Please use a PC Browser to access Register-Tadawul

Further Upside For TELA Bio, Inc. (NASDAQ:TELA) Shares Could Introduce Price Risks After 32% Bounce

TELA Bio TELA | 1.18 | +4.42% |

Despite an already strong run, TELA Bio, Inc. (NASDAQ:TELA) shares have been powering on, with a gain of 32% in the last thirty days. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 56% share price drop in the last twelve months.

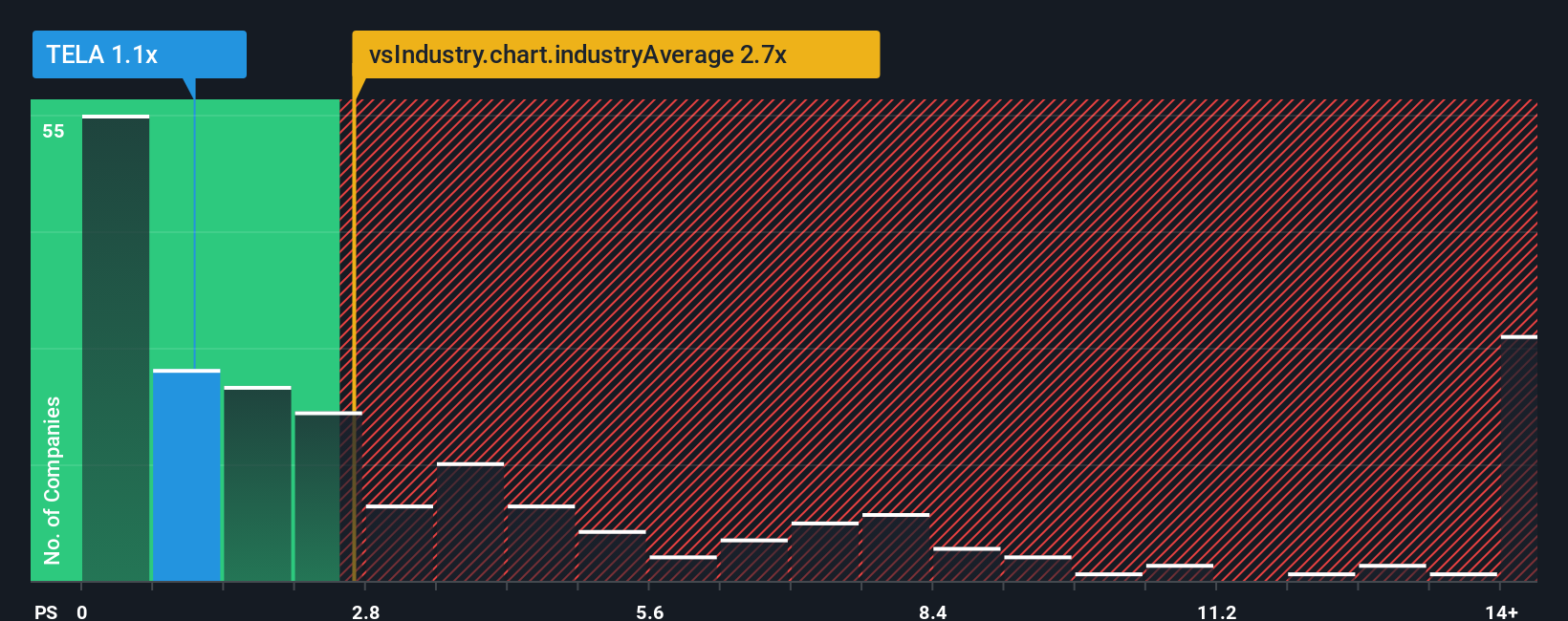

In spite of the firm bounce in price, TELA Bio's price-to-sales (or "P/S") ratio of 1.1x might still make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 2.7x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does TELA Bio's P/S Mean For Shareholders?

There hasn't been much to differentiate TELA Bio's and the industry's revenue growth lately. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on TELA Bio will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

TELA Bio's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. Pleasingly, revenue has also lifted 124% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 24% per annum as estimated by the five analysts watching the company. With the industry only predicted to deliver 10% per year, the company is positioned for a stronger revenue result.

With this information, we find it odd that TELA Bio is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From TELA Bio's P/S?

TELA Bio's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at TELA Bio's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with TELA Bio (at least 1 which is significant), and understanding them should be part of your investment process.

If you're unsure about the strength of TELA Bio's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.