Please use a PC Browser to access Register-Tadawul

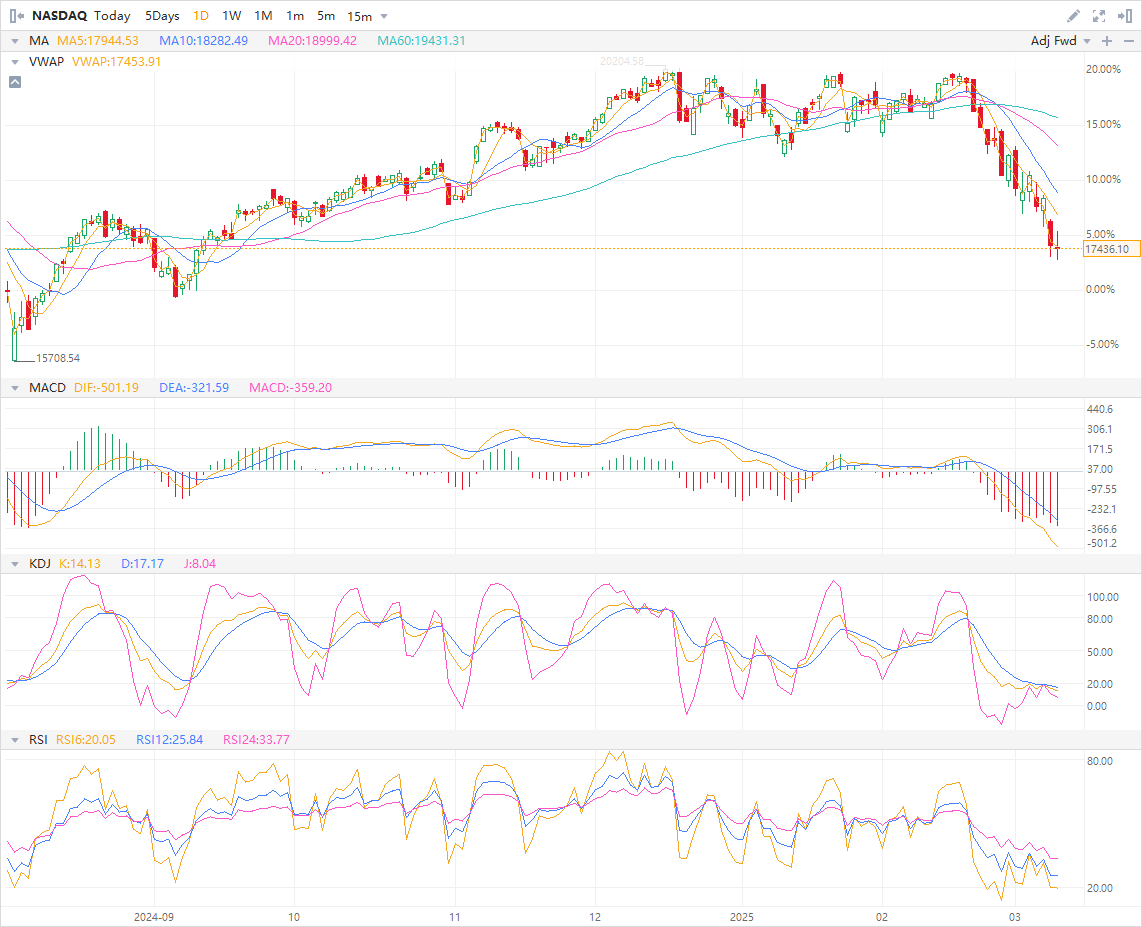

Generating 23.57% Gain With NASDAQ's 7.5% Drop - How Was It Done?

S&P 500 index SPX | 6827.41 | -1.07% |

NASDAQ IXIC | 23195.17 | -1.69% |

Ultrapro Short QQQ Proshares SQQQ | 70.50 | +5.90% |

Direxion Shares Etf Trust Daily S&P 500 Bear 3X Shs (Post R/S) SPXS | 35.83 | +3.35% |

Ultrapro Short DOW 30 Proshares SDOW | 31.47 | +1.61% |

Recent market volatility, driven by concerns over US President Trump's tariff policies and slowing AI growth expectations, has seen the S&P 500 INDEX(SPX.US) and the NASDAQ(IXIC.US) retreat sharply.

