Please use a PC Browser to access Register-Tadawul

Gold Hits Another High! What Opportunities Are There in the U.S. Stock Market?

AngloGold Ashanti Limited Sponsored ADR AU | 83.53 | -0.93% |

Gold Fields Limited Sponsored ADR GFI | 43.60 | -0.76% |

Kinross Gold Corporation KGC | 27.75 | -1.44% |

Newmont Mining Corporation NEM | 97.90 | -1.80% |

Agnico-Eagle Mines Limited AEM | 167.33 | -0.64% |

This week, spot gold prices continued their strong upward trend, successfully surpassing $3,680 per ounce and setting a new all-time high.

For many market observers, this gold price rally marks a significant milestone—international spot gold prices have surpassed the inflation-adjusted historical peak set in January 1980.

This means that gold, long considered an "anti-inflation" asset, has now truly outpaced 45 years of inflation, achieving a genuine "historic high."

As of September 12, gold has risen over 39% this year against the US dollar, marking the highest increase since 2000, far outpacing the S&P 500's 12% gain.

Why Is Gold Soaring? What Do Major Banks Think?

Multiple adverse factors drive the recent surge in gold prices: the rapid expansion of US debt and deficits, diminished Federal Reserve credibility, ongoing geopolitical tensions, and record gold buying by central banks—especially in emerging markets seeking to reduce reliance on the dollar. Central bank demand alone has provided structural support for gold prices not seen since 1980.

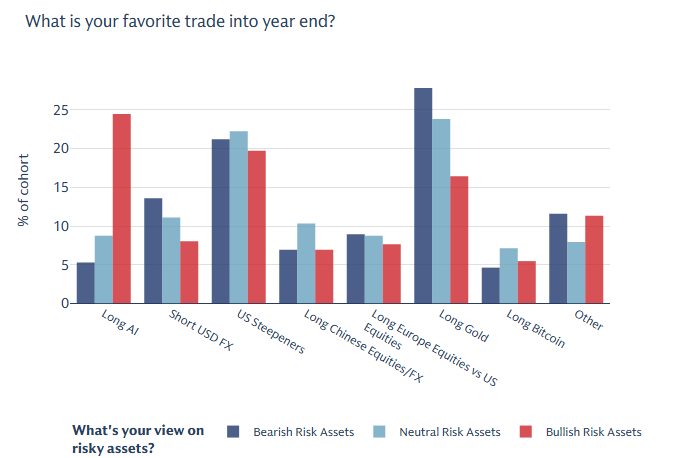

According to a recent Goldman Sachs report, gold has become the most favored long position among investors this month, even surpassing developed market equities. The survey, conducted over five years, indicates that bullish sentiment on gold is at an "all-time high."

Data shows that the ratio of bullish to bearish investors on gold is nearly 8 to 1, highlighting overwhelming market optimism. The report reveals a noteworthy trend: both long and short market participants consider going long on gold as a preferred trade.

Goldman Sachs also warns that if the Federal Reserve's credibility is compromised, even a small shift of investor holdings from US Treasuries to gold could drive prices to nearly $5,000 per ounce.

Goldman maintains its stance on gold as the "highest conviction long recommendation" in the commodities sector. The bank believes that, even under baseline scenarios, gold prices are poised for significant gains over the next two years. Specifically, Goldman has set three different price targets for gold.

- Under the baseline scenario, gold is expected to reach $4,000 per ounce by mid-2026, based on current market conditions and policy trends.

- In a tail-risk scenario, prices could rise to $4,500 per ounce, given additional uncertainties that may impact the market.

- In the most extreme case, if just 1% of privately held US Treasury market funds shift to gold, prices could soar to nearly $5,000 per ounce, assuming other conditions remain constant.

