Please use a PC Browser to access Register-Tadawul

GoDaddy (GDDY) Is Down 8.3% After Softer Recurring Revenue And Margin Pressures - Has The Bull Case Changed?

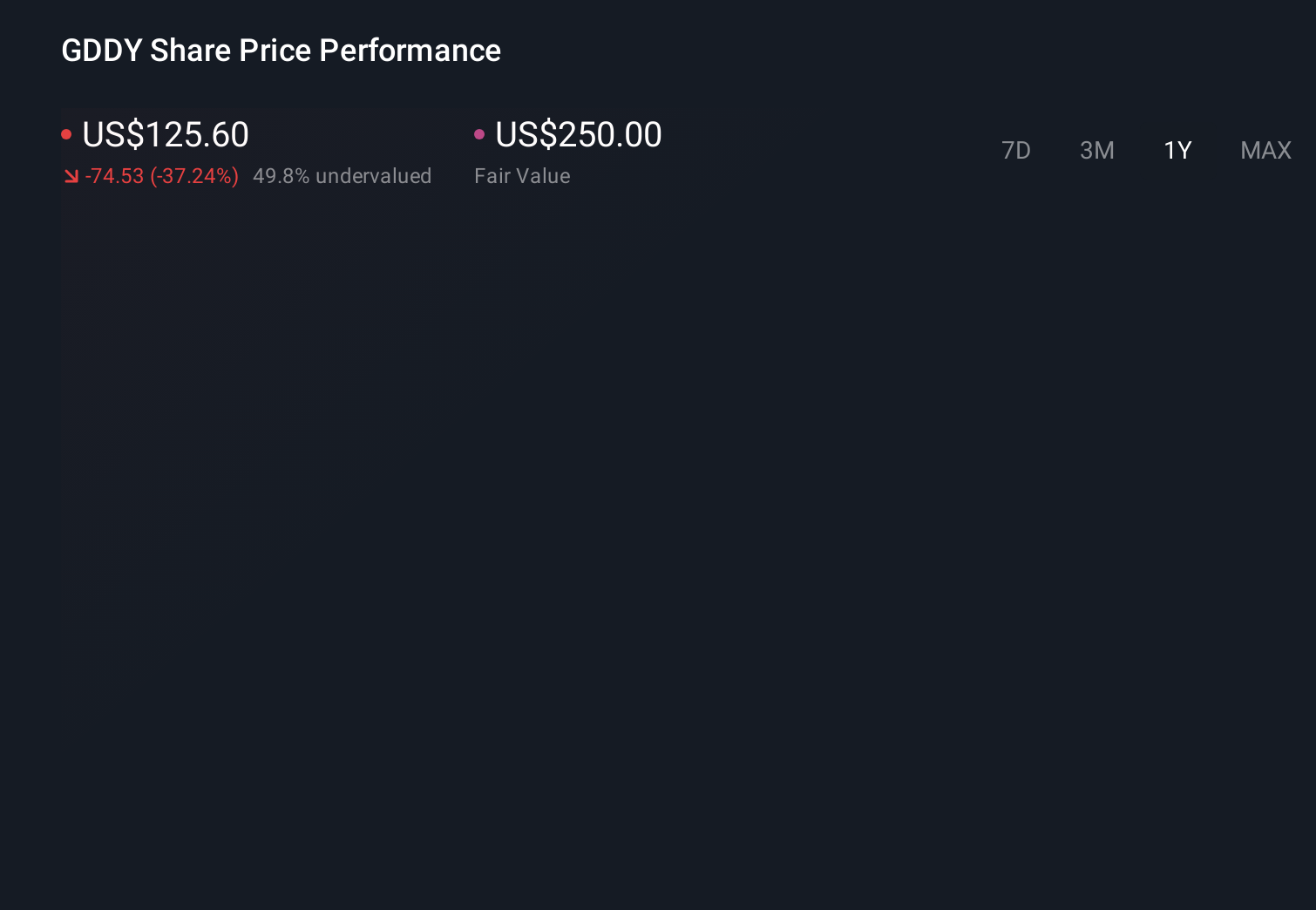

GoDaddy, Inc. Class A GDDY | 90.64 | +2.22% |

- In the days leading up to 15 February 2026, GoDaddy reported softer annual recurring revenue growth and a subdued demand outlook, highlighting challenges in winning and keeping long-term customers while managing high servicing costs and relatively weaker gross margins.

- This combination of slowing recurring revenue momentum and margin pressure has sharpened investor focus on whether GoDaddy’s newer, higher‑value services can offset these operational headwinds.

- We’ll now examine how concerns over slowing annual recurring revenue growth may affect GoDaddy’s broader investment narrative and long-term thesis.

We've uncovered the 12 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

GoDaddy Investment Narrative Recap

To own GoDaddy today, you have to believe its shift from basic domains and hosting toward higher value software and AI‑enabled tools can eventually support healthier, more durable recurring revenue. The latest softness in ARR growth and cautious demand outlook keeps the near term spotlight squarely on whether these newer services can stabilize growth. The biggest immediate risk is that elevated churn and weaker gross margins persist, but this ARR update does not yet appear to fundamentally alter that core debate.

In that context, GoDaddy’s large, ongoing share repurchase program, with up to US$3,000,000,000 authorized through 2027 and roughly 3.3% of shares already bought back by late 2025, is especially relevant. Buybacks can amplify per share metrics if cash generation holds up, but the recent pullback in the stock and softer ARR trends put more attention on whether underlying earnings and margins can support continued capital returns at this pace.

Yet beneath the headline ARR slowdown, a key risk investors should be aware of is how persistent customer churn and pricing pressure could eventually...

GoDaddy's narrative projects $5.9 billion revenue and $1.3 billion earnings by 2028. This requires 7.7% yearly revenue growth and about a $491.5 million earnings increase from $808.5 million today.

Uncover how GoDaddy's forecasts yield a $175.06 fair value, a 96% upside to its current price.

Exploring Other Perspectives

Some of the more pessimistic analysts were already assuming only about 7.3% annual revenue growth and roughly US$1,100,000,000 of earnings by 2028, which frames the recent ARR disappointment quite differently for you than the more optimistic consensus and shows how quickly these narratives might shift.

Explore 3 other fair value estimates on GoDaddy - why the stock might be worth just $175.06!

Build Your Own GoDaddy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoDaddy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free GoDaddy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoDaddy's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- Invest in the nuclear renaissance through our list of 85 elite nuclear energy infrastructure plays powering the global AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.