Please use a PC Browser to access Register-Tadawul

Gold's Wild Ride: Bulls See $5,000, Bears Warn of a 30% Crash. Here's How to See the Full Picture

SPDR Gold GLD | 395.44 399.05 | +0.56% +0.91% Pre |

Gold Trust Ishares IAU | 80.99 81.73 | +0.56% +0.91% Pre |

MicroSectors Gold Miners 3X Leveraged ETN GDXU | 243.22 243.22 | -1.70% 0.00% Pre |

Daily Gold Miners Bear 2x Shares DUST | 7.75 7.55 | +1.44% -2.58% Pre |

ETF-S&P 500 SPY | 681.76 685.10 | -1.08% +0.49% Pre |

The gold market has been a battleground this week, marked by a record-breaking surge, its largest single-day selloff in twelve years, and a sharp rebound following today's release of softer-than-expected U.S. inflation data.

As investors struggle to find their footing, Wall Street's top institutions are divided on what comes next, presenting a complex landscape of long-term optimism clashing with stark short-term warnings.

The latest catalyst came Friday, as the U.S. Bureau of Labor Statistics reported that the September headline Consumer Price Index (CPI) rose to 3.0%, below the 3.1% forecast. Core CPI also came in lower than anticipated at 3.0%. The data, the first major economic report since the government shutdown, immediately fueled bets on further Federal Reserve rate cuts. In response, spot gold surged over $20 to reclaim the $4,080 per ounce level, while the U.S. dollar tumbled.

Earlier in the week, on October 21, gold experienced a brutal correction, with intraday losses hitting 6% after a parabolic rise of over 30% since mid-August. This whiplash has left investors asking: Is this a healthy correction in a long-term bull market, or a sign of a deeper downturn to come?

The Bull Case: A "Healthy Correction" on the Path to $5,000

Despite the turbulence, major investment banks are holding their ground, viewing the sell-off as a necessary "breather" in a sustained upward trend.

JPMorgan's Global Commodities Research team has become even more optimistic. In a report on October 22, they called the pullback healthy and reiterated their belief in a "multi-year structural bull market" for gold. Upgrading their forecast, the team now projects an average gold price of $5,055 per ounce by the fourth quarter of 2026.

The bank’s confidence is built on several key pillars:

- Persistent Central Bank Buying: JPMorgan anticipates global central banks will purchase an average of 760 tons annually this year and next. They note that many banks' gold reserves remain below the 10% threshold recommended by the Bank for International Settlements (BIS), suggesting significant room for growth.

- Sustained Investor Inflows: With the Federal Reserve expected to cut rates three more times by early 2026, concerns about inflation and U.S. debt sustainability are projected to drive approximately 360 tons of inflows into gold ETFs.

- Fundamental Support: Strategist Gregory C. Shearer noted that the pullback brought prices back to a key technical support level between $3,944 and $4,000, where "dip buyers" like central banks and consumers are expected to re-emerge.

Goldman Sachs echoes this sentiment, remaining "firmly bullish" and maintaining its $4,900 per ounce target by the end of 2026, a forecast they suggest may even have "upside risk." The firm attributes the sell-off to the unwinding of speculative positions and spillover from the silver market, not a change in fundamentals. They argue the "smart money"—including central banks and ultra-high-net-worth individuals—continues to flow into gold.

