Please use a PC Browser to access Register-Tadawul

Haoxi Health Technology Limited (NASDAQ:HAO) Might Not Be As Mispriced As It Looks After Plunging 48%

Haoxi Health Technology Ltd. HAO | 1.60 1.60 | +6.67% 0.00% Pre |

The Haoxi Health Technology Limited (NASDAQ:HAO) share price has fared very poorly over the last month, falling by a substantial 48%. For any long-term shareholders, the last month ends a year to forget by locking in a 99% share price decline.

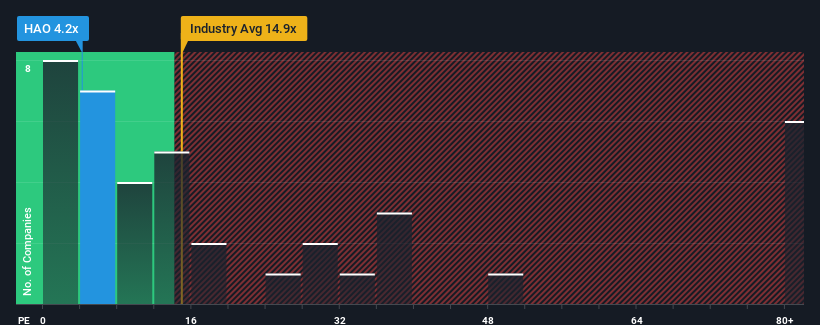

Following the heavy fall in price, Haoxi Health Technology may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.2x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Haoxi Health Technology has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is Haoxi Health Technology's Growth Trending?

In order to justify its P/E ratio, Haoxi Health Technology would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 20% last year. The latest three year period has also seen an excellent 51% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 14% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it odd that Haoxi Health Technology is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Shares in Haoxi Health Technology have plummeted and its P/E is now low enough to touch the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Haoxi Health Technology currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.