Please use a PC Browser to access Register-Tadawul

Has Alliance Resource Partners Run Too Far After Its 744.1% Five Year Surge?

Alliance Resource Partners, L.P. ARLP | 23.79 23.79 | +0.25% 0.00% Pre |

- If you have been wondering whether Alliance Resource Partners is still a good value pick after its huge multi year run, this breakdown will walk through what the current price is really baking in.

- The stock has pulled back about 11.0% year to date and is roughly flat over the last month, but it is still up 64.6% over three years and an eye catching 744.1% over five years.

- That kind of long term outperformance has come as investors reassessed the outlook for coal linked cash flows and the broader energy mix in the United States, shifting how they price risk in this corner of the market. Alongside that, ongoing conversations about energy security and capital discipline in traditional fuels have kept Alliance Resource Partners on the radar of value focused investors.

- Even after that run, our valuation checks suggest Alliance Resource Partners scores a 6/6 on value. Next, we will unpack what different valuation approaches say about that number, before finishing with an even more practical way to think about what the market might be missing.

Approach 1: Alliance Resource Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow approach estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back into today’s dollars.

For Alliance Resource Partners, the latest twelve month Free Cash Flow stands at about $326.9 million. Analysts provide detailed forecasts for the next few years and, beyond that, Simply Wall St extrapolates the trend, resulting in projected Free Cash Flow of roughly $608.3 million by 2035. Those projections are based on a two stage Free Cash Flow to Equity model, which assumes a period of higher near term growth that gradually moderates over time.

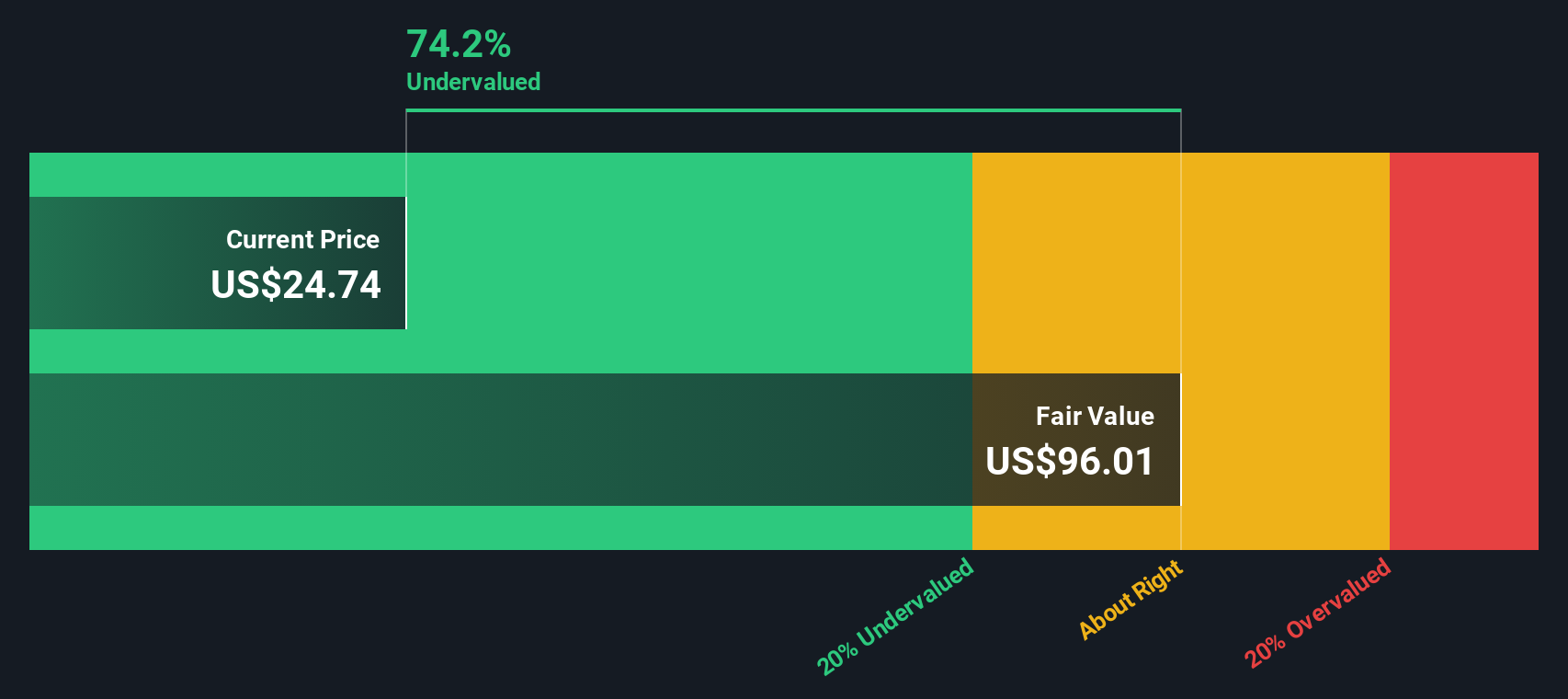

Rolling all those future cash flows together and discounting them back, the DCF model arrives at an intrinsic value of about $95.52 per unit. Compared with the current market price, this implies the units are trading at a 75.2% discount, indicating the market may be heavily discounting the durability of those future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alliance Resource Partners is undervalued by 75.2%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: Alliance Resource Partners Price vs Earnings

