Please use a PC Browser to access Register-Tadawul

Has Freeport-McMoRan’s Slide Created Opportunity After Copper Supply News in 2025?

Freeport-McMoRan, Inc. FCX | 45.20 | +1.32% |

Trying to decide what to do with Freeport-McMoRan stock right now? You are definitely not alone. With the price closing recently at $41.71, and a volatile stretch that has seen the share price dip 2.7% over the last week and fall 8.6% in the past month, many investors are reevaluating their positions. But take a step back. Despite these near-term declines, Freeport-McMoRan’s longer-term growth story is hard to ignore, with gains of 53.4% over three years and an impressive 151.5% over five.

Much of this movement, especially the ups and downs over the last year, ties directly to ongoing shifts in global demand for copper and other commodities. Recent market developments, such as renewed optimism around global infrastructure spending and shifting risk appetite among investors, have played a big role in swinging the stock both ways. All that volatility makes valuation an even bigger part of the conversation.

If you are looking at value metrics, the current score for Freeport-McMoRan is right in the middle: 3 out of 6 valuation checks suggest the stock is undervalued. That means it is passing half of the main tests investors use to hunt for a bargain. But numbers never tell the whole story at a glance. Next, let us break down the different valuation approaches analysts use. Stick around, because there is an even smarter way to think about valuation that we will get to by the end of the article.

Approach 1: Freeport-McMoRan Discounted Cash Flow (DCF) Analysis

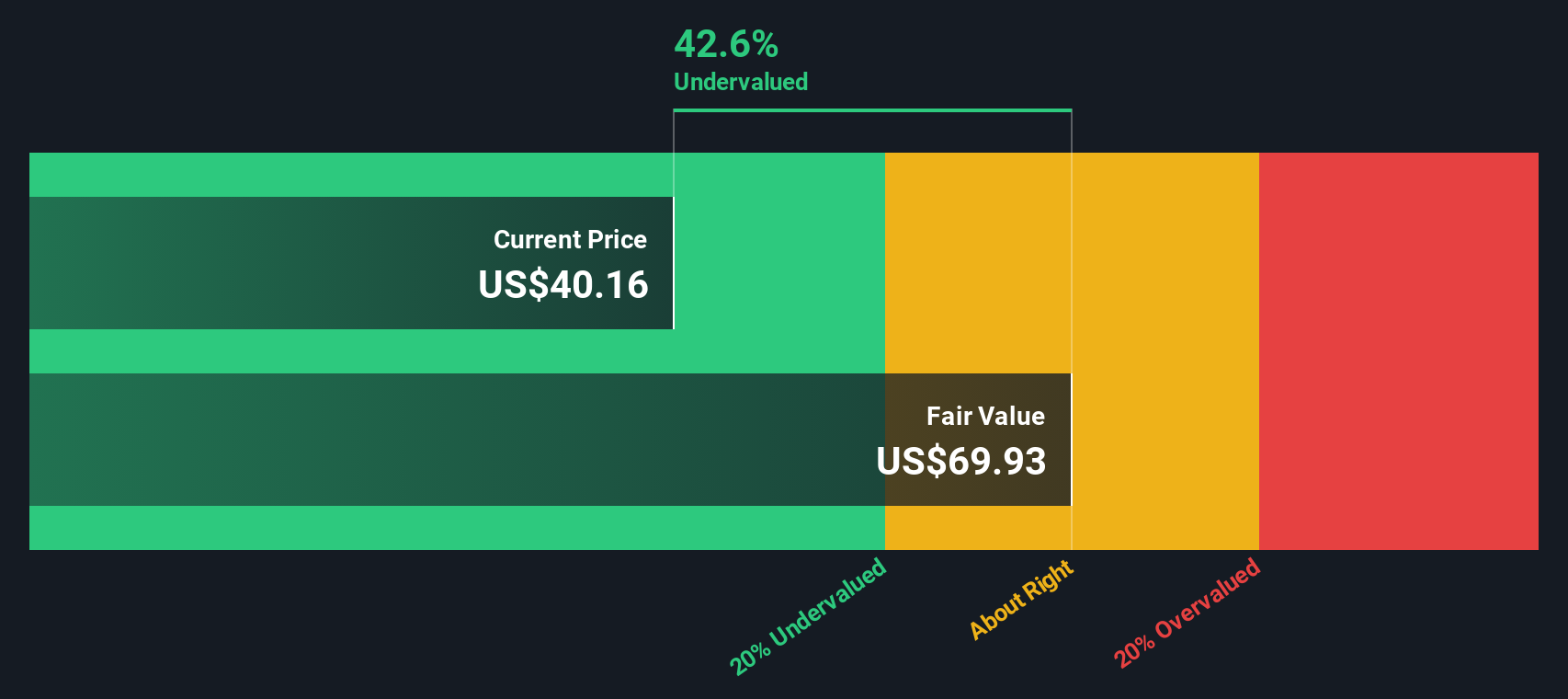

The Discounted Cash Flow (DCF) model estimates a business’s true value by projecting its future cash flows and bringing them back to today’s value using a discount rate. For Freeport-McMoRan, that means analysts and modelers look at how much money the company is set to generate each year, then calculate what all those dollars are really worth right now.

