Please use a PC Browser to access Register-Tadawul

Green Plains Inc. (NASDAQ:GPRE) Might Not Be As Mispriced As It Looks

Green Plains Inc. GPRE | 14.02 | +3.32% |

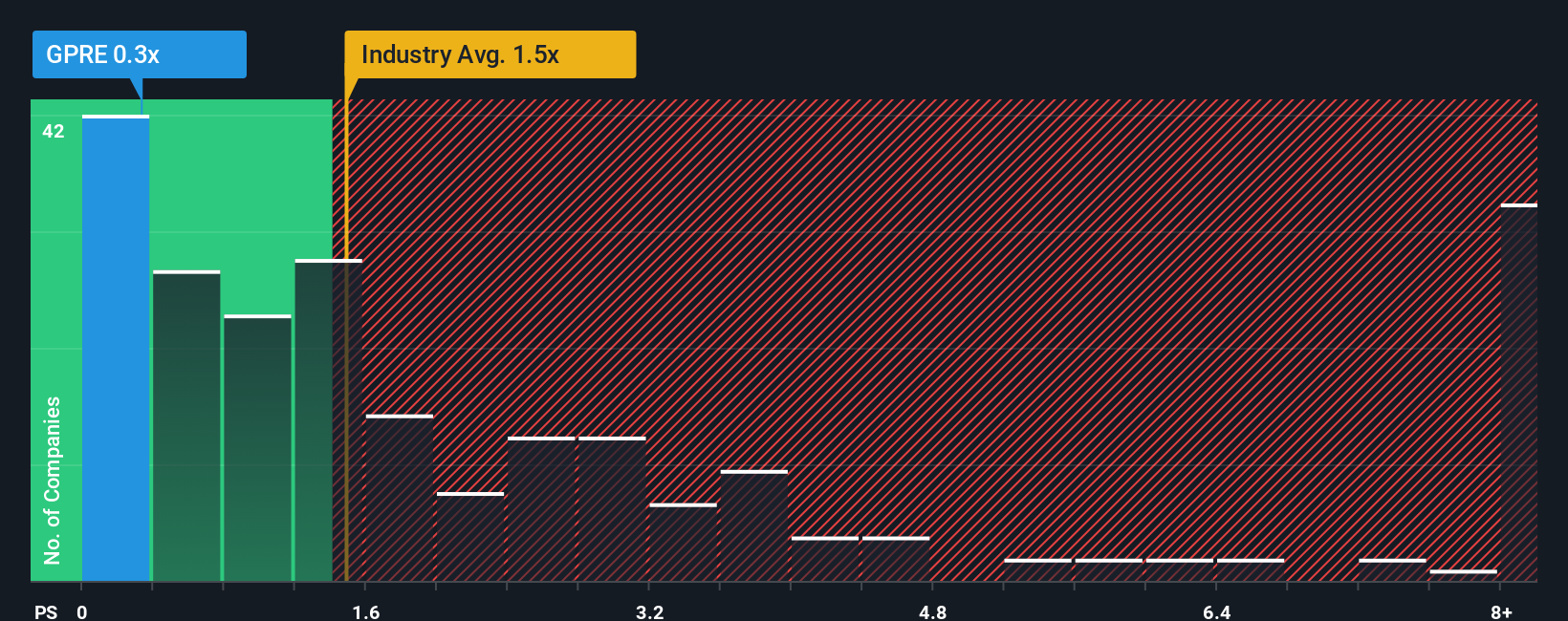

With a price-to-sales (or "P/S") ratio of 0.3x Green Plains Inc. (NASDAQ:GPRE) may be sending bullish signals at the moment, given that almost half of all the Oil and Gas companies in the United States have P/S ratios greater than 1.5x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Green Plains Performed Recently?

While the industry has experienced revenue growth lately, Green Plains' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Green Plains' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Green Plains?

The only time you'd be truly comfortable seeing a P/S as low as Green Plains' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. As a result, revenue from three years ago have also fallen 37% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 15% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially higher than the 4.2% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Green Plains' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Green Plains' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Green Plains with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Green Plains, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.