Please use a PC Browser to access Register-Tadawul

Further Upside For Carnival Corporation & plc (NYSE:CCL) Shares Could Introduce Price Risks After 28% Bounce

Carnival Corporation CCL | 28.20 28.35 | -1.40% +0.53% Pre |

Carnival Corporation & plc (NYSE:CCL) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 57%.

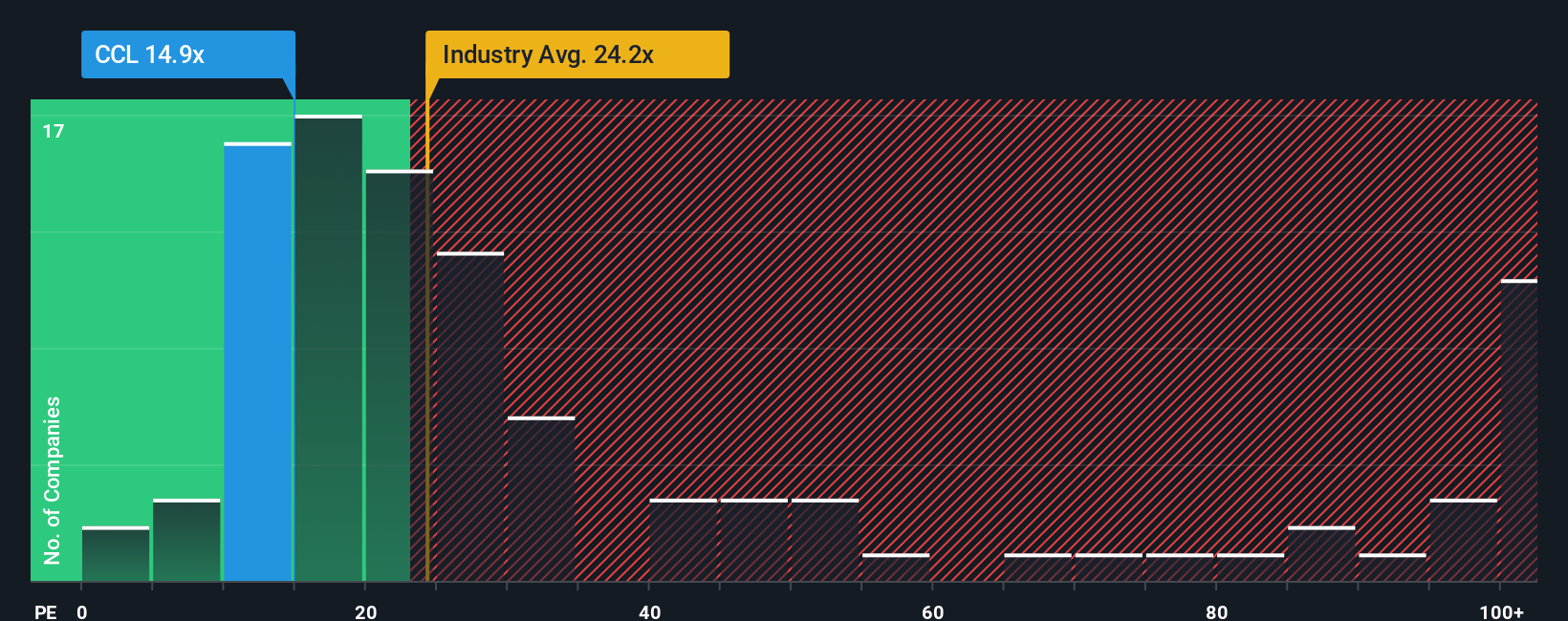

Even after such a large jump in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Carnival Corporation & as an attractive investment with its 14.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Carnival Corporation & as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Carnival Corporation &'s is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 173%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 11% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 10% per annum, which is not materially different.

With this information, we find it odd that Carnival Corporation & is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Carnival Corporation &'s P/E

The latest share price surge wasn't enough to lift Carnival Corporation &'s P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Carnival Corporation & currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

If you're unsure about the strength of Carnival Corporation &'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.