Please use a PC Browser to access Register-Tadawul

Globus Medical (GMED) Valuation Check After Updated Guidance And NuVasive Synergy Outlook

Globus Medical Inc Class A GMED | 90.59 | -0.36% |

Why Globus Medical’s latest guidance matters for shareholders

Globus Medical (GMED) has put fresh numbers on the table, outlining expected sales for late 2025 and a revenue range for 2026 that builds on its integration of NuVasive and recent earnings momentum.

Globus Medical’s guidance has arrived alongside strong momentum in the share price, with a 90 day share price return of 49.08% and a 5 year total shareholder return of 46.66%. Together, these figures point to building enthusiasm around its growth and NuVasive integration story.

If this update has you rethinking the sector, it could be a good moment to see what else is happening across healthcare stocks and compare how other medical names are shaping up.

With the shares up 49.08% over 90 days and trading at a roughly 19% intrinsic discount, is Globus Medical still mispriced, or is the market already factoring in the NuVasive synergies and potential growth story?

Price-to-Earnings of 29.4x: Is it justified?

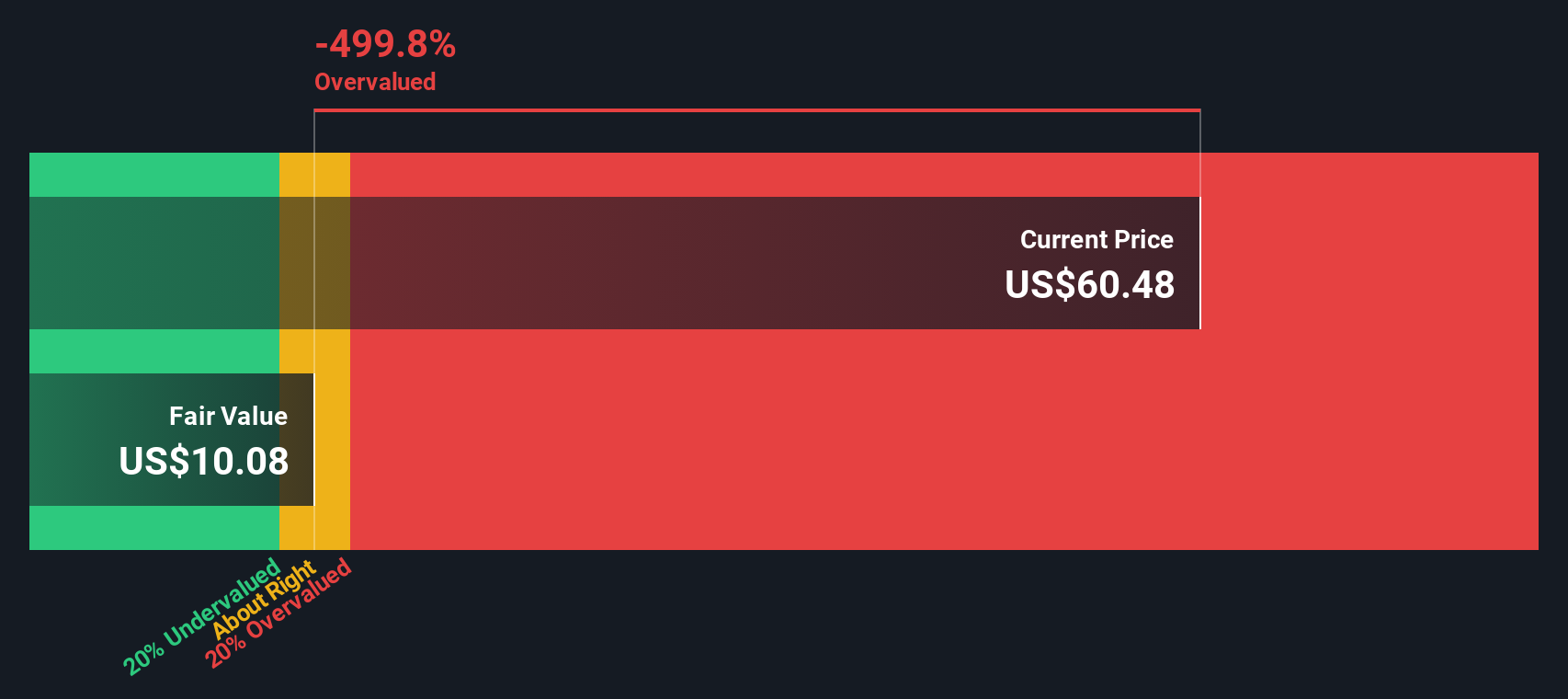

Globus Medical is trading on a P/E of 29.4x, yet our DCF estimate of fair value at US$114.55 versus the last close of US$92.95 suggests a discount, and the stock also sits below the peer average P/E of 54.3x and the sector average of 31.2x.

The P/E ratio compares the current share price with the company’s earnings per share and is a common way to see how the market values each dollar of profit. For a medical equipment name like Globus Medical, this multiple is often used to reflect expectations around future procedure volumes, product mix and margin profile.

Here, the picture is mixed. On one hand, the shares are described as expensive relative to an estimated fair P/E of 22.1x, which implies the market is paying more than that regression based level for current earnings. On the other hand, the SWS DCF model fair value of US$114.55 and the current 18.9% discount to that estimate point to a share price that is below the cash flow based valuation anchor.

Against peers, the 29.4x P/E sits clearly below the peer average of 54.3x and slightly below the US Medical Equipment industry average of 31.2x. This means the market is valuing Globus Medical’s earnings at a lower multiple than many comparable names, even though the fair ratio work suggests a level closer to 22.1x could be a point the market moves toward over time if earnings expectations cool.

Result: Price-to-Earnings of 29.4x (ABOUT RIGHT)

However, the market’s enthusiasm could be tested if NuVasive integration synergies disappoint or if current P/E multiples compress across the wider medical equipment peer group.

Another way to look at value

While the P/E work paints GMED as roughly fairly priced against peers, our DCF model approaches the question from cash flows instead of earnings multiples and lands on a fair value of US$114.55 per share versus the current US$92.95. This implies the stock trades at an 18.9% discount. Which signal do you trust more when the two are not perfectly aligned?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Globus Medical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Globus Medical Narrative

If you see the numbers differently, or just want to stress test this view against your own work, you can build a custom story in minutes with Do it your way.

A great starting point for your Globus Medical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Globus Medical has sharpened your thinking, do not stop here. The screener can surface other opportunities that might fit your style and portfolio goals.

- Spot potential value candidates early by checking out these 876 undervalued stocks based on cash flows that line up with your preferred valuation metrics and risk tolerance.

- Tap into the growth potential of next wave technology by scanning these 23 AI penny stocks that could reshape how you think about long term themes.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that match your expectations for yield and payout consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.