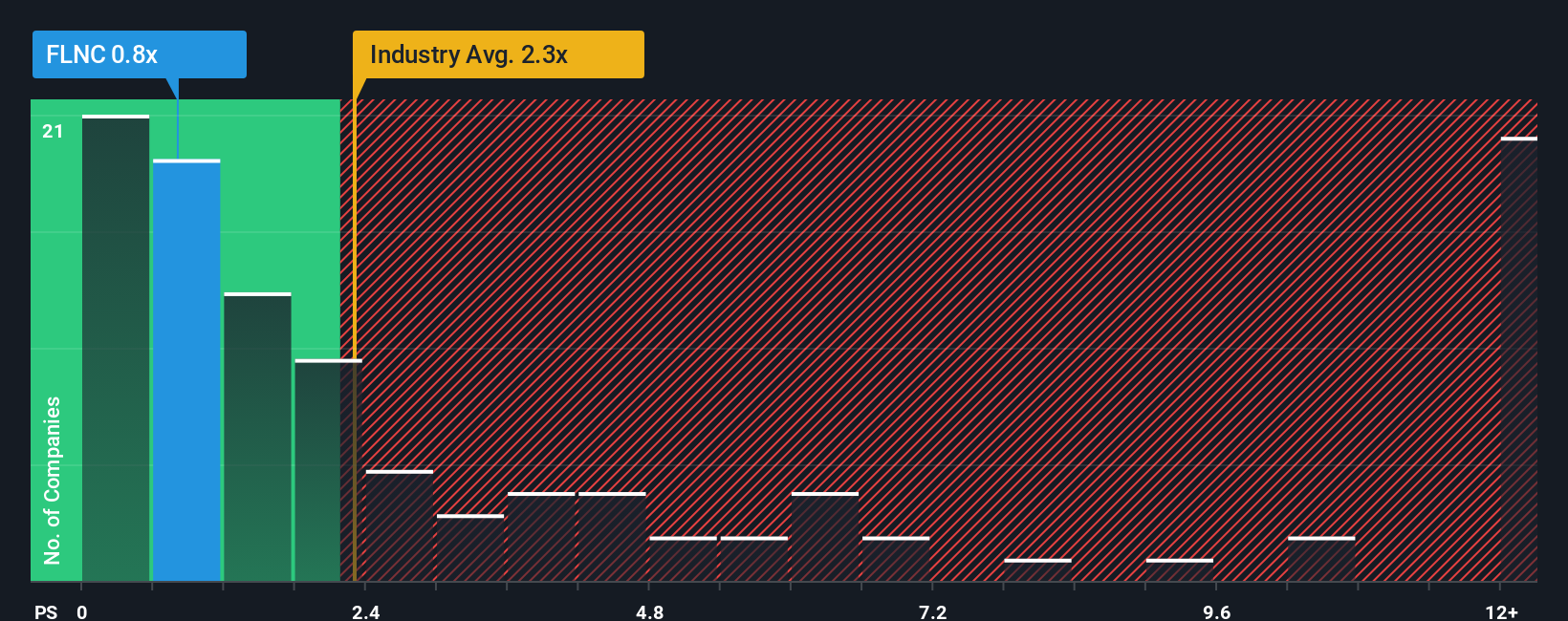

Another View: Price To Sales Paints A Cheaper Picture

The narrative fair value of $17.13 suggests Fluence Energy looks 13.5% overvalued at $19.44, yet its P/S ratio of about 1x screens as low compared with the US Electrical industry at 2.5x and peers at 2.9x, and even further below a 2.6x fair ratio. If sentiment or fundamentals shift, the market could move closer to that fair ratio instead.

Build Your Own Fluence Energy Narrative

If you see the data differently or prefer to test your own assumptions, you can build a custom Fluence thesis in just a few minutes, starting with Do it your way.

A great starting point for your Fluence Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Fluence has caught your attention, do not stop here. Some of the most interesting opportunities often sit just outside your current watchlist.

- Target value potential with our screener highlighting 53 high quality undervalued stocks that may offer attractive fundamentals at prices that still look reasonable.

- Prioritise resilience by checking out 86 resilient stocks with low risk scores, focusing on companies that score well on stability and risk controls.

- Spot early opportunities by scanning our screener containing 24 high quality undiscovered gems before they appear on everyone else's radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.