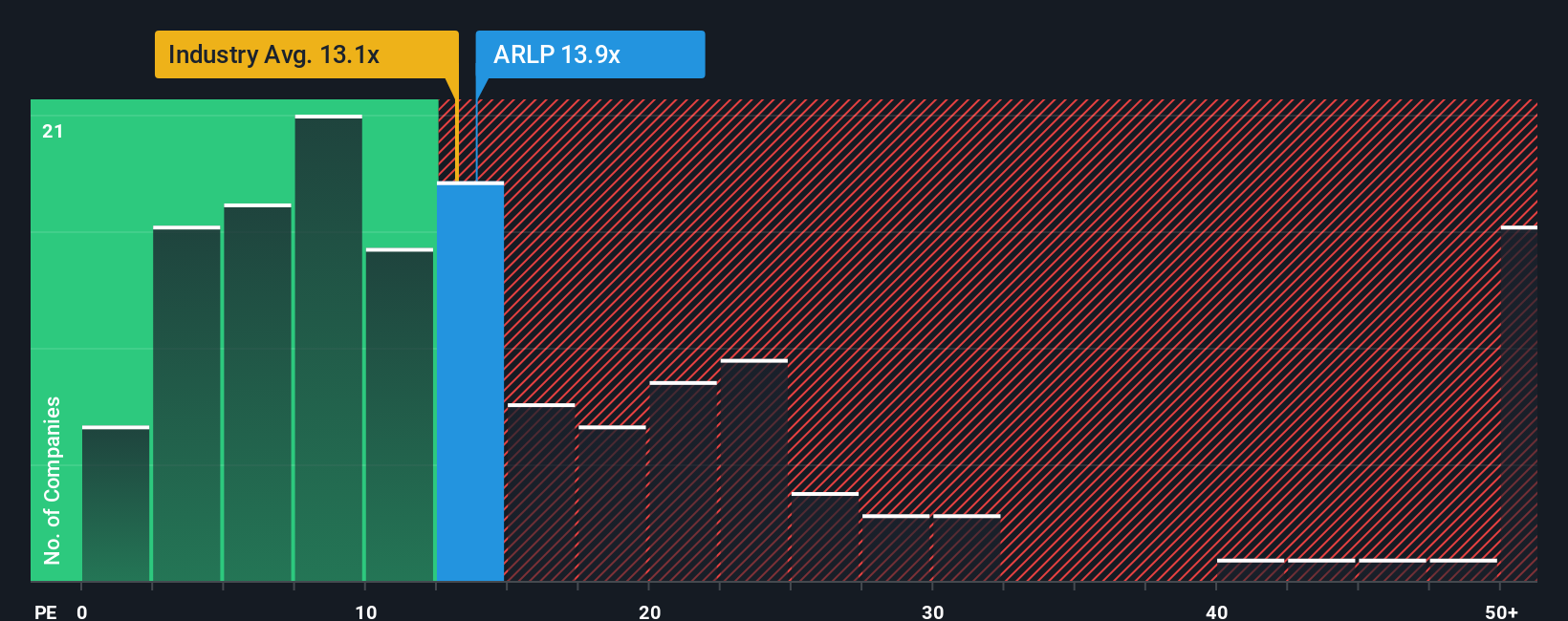

For profitable companies like Alliance Resource Partners, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. That multiple tends to rise when markets expect stronger, more durable growth and lower risk, and to fall when earnings are seen as cyclical or uncertain. As a result, what counts as a “normal” PE depends heavily on both outlook and risk profile.

Alliance Resource Partners currently trades on a PE of about 12.5x, which is slightly below the broader Oil and Gas industry average of roughly 12.9x and well below its peer group average of around 18.6x. Simply Wall St also calculates a Fair Ratio of 17.9x, a proprietary estimate of the PE that would be justified given the partnership’s earnings growth prospects, margins, industry, market cap and specific risks. This Fair Ratio is more informative than simple peer or industry comparisons because it adjusts for company specific fundamentals rather than assuming all businesses deserve the same multiple. With the current PE sitting meaningfully under the 17.9x Fair Ratio, the multiple based view lines up with the DCF and points to Alliance Resource Partners being undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alliance Resource Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers, from your assumptions about future revenue, earnings and margins through to your view of fair value. A Narrative links what you believe about a company’s business, industry and risks to an explicit financial forecast and then to a fair value estimate, so your decision to buy, hold or sell is grounded in a consistent story rather than isolated metrics. On Simply Wall St, millions of investors can create and compare Narratives for Alliance Resource Partners on the Community page, using an easy interface that shows how their Fair Value compares with the current Price. These Narratives update dynamically as fresh information comes in, such as earnings reports, regulatory news or changes in analyst expectations, keeping your thesis current without starting from scratch. For example, one Alliance Resource Partners Narrative might assume strong, policy supported coal demand and rising margins that justify a fair value near the $30.50 analyst target, while a more cautious Narrative could focus on regulatory risk and weaker coal pricing that supports a fair value much closer to today’s market price.

Do you think there's more to the story for Alliance Resource Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.