Please use a PC Browser to access Register-Tadawul

Getting In Cheap On Mirion Technologies, Inc. (NYSE:MIR) Is Unlikely

Mirion Technologies, Inc. Class A Common Stock MIR | 24.67 | -6.16% |

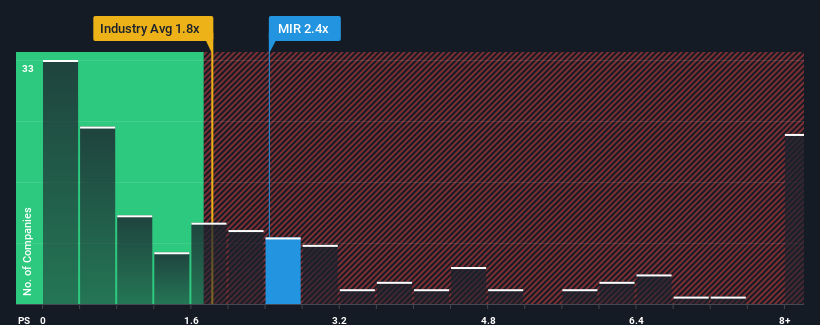

When you see that almost half of the companies in the Electronic industry in the United States have price-to-sales ratios (or "P/S") below 1.8x, Mirion Technologies, Inc. (NYSE:MIR) looks to be giving off some sell signals with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Mirion Technologies

How Has Mirion Technologies Performed Recently?

Recent times have been pleasing for Mirion Technologies as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mirion Technologies.How Is Mirion Technologies' Revenue Growth Trending?

Mirion Technologies' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. This was backed up an excellent period prior to see revenue up by 40% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 5.3% per annum over the next three years. That's shaping up to be materially lower than the 17% per year growth forecast for the broader industry.

With this information, we find it concerning that Mirion Technologies is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that Mirion Technologies currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Mirion Technologies that you should be aware of.

If these risks are making you reconsider your opinion on Mirion Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.