However, what comes in as a crisis can also be seen as a golden opportunity from a different direction.

Yes! You know what I mean.

That is to say, a reversed trade during a bear market, would eventually be a bull one.

Recession Fears and Market Sentiment

The question on many investors' minds is whether to buy the dip or remain on the sidelines.

Wall Street firms like Wedbush believe that the market's valuation contraction is nearing an extreme, suggesting that the current period offers a prime opportunity to invest in tech stocks.

Uncertain Tariff Policies: President Trump's unpredictable tariff decisions continue to worry the market. Recently, he reversed a plan to increase tariffs on Canadian steel and aluminum within six hours of the announcement. Such volatility has led to increased recession fears, with JPMorgan raising the probability of a recession this year from 30% to 40%.

Hedge Funds Shift Focus: Hedge funds have begun to withdraw from US tech stocks, redirecting investments to European and emerging markets. EPFR Global data indicates a significant inflow of US$12 billion into European equity funds over four weeks, the highest in a decade, while emerging markets, particularly China, saw a US$2.4 billion inflow.

Strategic ETFs Outpace

Given the current market dynamics, certain tech giants and strategic ETFs present attractive opportunities. Despite the recent downturn, the S&P 500 and Dow Jones maintain dynamic P/E ratios of 21.0 and 19.9, respectively, while the Nasdaq 100 stands at 24.7.

Strategic ETFs:

- Reversed ETFs:

These ETFs are designed for short-term trading and are used by investors who want to profit from or protect against declines in major stock indices.

They don't directly buy or sell the stocks in the indices they track. Instead, they use a combination of financial derivatives, such as futures contracts, options, and swaps, to achieve their investment objectives.

They also use leverage to amplify daily movements, so they can be very volatile and are typically not suitable for long-term investments.- Ultrapro Short QQQ Proshares(SQQQ.US): +23.57% vs -7.49% of NASDAQ(IXIC.US) in March.

- Direxion Shares Etf Trust Daily S&P 500 Bear 3X Shs (Post R/S)(SPXS.US): +21.28% vs -6.42% of S&P 500 INDEX(SPX.US) in March.

- Ultrapro Short DOW 30 Proshares(SDOW.US): +17.76% vs -5.49% of Dow Jones Industrial Average(DJI.US) in March.

- Hedging Strategies:

These ETFs buy stocks from target indices, such as NASDAQ(IXIC.US) or S&P 500 INDEX(SPX.US).

In the meantime, they sell call options on these stock holdings, so they would earn extra income from the option premiums and dividends from the stocks, with less volatility than the indices themselves.- J.P. MORGAN NASDAQ EQUITY PREMIUM INCOME ETF(JEPQ.US): -6.70% vs -7.49% of NASDAQ(IXIC.US) in March.

- JPMORGAN EQUITY PREMIUM INCOME ETF(JEPI.US): -3.95% vs -6.42% of S&P 500 INDEX(SPX.US) in March.

- GLOBAL X FDS RUSSELL 2000 COVERED CALL ETF(RYLD.US): -5.79% vs -6.45% of Dow Jones Industrial Average(DJI.US) in March.

- Low Volatility Strategies:

The aim is to provide more stable returns by focusing on stocks that have historically shown lower price fluctuations.

This can be appealing to investors who want to reduce risk and avoid large swings in their investment value.- iShares MSCI Min Vol USA ETF(USMV.US): -2.88% vs -2.80% of MSCI USA Minimum Volatility Index in March.

- S&P 500 Low Volatility Powershares(SPLV.US): -2.24% vs -6.42% of S&P 500 INDEX(SPX.US) in March.

- PowerShares S&P MidCap Low V(XMLV.US): -2.40% vs -6.42% of S&P 500 INDEX(SPX.US) in March.

While the market faces short-term challenges, the current environment may offer substantial opportunities for strategic investments, particularly in tech stocks and specialized ETFs.

Approach cautiously though.

Low Volatility or Hedging strategies mean less profit but more security.

Leveraged reversed ETFs can help investors gain more, but with less certainty.