Please use a PC Browser to access Register-Tadawul

Fresh Broker Coverage On Samsara (IOT) Sparks A Closer Look At Its Valuation And Growth Expectations

Samsara, Inc. Class A IOT | 26.79 | -0.04% |

Fresh coverage on Samsara (IOT) from several brokerages, highlighting its annual recurring revenue scale and its role in digitizing physical operations, has pushed the stock back into focus for investors assessing AI driven software names.

The latest brokerage coverage arrives after a choppy stretch, with a 1 month share price return of 8.74% decline and a 1 year total shareholder return of 25.56% decline. This contrasts with a very large 3 year total shareholder return and suggests that long term momentum has cooled in the short run as attention shifts to sentiment, technical signals and how much growth risk investors are willing to accept at the current US$34.89 share price.

If Samsara’s recent moves have you thinking about where else AI and software could reshape operations, it might be worth scanning high growth tech and AI stocks as a starting list of ideas.

With the shares at US$34.89, a 1 year total shareholder return of a 25.56% decline, and a very large 3 year gain already in the bag, the key question is whether there is still a buying opportunity or if markets are already pricing in future growth.

Most Popular Narrative: 30.7% Undervalued

On the most followed narrative, Samsara’s fair value sits at about US$50.36 per share versus the current US$34.89 price. This indicates a wide valuation gap driven by future growth and margin assumptions.

Samsara is experiencing strong growth in annual recurring revenue (ARR), evidenced by a 32% year over year increase. This growth is primarily driven by their success in landing large enterprise customers, indicating future revenue expansion opportunities with existing clients. Impact: Revenue growth.

Want to see what kind of revenue climb, margin shift, and premium P/E multiple are reflected in that fair value? The narrative leans on rich earnings assumptions, aggressive recurring revenue growth and a long runway for connected fleet adoption. Curious which numbers have to align to support a price target far above today’s level?

Result: Fair Value of $50.36 (UNDERVALUED)

However, there are real pressure points here, including long enterprise sales cycles and uncertainty around how quickly Samsara’s early stage AI products actually translate into ARR.

Another View: Price Tag Looks Full

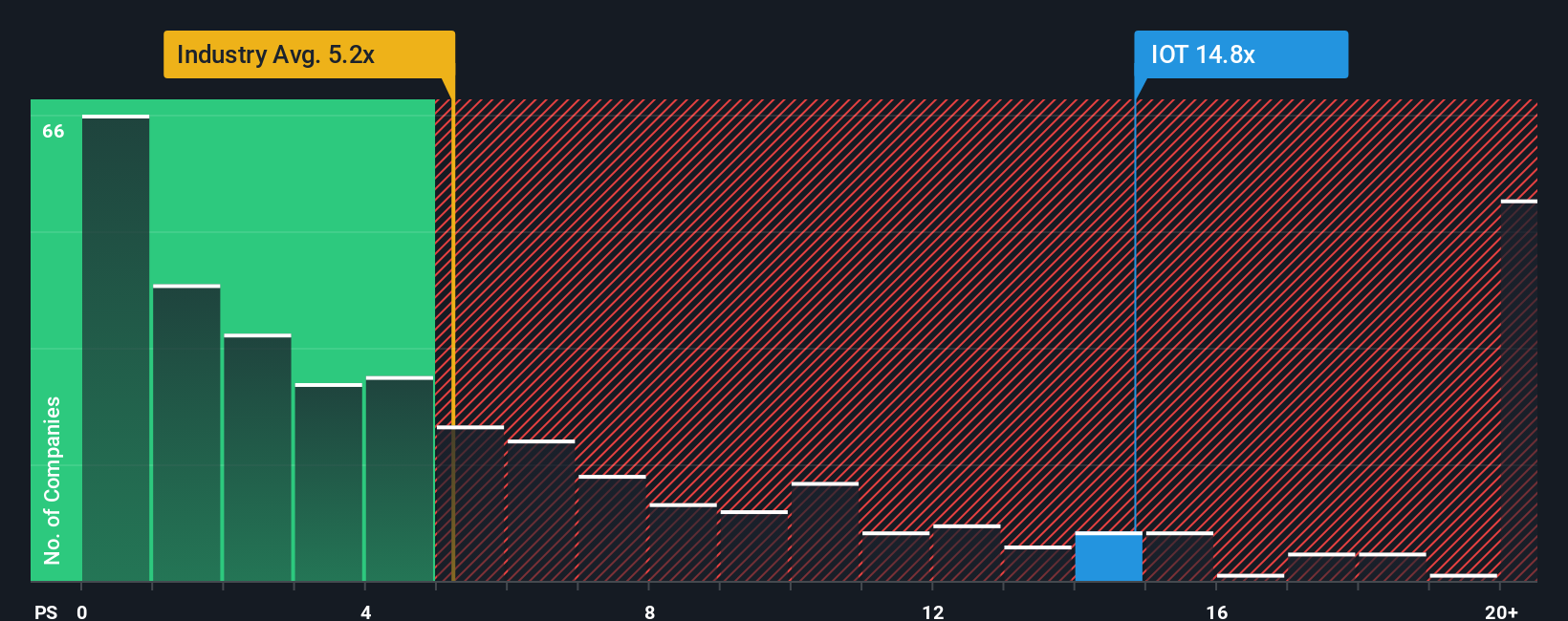

That 30.7% undervaluation story sits alongside a very different message from the current P/S ratio. Samsara trades at about 13.2x sales, compared with 4.7x for the US Software industry, 7.2x for peers, and a fair ratio of 10x. That rich gap suggests less room for error if growth or margins fall short. Where do you land between the growth story and the premium price tag?

Build Your Own Samsara Narrative

If this view does not quite match your own, or you would rather weigh the numbers yourself, you can shape a custom thesis in minutes with Do it your way.

A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Samsara has sparked your interest, do not stop here. Use the Simply Wall St Screener to spot other ideas that might fit your style before they move.

- Capture potential value by scanning these 863 undervalued stocks based on cash flows that currently trade below what their cash flows may imply.

- Ride emerging tech themes by reviewing these 24 AI penny stocks that tie artificial intelligence to real world revenue models.

- Strengthen your income watchlist by checking out these 12 dividend stocks with yields > 3% that offer yields above 3% with supporting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.