Please use a PC Browser to access Register-Tadawul

“Four Strong, Three Weak”! Are the US Stock “Magnificent Seven” Diverging?

NVIDIA Corporation NVDA | 175.02 | -3.27% |

Meta Platforms META | 644.23 | -1.30% |

Microsoft Corporation MSFT | 478.53 | -1.02% |

Amazon.com, Inc. AMZN | 226.19 | -1.78% |

Tesla Motors, Inc. TSLA | 458.96 | +2.70% |

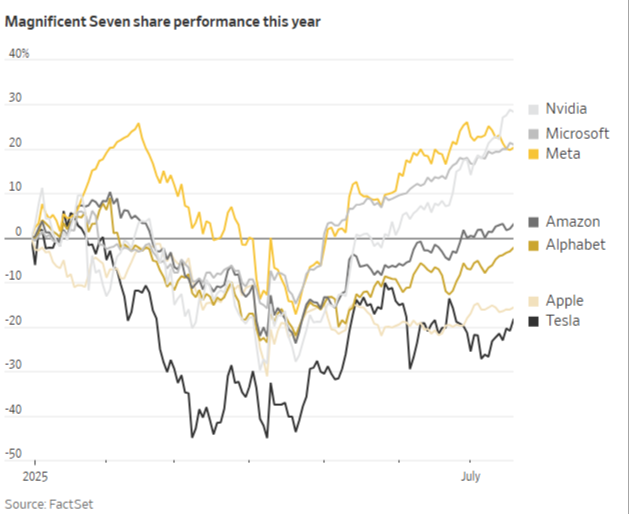

① Based on year-to-date performance trends, the “Magnificent Seven” can be easily divided into two camps: “Four Strong, Three Weak”;

② Nvidia (NVIDIA Corporation(NVDA.US)), Meta (Meta Platforms(META.US)), and Microsoft (Microsoft Corporation(MSFT.US)) have each gained about 20% or more this year, while Amazon (Amazon.com, Inc.(AMZN.US)) at least remains in positive territory;

③ On the other hand, Tesla (Tesla Motors, Inc.(TSLA.US)), Apple (Apple Inc.(AAPL.US)), and Alphabet (Alphabet Inc. Class C(GOOG.US)) have fallen by 18% to 2%, respectively.

Many US stock investors have undoubtedly noticed this year: the performance of the tech “Magnificent Seven” is beginning to diverge...

While not yet a complete polarization between strength and weakness, some tech giants are indeed leading further ahead under the AI wave, while others have stumbled year-to-date. This has sparked heated debate among industry insiders about whether they should still be grouped together as an investment portfolio label.

In recent years, Amazon, Alphabet (Google's parent company), Apple, Meta, Microsoft, Nvidia, and Tesla have undoubtedly dominated the US stock market, as these tech giants play huge roles in the future US economy and hold significant weight in the S&P 500 index (S&P 500 index(SPX.US)).

However, based on year-to-date price movements, it's easy to divide the “Magnificent Seven” into two camps of “Four Strong, Three Weak”:

Nvidia, Meta, and Microsoft have each risen by about 20% or more this year. And despite negative impacts from Trump's tariffs, Amazon still holds gains;

But on the other side, Tesla, Apple, and Alphabet have fallen by 18% to 2%, respectively.

Regarding this divergence within the “Magnificent Seven,” Jamie Cox, Managing Partner at Harris Financial Group, stated, “It was inevitable. They can't march in lockstep forever because they are in different businesses. And now, the separation of winners and losers has arrived.”

Has the Line Been Drawn?

Bank of America (Bank of America Corporation(BAC.US)) strategist Michael Hartnett first coined the term “Magnificent Seven” in 2023. He noted that the primary reason these seven companies were initially grouped under one label was their leadership in advancing the AI field.

Currently, the “Magnificent Seven” still firmly control the market. Their stocks led the tariff war-induced selloff in April and then helped the market recover all the way to new highs. According to Dow Jones Market Data, the “Magnificent Seven” currently account for about 35% of the S&P 500's total market capitalization, and investors don't expect this to change soon.

