Gartner (NYSE:IT) sheds 7.8% this week, as yearly returns fall more in line with earnings growth

Gartner, Inc. IT | 0.00 |

It might be of some concern to shareholders to see the Gartner, Inc. (NYSE:IT) share price down 11% in the last month. But that doesn't change the fact that shareholders have received really good returns over the last five years. We think most investors would be happy with the 192% return, over that period. We think it's more important to dwell on the long term returns than the short term returns. Only time will tell if there is still too much optimism currently reflected in the share price. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 21% drop, in the last year.

Since the long term performance has been good but there's been a recent pullback of 7.8%, let's check if the fundamentals match the share price.

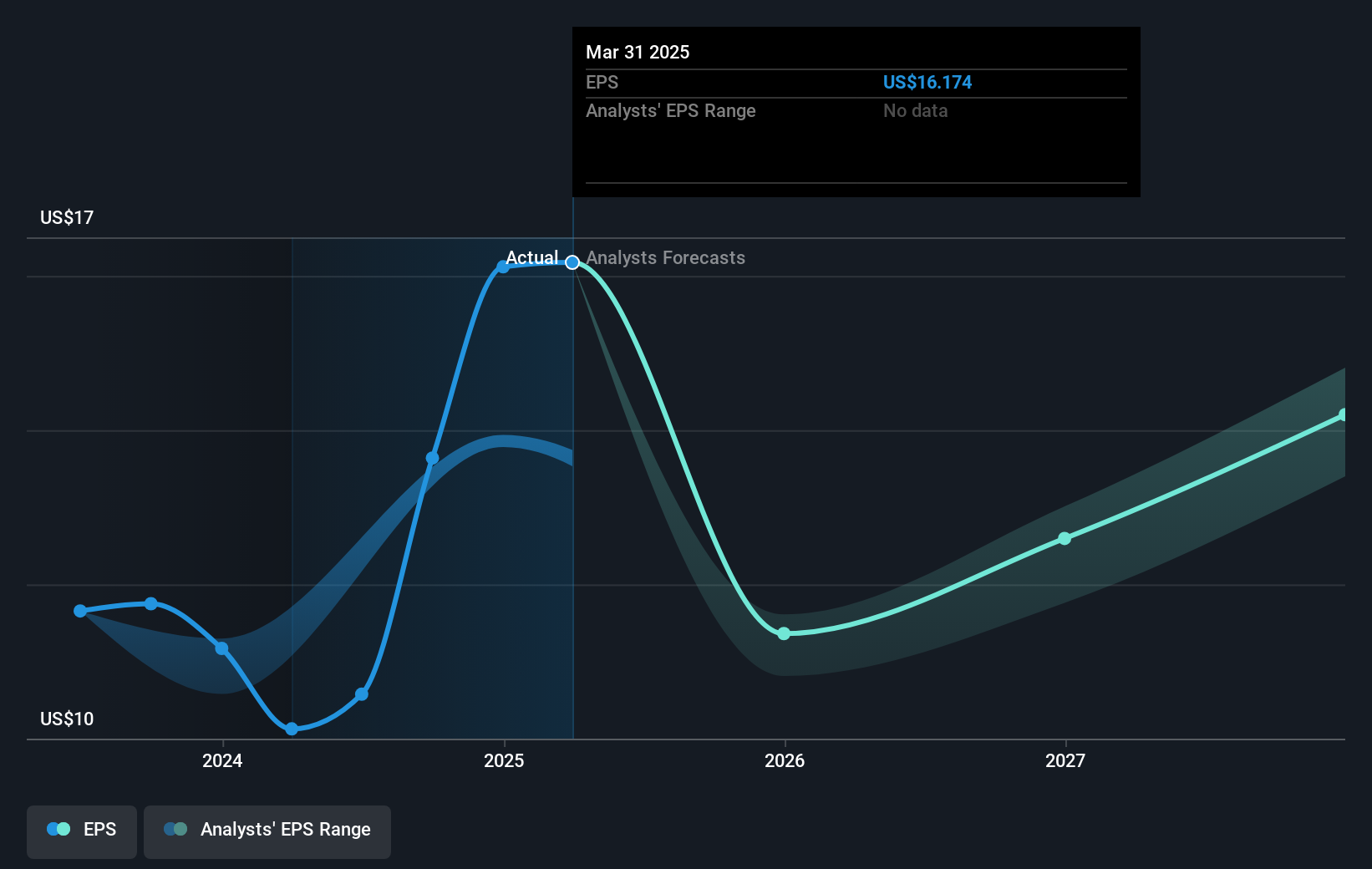

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Gartner achieved compound earnings per share (EPS) growth of 38% per year. The EPS growth is more impressive than the yearly share price gain of 24% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Gartner has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

Investors in Gartner had a tough year, with a total loss of 21%, against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 24% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Gartner better, we need to consider many other factors.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Simply Wall St 07/11 22:29

Benzinga Bulls And Bears: Starbucks, DraftKings, Enovix — And AI Stocks Take A Fall

Benzinga News 08/11 13:01Remitly (RELY): Evaluating Valuation After Strong Results and Mixed Forward Outlook Spark Market Shift

Simply Wall St 08/11 20:38Can ACV Auctions’ (ACVA) Margin Pressures Reshape Its Long-Term Marketplace Strategy?

Simply Wall St 08/11 20:37Gartner (IT): Valuation Insights Following Earnings Beat, Margin Pressures, and Rising AI Competition

Simply Wall St 09/11 12:21Celsius, DoorDash and HubSpot Are Among Top 10 Large Cap Losers Last Week (Nov. 3-Nov. 7): Are the Others in Your Portfolio?

Benzinga News 09/11 13:02How Investors May Respond To FIS (FIS) Q3 Earnings Beat and Launch of Asset Servicing Platform

Simply Wall St 09/11 13:24Assessing SuperX AI Technology (SUPX) Valuation After Launch of New 800VDC AI Data Center Solutions

Simply Wall St 09/11 16:25