Please use a PC Browser to access Register-Tadawul

Hims & Hers Health (HIMS) Valuation Check After $200M Ohio Expansion and Ongoing International Growth

Hims & Hers Health, Inc. Class A HIMS | 31.32 31.43 | -2.73% +0.35% Pre |

Hims & Hers Health (HIMS) just committed over $200 million to a new Ohio facility that will double its footprint and add 400 jobs, a move that directly supports its fast growing telehealth business.

That expansion comes on the heels of strong third quarter results and international moves into the U.K. and Canada. Investors have largely rewarded the trajectory, with a robust year to date share price return contrasting sharply with the recent 90 day pullback and powerful multi year total shareholder return. Together, these still signal underlying growth momentum rather than a broken story at a latest share price of $34.77.

If this kind of digital health growth story interests you, it could be worth scanning other potential opportunities in healthcare stocks to see what else is building momentum.

Yet with shares up nearly 40% this year, but still trading below analyst targets and some intrinsic value estimates, is Hims & Hers a rare growth story at a discount, or has the market already baked in its next leg higher?

Most Popular Narrative: 59.6% Undervalued

According to BlackGoat, the narrative fair value for Hims & Hers sits far above the latest close of $34.77, implying deep upside if the thesis plays out.

Hims is demonstrating rare execution: fast growth, rising profitability, and increasing efficiency all at once. The company is not only expanding its subscriber base but also deepening engagement through personalised care, which boosts retention and monetisation.

Curious how this story supports such a large gap between price and fair value? The engine is aggressive growth, expanding margins, and a bold future profit multiple. Want to see exactly how those moving parts stack up into that target?

Result: Fair Value of $86.09 (UNDERVALUED)

However, regulatory scrutiny of compounded GLP 1s and intensifying competition from big tech and pharma could quickly undermine the long term growth narrative.

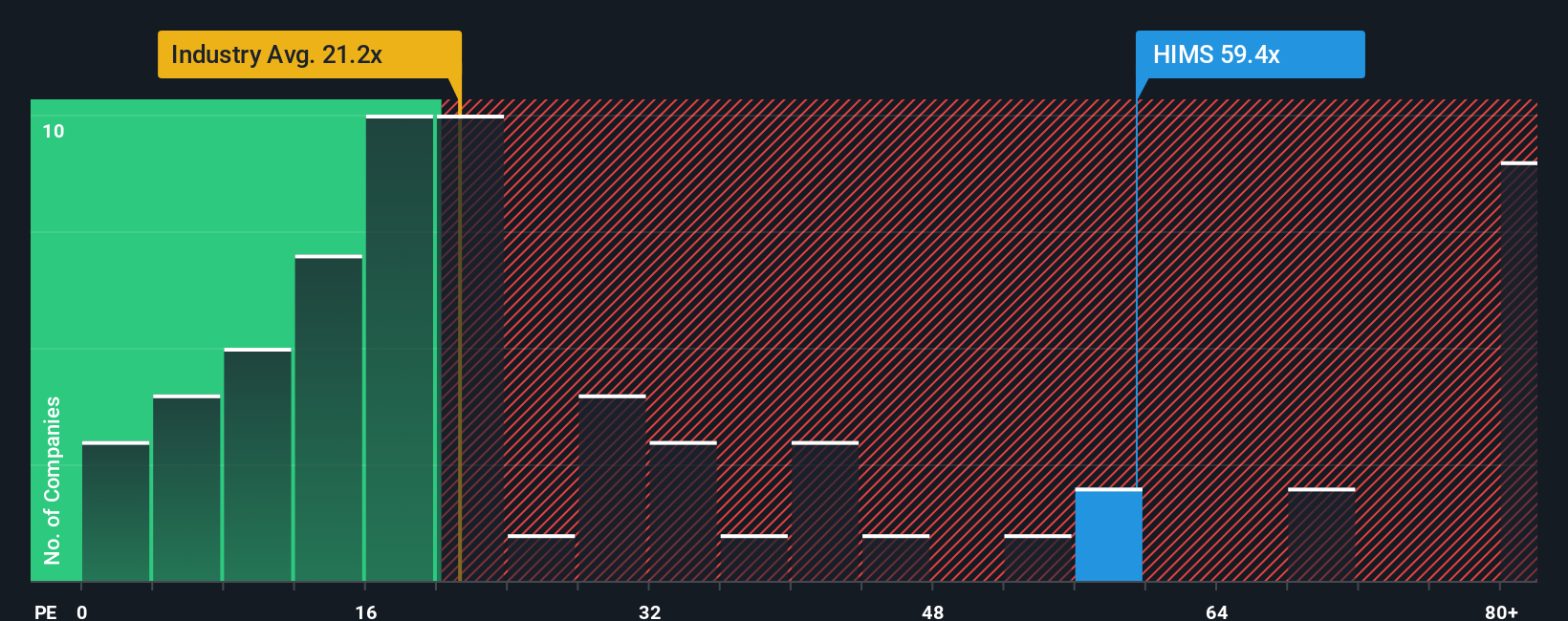

Another View: Market Ratios Tell a Tougher Story

While narrative fair value and some intrinsic models point to upside, the current earnings multiple portrays Hims & Hers as richly priced. At 59.2 times earnings versus a 41.5 fair ratio, 23.6 for the healthcare sector and 31.4 for peers, the share price already reflects a substantial amount of anticipated success. If growth or sentiment weakens, how much could this valuation compress?

Build Your Own Hims & Hers Health Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh narrative in just minutes, Do it your way.

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Smart investors never stop raising the bar. Use the Simply Wall St Screener to uncover fresh opportunities before the crowd and keep your portfolio one step ahead.

- Capitalize on mispriced potential by targeting companies trading below intrinsic value with these 916 undervalued stocks based on cash flows built to spotlight quality at a discount.

- Position yourself at the frontier of innovation through these 24 AI penny stocks where emerging artificial intelligence leaders could define the next market cycle.

- Lock in reliable income streams and combat inflation using these 13 dividend stocks with yields > 3% focused on businesses offering yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.