According to current data, Freeport-McMoRan generated $1.59 billion in free cash flow over the last twelve months. Analysts forecast robust growth in the years ahead, with cash flow projected to reach $5.53 billion by 2029, and modeled to increase further over the decade. This forecast uses a two-stage Free Cash Flow to Equity approach, combining near-term analyst estimates (out to five years) with long-term projections that assume more stable growth.

By summing up all these discounted future cash flows, the model calculates a “fair value” price for the stock of $74.67 per share. With the recent market price sitting at $41.71, the DCF model suggests Freeport-McMoRan is trading at a 44.1% discount. In other words, it is significantly undervalued against its projected cash-generating ability.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Freeport-McMoRan is undervalued by 44.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Freeport-McMoRan Price vs Earnings

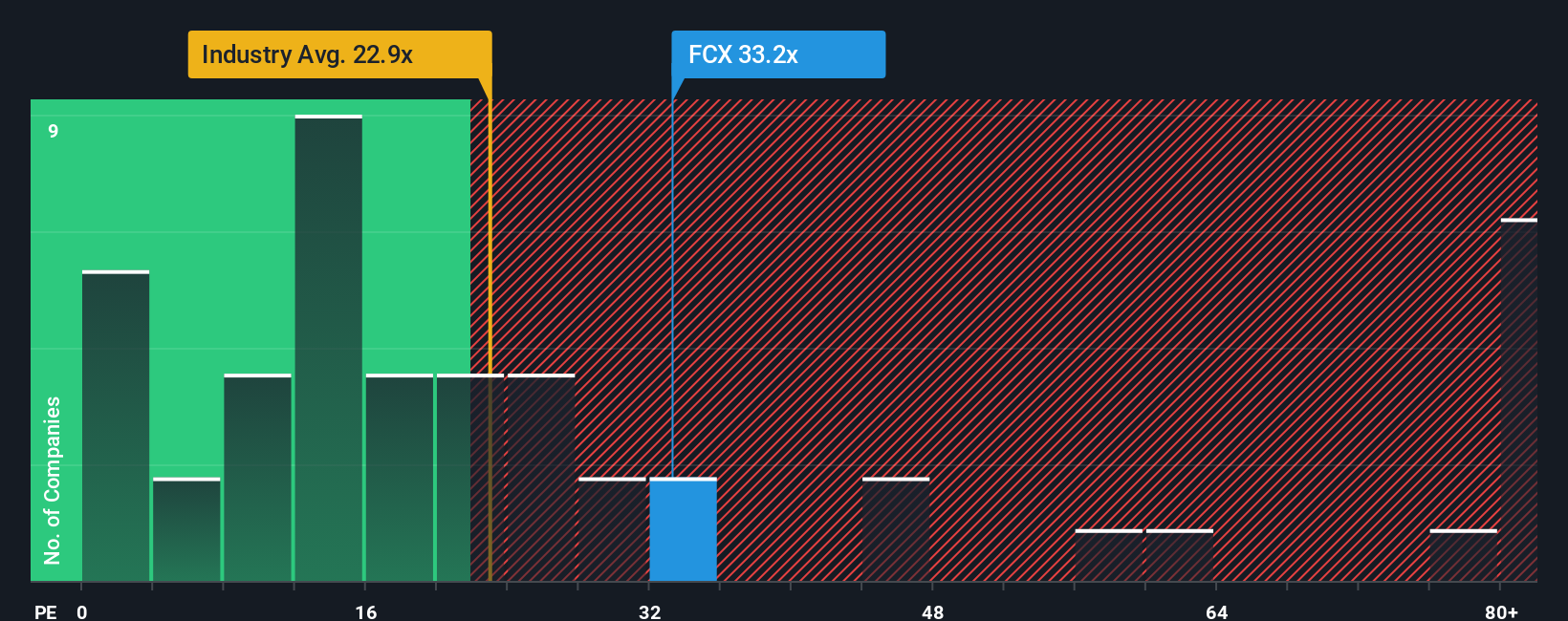

For profitable companies like Freeport-McMoRan, the Price-to-Earnings (PE) ratio is a widely used measure of value. It shows how much investors are willing to pay for a dollar of the company’s earnings, offering a straightforward snapshot of market sentiment. Generally, higher growth expectations and lower risk justify a higher PE ratio, while lower growth or more uncertainty puts downward pressure on the “normal” or “fair” multiple.

