Forget Forecasts, Watch Options When Trading Stocks! Intel Signals ±8.71% Potential Move and Strategies

Intel Corporation INTC | 0.00 | |

PHLX Sox Semiconductor Sector Ishares SOXX | 0.00 | |

PowerShares QQQ Trust,Series 1 QQQ | 0.00 | |

ETF-S&P 500 SPY | 0.00 | |

ETF-Dow Jones Industrial Average DIA | 0.00 |

Hey Traders!

Intel Corporation(INTC.US) is reporting earnings soon, and everyone's watching (after-market on April 24). Forget the complex stuff for a minute. Let's look at what the options market is signaling – this can give valuable clues for trading the stock itself. Of course, if you do trade options, we've got the specific ideas too.

Key Signals from Options Data (For Stock Traders):

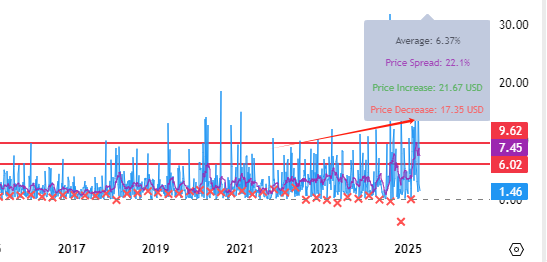

- Big Move Expected: The options market predicts Intel stock could swing ±8.71% after earnings. That's bigger than its average post-earnings move of 6.37%. Signal: Expect higher-than-usual volatility. Brace for a potentially sharp move, up or down.

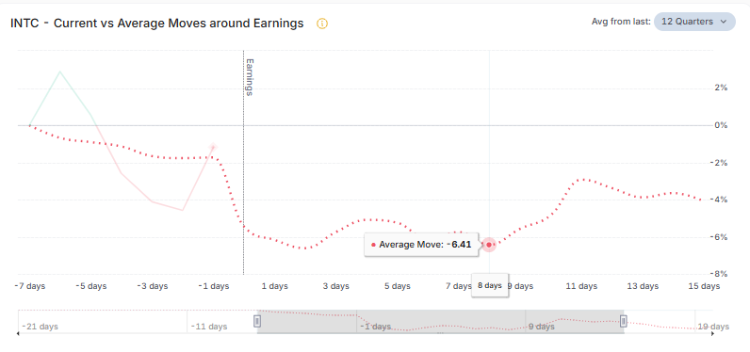

- History Hints Downwards: Looking back at the last 12 earnings reports, INTC stock has dropped more often than it has risen afterward. Signal: While history isn't guaranteed, there's a past tendency for the stock to fall after the earnings news.

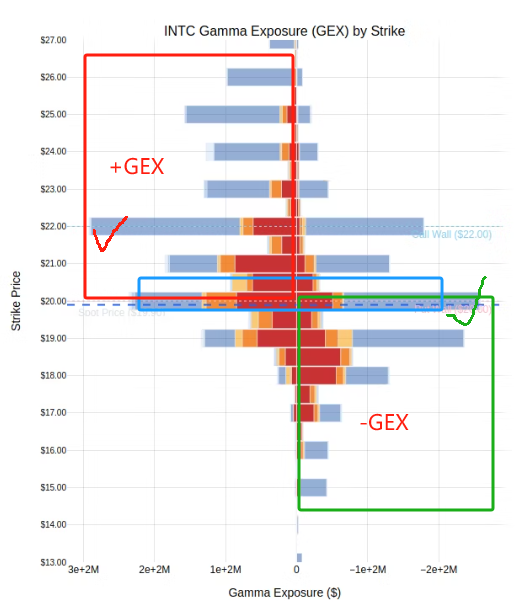

- Watch the $20 Level: Options data (specifically GEX - Gamma Exposure) highlights $20 as a critical level. If INTC drops below $20, things could get shaky and volatility might increase (market makers might amplify selling). Above $21, the market might find more stability. Signal: Keep a close eye on the $20 mark as potential support; a break below could signal further weakness for the stock.

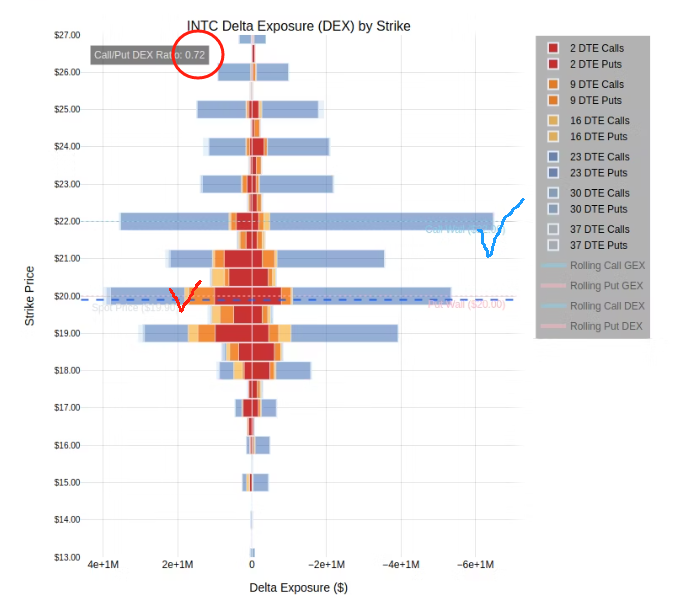

- Market Makers Leaning Slightly Bearish: Another indicator (DEX - Delta Exposure) suggests that big market players are positioned slightly bearishly, especially if the stock price stays below the $22 level. Signal: This adds a bit more weight to the cautious outlook, particularly if INTC struggles to climb above $22.