Investment Opportunities in US Stocks

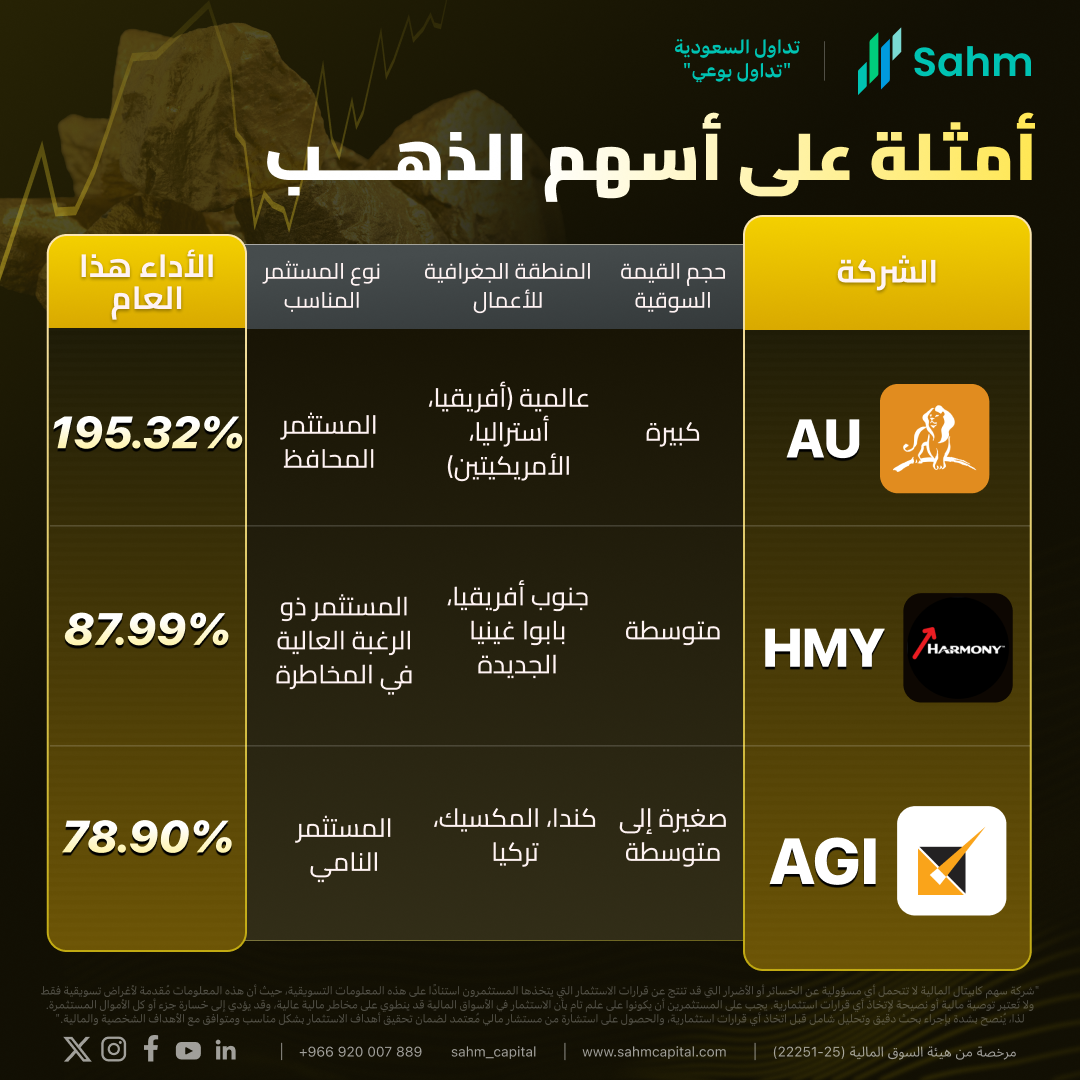

We have identified investment opportunities in US gold stocks and ETFs for investors:

US gold stocks include AngloGold Ashanti Limited Sponsored ADR(AU.US), Gold Fields Limited Sponsored ADR(GFI.US), Kinross Gold Corporation(KGC.US), Newmont Mining Corporation(NEM.US), Agnico-Eagle Mines Limited(AEM.US), Harmony Gold Mining Co. Ltd. Sponsored ADR(HMY.US), Alamos Gold Inc.(AGI.US) and Barrick Mining(B.US), all of which have seen gains between 90% and 180% this year.

US gold ETFs include SPDR Gold(GLD.US), Gold Trust Ishares(IAU.US), and VanEck Vectors Gold Miners ETF(GDX.US). Leveraged options include MicroSectors Gold Miners 3X Leveraged ETN(GDXU.US), Daily Gold Miners Bull 2x Shares(NUGT.US), and Ultra Gold Proshares(UGL.US).