Please use a PC Browser to access Register-Tadawul

Here's What's Concerning About Al Kathiri Holding's (TADAWUL:3008) Returns On Capital

ALKATHIRI 3008.SA | 1.99 | 0.00% |

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after investigating Al Kathiri Holding (TADAWUL:3008), we don't think it's current trends fit the mold of a multi-bagger.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Al Kathiri Holding, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.018 = ر.س4.6m ÷ (ر.س303m - ر.س52m) (Based on the trailing twelve months to September 2024).

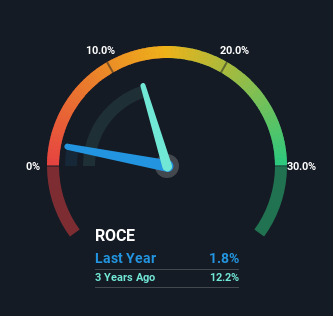

Therefore, Al Kathiri Holding has an ROCE of 1.8%. Ultimately, that's a low return and it under-performs the Basic Materials industry average of 6.9%.

Historical performance is a great place to start when researching a stock so above you can see the gauge for Al Kathiri Holding's ROCE against it's prior returns. If you'd like to look at how Al Kathiri Holding has performed in the past in other metrics, you can view this free graph of Al Kathiri Holding's past earnings, revenue and cash flow .

What Does the ROCE Trend For Al Kathiri Holding Tell Us?

When we looked at the ROCE trend at Al Kathiri Holding, we didn't gain much confidence. Around five years ago the returns on capital were 20%, but since then they've fallen to 1.8%. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. If these investments prove successful, this can bode very well for long term stock performance.

Our Take On Al Kathiri Holding's ROCE

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for Al Kathiri Holding. In light of this, the stock has only gained 12% over the last five years. So this stock may still be an appealing investment opportunity, if other fundamentals prove to be sound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.