Currently, Freeport-McMoRan trades at a PE ratio of 31.2x. For context, this is above the Metals and Mining industry average of 25.5x, and higher than the average of its closest peers at 24.4x. At first glance, paying a premium might raise some eyebrows, but it is important to consider what drives this valuation.

The “Fair Ratio,” a proprietary metric by Simply Wall St, factors in not just industry trends and peer multiples but also company-specific factors like expected earnings growth, market cap, profit margins, and risks. This comprehensive approach means the Fair Ratio offers a more tailored benchmark for Freeport-McMoRan. Here, it stands at 34.9x. Unlike basic industry or peer comparisons, the Fair Ratio adapts to what is actually unique about this business now and into the future.

Comparing Freeport-McMoRan’s current PE (31.2x) to its Fair Ratio (34.9x), the stock is trading below what would be expected given its fundamentals, suggesting it may be slightly undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Freeport-McMoRan Narrative

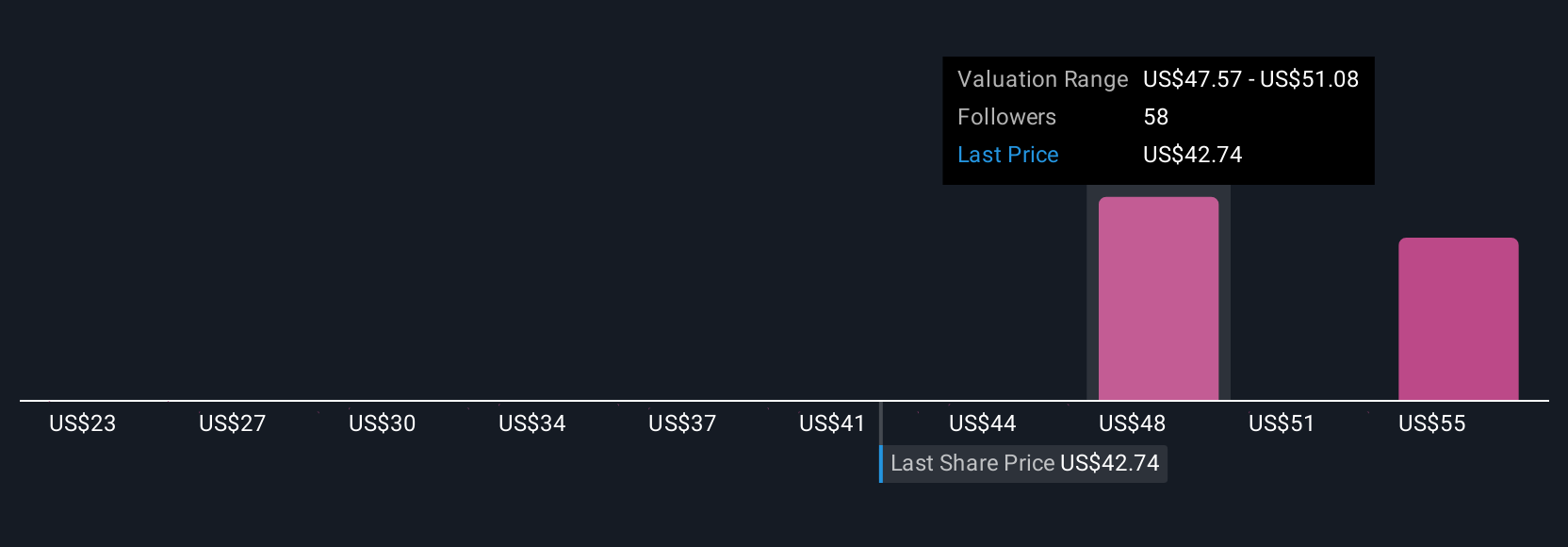

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, a perspective that links what is happening in the business (like a new smelter, market risks, or growth initiatives) to your forecasts for future revenue, margins, and ultimately, what you think a fair value for the stock should be.

Unlike traditional metrics, Narratives connect your view of the business directly to a financial forecast and fair value estimate, helping you see how your expectations stack up against others and against real-time price movements. On Simply Wall St’s Community page, millions of investors use Narratives to guide their decisions by comparing fair value to the current market price. Narratives update automatically when news or earnings are released, so your decision-making always stays relevant.

For example, some Freeport-McMoRan Narratives are bullish, building in higher copper prices and calling for a fair value as high as $57.00. Others are more cautious, factoring in operational challenges for a fair value as low as $27.00, showing how different investors’ stories and assumptions drive distinct investment actions, all on a single, easy-to-use platform.

Do you think there's more to the story for Freeport-McMoRan? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.