Please use a PC Browser to access Register-Tadawul

Generation Bio Co. (NASDAQ:GBIO) Not Doing Enough For Some Investors As Its Shares Slump 29%

Generation Bio GBIO | 0.00 |

Unfortunately for some shareholders, the Generation Bio Co. (NASDAQ:GBIO) share price has dived 29% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 84% loss during that time.

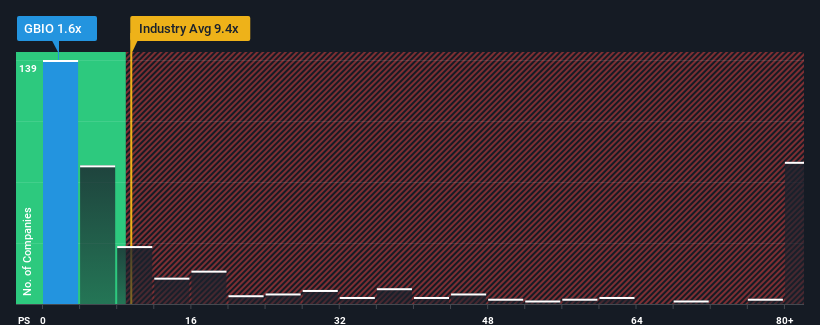

After such a large drop in price, Generation Bio may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.6x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 9.4x and even P/S higher than 55x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Generation Bio's P/S Mean For Shareholders?

Recent times have been advantageous for Generation Bio as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Generation Bio will help you uncover what's on the horizon.How Is Generation Bio's Revenue Growth Trending?

In order to justify its P/S ratio, Generation Bio would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 237% last year. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 20% each year during the coming three years according to the five analysts following the company. That's not great when the rest of the industry is expected to grow by 142% each year.

In light of this, it's understandable that Generation Bio's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Generation Bio's P/S Mean For Investors?

Having almost fallen off a cliff, Generation Bio's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Generation Bio's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Generation Bio's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

If you're unsure about the strength of Generation Bio's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.