What's the Background? (Why this matters)

This earnings report is crucial for Intel's New CEO, Lip-Bu Tan. Everyone wants to see if his turnaround plan is working. The past results (likely showing falling revenue and bigger losses) aren't the main focus; it's all about what the CEO says about the future.

For Option Traders: Specific Strategy Ideas

Okay, if you are comfortable with options, here are the specific strategies for reference:

- Strategy 1: Betting on a HUGE Move (Aggressive)

- Idea: If you believe the move will be much larger than the expected ±8.71%, in either direction.

- Play: Buy the $20 Call AND Buy the $20 Put (Expiration: April 25th).

- Goal: Aims for potential profit starting from 25%+ if a massive price swing occurs. Typically closed shortly after market open post-earnings (e.g., 15 mins in) to capture the move.

- Strategy 2: Betting on the Downward "Habit" (Bearish)

- Idea: Aligns with the historical downward trend and the slightly bearish DEX data.

- Play: Sell the $20.5 Call AND Buy the $21 Call (Expiration: May 2nd, 2025).

- Goal: Profits if INTC stays below $20.65 by expiry. Potential return approx. 30% on margin used (around $50) in about 8 days.

- Strategy 3: Betting the Market is Overreacting (Conservative)

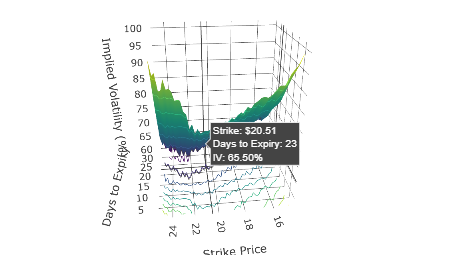

- Idea: Based on the observation that short-term volatility (Implied Volatility - IV) seems unusually high ("overpriced") compared to history and longer-term options. Assumes the actual move might be less dramatic than feared.

- Play: Sell the $20.5 Call AND Sell the $19.5 Put (Expiration: May 2nd, 2025).

- Goal: Profits if INTC price stays between $19.50 and $20.50 by expiry. Potential return approx. 20% over ~10 days.

Bottom Line:

For stock traders, the options market is flashing signals: expect a potentially large move (±8.71%), watch the crucial $20 level, and be aware of the historical tendency for INTC to dip post-earnings. Use this data to inform your stock trading plan.

For options traders, the strategies above offer specific ways to play potential outcomes based on volatility expectations and directional bias.

Remember: Trading involves risk. This is analysis, not financial advice. Do your own research before making any trades. Good luck!

Explainer: GEX helps us understand how market makers (the big players who provide liquidity) might influence stock price stability based on options positions. Think of it like this:

- Positive GEX Zone ("The Stabilizer"):

- What it means: In this zone, market makers often act against the current trend to stay balanced. If people are selling heavily, they tend to buy. If people are buying heavily, they tend to sell.

- Effect on Stock: This acts like a brake or cushion, often leading to lower volatility. The stock price tends to move more smoothly, making it a potentially more comfortable zone for those holding shares (long positions).

- Negative GEX Zone ("The Accelerator"):

- What it means: Here, market makers often have to trade with the current trend to manage their risk. If people sell, they might need to sell too. If people buy, they might need to buy too.

- Effect on Stock: This can amplify moves, leading to higher volatility. It's like stepping on the gas. Sharp moves, especially sudden drops ("air pockets"), are more likely in this zone. It can feel choppy and less stable for stockholders.

- The "In-Between" Zone (Transition / HVL / Key Levels):

- What it means: This is the area where the market shifts between Positive and Negative GEX. Often, a specific price level with lots of options interest (like a "Put Wall" or "Call Wall") acts as this tipping point.

- Effect on Stock: These levels are critical to watch. Crossing them can significantly change the stock's behavior, moving it from a stable phase to a volatile one, or vice-versa.

Recommend

- Sahm Platform 11/11 06:00

US Market Preview | MSPR Surges 78.5% Pre-Market; SoftBank Sells All NVDA Stakes; BBAI, RKLB Jump Post-Earnings, CRWV, BYND Dive

Sahm Platform 11/11 13:35Zohran Mamdani Says No More Thanking Veterans Today, Forgetting Tomorrow — Trump, Obama And Others Express Gratitude For Service

Benzinga News 12/11 02:25Eric Schmidt Says Free Chinese AI Models Could Overtake Western Systems In Global Use

Benzinga News 12/11 10:28Is Now the Right Moment to Reassess Intel’s Value After 87% Share Price Surge?

Simply Wall St Today 03:32ACS, BlackRock to seal $27 billion data centre deal, report says

Reuters Today 08:00Key AI Chip Supplier ASML Deepens Ties With Samsung and SK hynix in South Korea

Benzinga News Today 15:0910 Information Technology Stocks With Whale Alerts In Today's Session

Benzinga News Today 17:35