But Ivana Delevska, Founder and CIO of Spear Invest (Spear Alpha ETF(SPRX.US)) , said, “We are indeed seeing considerable divergence in the fundamentals right now.”

For example, Apple's efforts in AI have consistently failed to attract investors.

Last year, despite the company's grand launch of Apple Intelligence, its development since then has not been smooth, and Siri remains trapped in the rut of "command-based interaction." Apple has stated it will share updates on its AI-powered voice assistant Siri over the next year, meaning it likely won't hit the market until late 2026.

Dan Morgan, Senior Portfolio Manager at Synovus Trust, said he recently reduced his Apple holdings for the first time in years. When a client wanted to make a donation, he also recommended donating Apple stock – advice he wouldn't have given a few years ago.

Other investors have also trimmed Apple positions, shifting towards Nvidia or Microsoft. “Apple is sitting on a park bench eating an apple, watching the AI revolution speed down the highway,” characterized Dan Ives, Managing Director at Wedbush Securities. He is one of Wall Street's most bullish voices on AI.

Besides Apple, the other two in the “Three Weak” camp are also facing tough times. Alphabet faces antitrust scrutiny in the US and Europe, while concerns grow that AI chatbots like ChatGPT will erode Google's dominant search business.

Tesla is faring even worse. A longtime favorite among retail investors, Tesla has led the declines among the “Magnificent Seven” this year. Reasons include a sharp drop in the company's EV sales and CEO Elon Musk's continued political involvement, even as Musk pushes to transform Tesla from an EV maker into a robotics and AI company. Musk recently stated Tesla shareholders will vote on whether to invest in his other company, xAI.

Will Divergence Lead to Reunion?

Ives used a metaphor: “Within the Magnificent Seven, there’s a ‘cool kids table.’ And Apple, Tesla, and Alphabet are at the ‘bad kids table’ by the kitchen, longing to sit at the ‘cool kids table.’”

In fact, the stronger end of the “Magnificent Seven” is still enjoying the benefits of optimism.

Chip giant Nvidia remains the clearest winner in the AI race so far. As the world's first company to surpass a $4 trillion market cap, its stock has more than tripled in the past two years, vastly outperforming the other companies in the “Magnificent Seven.”

Investors say Meta and Microsoft are also well-positioned. While Amazon's stock is up only 3% year-to-date, this is mainly due to tariffs and their uncertainty. The company has invested in AI startup Anthropic and still holds unique strengths in AI and robotics.

These tech giants will soon report their latest quarterly results to investors: Alphabet and Tesla report this Wednesday, while Meta, Microsoft, and Apple report next week. Wall Street will undoubtedly scrutinize the Q2 earnings reports to determine if these large tech companies are still making massive investments in AI.

This is important given their high valuations: Six of the seven recently had forward price-to-earnings ratios (based on next year's expected earnings) exceeding 25 times, compared to the S&P 500 average of 22.35 times – Alphabet was the only one below that level.

“The earnings have to be spectacular to drive these stocks significantly higher from current levels,” said Cox of Harris Financial. “I don’t know if that can be done.”

According to a recent Morgan Stanley report, the seven tech giants are expected to see a 14% year-over-year increase in net profit for Q2, far exceeding the 3% decline expected for the other 493 companies in the S&P 500.

Given that all seven have significant AI plans or sufficient capital for acquisitions to catch the trend, some investors believe this divergence among tech giants might be temporary. Ives stated, “The Magnificent Seven could reunite within the next year, but it all depends on how they navigate the AI revolution.”

Previously, another tech giant label, “FAANG” (Meta, Amazon, Apple, Netflix, Alphabet), defined the previous era until it lost its luster in 2023.

It's easy to imagine that if these companies' stock prices continue moving in starkly different directions, it could open the door for a newly named market darling label – and the “Magnificent Seven” might follow FAANG or the “Nifty Fifty” into gradual obscurity.

Some investors may already be speculating about what the next label will be...