The Bear Case: A Warning of a 2006-Style Correction

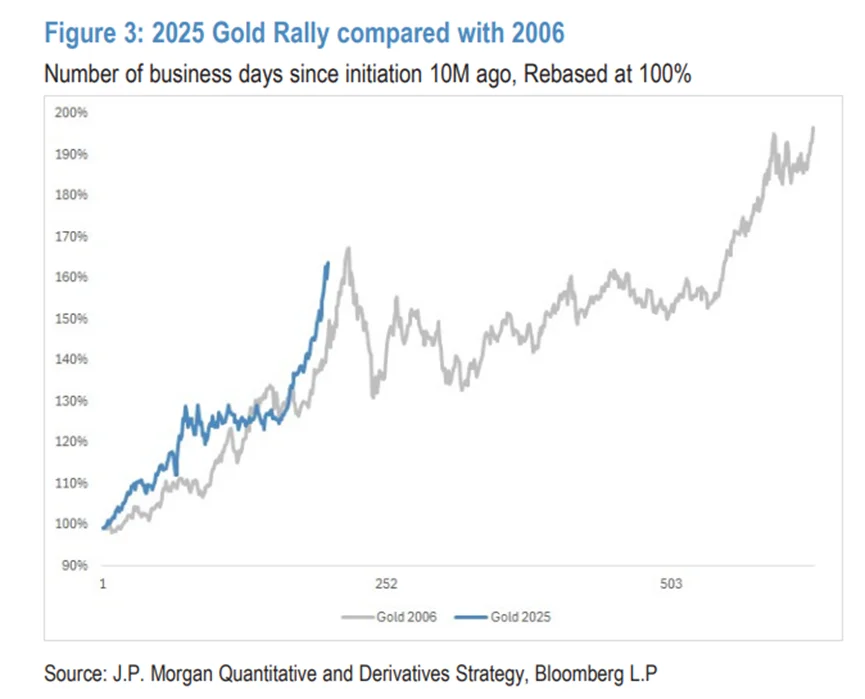

However, a dissenting voice has emerged from within JPMorgan itself. The bank's Quantitative and Derivatives Strategy team has flagged serious short-term risks, drawing a chilling parallel to the market of May 2006, when gold plummeted 30% in just six weeks after a similar meteoric rise.

Led by Yangyang Hou, the quant team points to two alarming signals:

- Extreme Options Market Positioning: In late September and early October, the net short Gamma imbalance in GLD (a major gold ETF) options reached an unprecedented 10 times its historical standard deviation. This was driven by a massive surge in short-term call option purchases, indicating extreme speculative froth and making the market fragile and vulnerable to sharp reversals.

- Overheated Momentum: Current momentum indicators and short-term implied volatility are both at the 100th percentile, signaling that market sentiment is dangerously overheated.

Adding weight to the technical warnings, Guotai Junan Securities noted that gold is transforming from a safe-haven to a high-volatility asset. Their analysis shows that by multiple metrics, gold is "extremely overbought." The price surge of roughly 30% since late August has reached the historical upper limit for short-term rallies, which are typically followed by pullbacks.

The New Drivers: Hedging the AI Bubble

Beyond traditional factors, analysts are pointing to a novel driver for gold's recent rally: its role as a hedge against a potential AI bubble in the U.S. stock market.

Guotai Junan Securities suggests that investors are employing a "barbell" strategy: investing in the future of AI with one hand, while seizing the present certainty of gold with the other. This makes gold a "narrative asset" in its own right—a hedge against chaos and the potential fallout from a tech bubble fueled by debt rather than pure operating cash flow.

This dynamic creates a new relationship to watch:

- If U.S. tech stocks continue their aggressive rally, gold may continue to rise as a hedge.

- Conversely, if the AI-driven stock market begins to correct, gold could lose a key short-term catalyst, with funds potentially rotating into bonds or other dividend-yielding assets.

Key Risks for Investors to Monitor

Even the most bullish outlooks come with clear caveats. JPMorgan's commodities team explicitly highlighted several risks that could challenge the upward trajectory of gold:

- A Sharp Slowdown in Central Bank Purchases: This is identified as the single biggest risk. While central bank buying provides a floor for prices, a significant drop in this relatively price-inelastic demand would test the market's foundation.

- Weak Physical Demand: Soaring prices are already hurting physical gold consumption. Jewelry demand has fallen in terms of weight, and high prices are incentivizing the supply of scrap gold as people recycle old items. This combination could significantly suppress net demand for new jewelry.

Outlook: A Tug-of-War Between Today and Tomorrow

The gold market is currently caught in a tug-of-war between powerful long-term fundamentals and precarious short-term technicals.

The long-term case for gold remains intact, rooted in the erosion of the U.S. dollar's global standing, persistent U.S. fiscal deficits, and geopolitical shifts driving central banks to diversify their reserves. As long as this backdrop of global stagflation and deficit monetization continues, the argument for holding gold remains compelling.

However, the short-term picture is far murkier. Overbought technical indicators and extreme positioning in the derivatives market suggest the rally is exhausted and vulnerable. The latest CPI data has given bulls fresh ammunition by reinforcing expectations of Fed easing, but the warnings from quantitative analysts of a sharp, painful correction cannot be ignored. For investors, the path forward will require balancing a long-term strategic vision with a keen awareness of the immediate, and significant, risks.